Shares of MP Materials (MP 2.30%), by far the biggest of several companies working to jump-start rare-earth oxide mining and rare-earth magnet manufacturing in the United States, jumped 8.5% through 11 a.m. ET Thursday. And why?

China announced more curbs on rare-earth exports as part of its trade war with the United States.

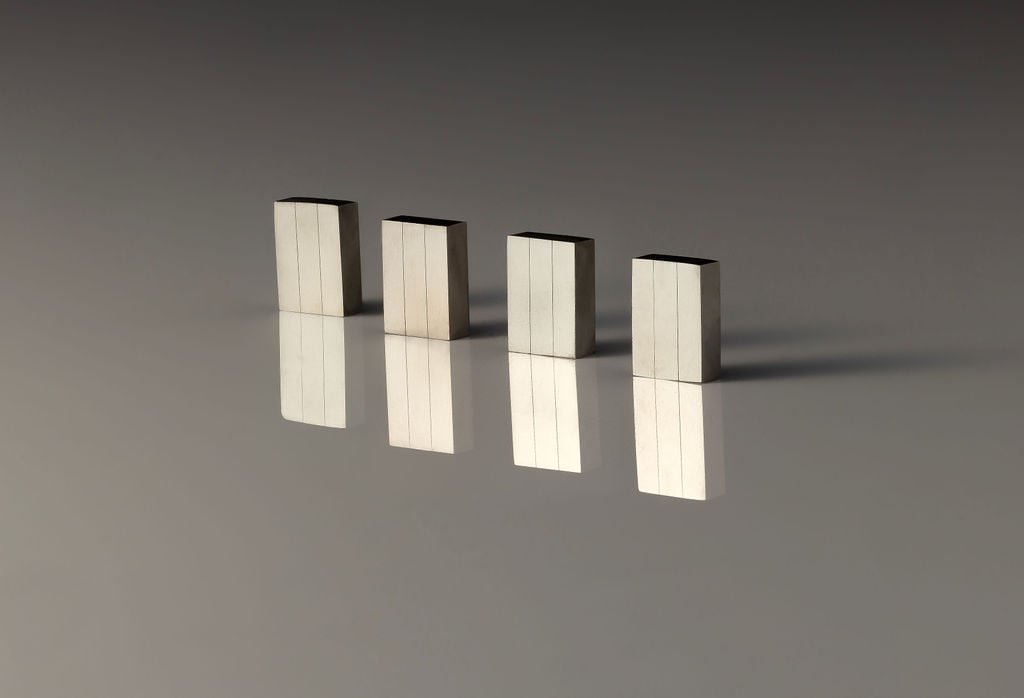

Image source: Getty Images.

China's big stick in trade negotiations

China's Commerce Ministry announced Thursday it will require government approval to export products containing certain rare-earth metals. China dominates global rare-earths mining (69% of global production), refining (85%), and manufacture into rare-earth magnets (90%).

China uses its near-monopolies in rare earths as a cudgel in trade negotiations, punishing the U.S. with embargoes as a way to convince President Donald Trump to lift tariffs imposed on Chinese exports. That's bad news for companies that need Chinese magnets to make motors for their electric cars, wind turbines, and similar "green" technologies, but it's pretty great news for MP Materials.

After all, creating an alternative to Chinese rare-earth imports is the main reason MP exists.

NYSE: MP

Key Data Points

Is MP Materials stock a buy?

Even better news for MP investors: China's been at this a long time, and MP began responding to the threat years ago -- such that by now, the company's at a point where it can almost earn a profit from rare-earths mining and magnet production.

Analysts polled by S&P Global Market Intelligence think MP will earn $0.68 per share next year -- then nearly triple that number over the next three years. That's the good news.

The bad news is that $0.68 in profit on a $75 stock means MP costs more than 110 times forward earnings. Even with a lot of "help" from China, MP stock is probably too expensive to buy.