This eclectic group of stocks trades at significant discounts to their all-time high prices, with advanced materials company Hexcel (HXL +0.19%) down 25%, e-commerce logistics company GXO Logistics (GXO +1.53%) down 48%, and ON Semiconductor (ON +2.52%) down 54%. All three companies operate in long-term growth markets that are currently experiencing temporary weakness, and this article will briefly summarize why and how they can return to their growth path.

Hexcel, because composites are the future of the aerospace industry

No one disputes that airplanes are likely to contain more advanced composite materials in the future. Indeed, every new generation of aircraft has led to more value per plane for Hexcel. For example, the classic Boeing 737 had approximately 5% of its content made from advanced composites, whereas the newer Boeing 737 MAX has 15%. That figure increases even higher for wide-body aircraft like the Boeing 787 and Airbus A350, which contain at least 50% composite content.

NYSE: HXL

Key Data Points

The investment case for Hexcel is relatively straightforward: A combination of increasing content on each new generation of aircraft and multiyear backlogs at Boeing and Airbus presents an excellent long-term growth opportunity.

That said, both airplane manufacturers have struggled to ramp up aircraft production in recent years (at least relative to expectations), and that has caused knock-on issues at Hexcel as end demand has been weaker than expected at a time when management is looking to increase its manufacturing capacity.

Still, it appears to be a question of "when, not if" for the company, and Wall Street expects double-digit revenue growth to kick in, in 2026 and 2027 , with net income almost doubling from 2025 to 2027. As such, now looks like a great time to buy a growth stock on a dip.

Image source: Getty Images.

GXO Logistics, because e-commerce and outsourcing logistics will only grow

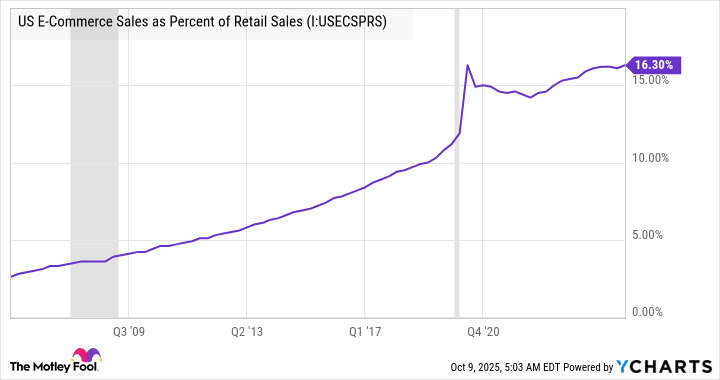

The case for the stock is based on very powerful business trends. The share of retail sales coming from e-commerce activities continues to grow, meaning it will become an increasingly larger part of a company's activities. In addition, the rapid development of productivity-enhancing technologies in logistics, such as automation and robotics, innovative warehousing, and AI-led analytics, means e-commerce logistics is becoming a more complex activity.

NYSE: GXO

Key Data Points

All of which points to an environment in which GXO's offering of contract logistics provision (advanced warehousing with e-commerce warehousing being its largest industry vertical) is set to enjoy long-term demand growth.

However, there's been a problem in recent years, and it's best encapsulated in the following chart. Following the boom in e-commerce created by the lockdowns, the growth rate has returned to its long-term trend line.

US E-Commerce Sales as Percent of Retail Sales data by YCharts.

Unfortunately, the adjustment in growth, from a previously unsustainable growth rate, also led to a slowing of GXO's organic revenue growth rate in 2023 and 2024.

|

GXO Logistics |

2021 |

2022 |

2023 |

2024 |

2025Est |

|---|---|---|---|---|---|

|

Organic Revenue Growth |

15% |

15.4% |

2% |

3% |

3.5% to 6.5% |

Data source: GXO Presentations.

The good news is the company appears to be building momentum in 2025, and it's winning new contracts to offset some customers previously rationalizing how much logistics supporyt they outsource. Wall Street sees its earnings growing at a double-digit rate in 2026 and 2027.

ON Semiconductor: Near-term risk and long-term opportunity

The company's focus on power and sensing technology for the automotive (notably electric vehicles, or EVs) and industrial (EV charging, automation, smart cities) sectors, as well as more recently AI data centers (Nvidia), gives it exciting exposure to some excellent long-term, secular growth trends.

NASDAQ: ON

Key Data Points

While that still holds, the company is going through a difficult period, as automakers have pared back EV spending in response to relatively high interest rates and, aside from Tesla, difficulties in profitability.

Data source: ON Semiconductor presentations.

Still, if you believe that EVs remain the future of the automotive industry, and Ford's recent $5 billion spending commitment supports that argument, then a recovery will likely emerge even as the near-term outlook remains uncertain.

Stocks to buy

All three contain near-term risk, but they also have substantive upside potential. On a risk-reward basis, they all appear to be attractive stocks to buy for investors who can tolerate the potential for some near-term disappointment.