Dividend Kings are an exclusive group of dividend stocks. Attaining this status means that they have increased their payouts for a minimum of 50 consecutive years. To achieve this, a company must consistently generate strong and rising free cash flow and manage its cash in such a way that it can hike payouts while strengthening the underlying business.

The payout is a significant factor in why I have invested in Target (TGT -3.73%) as the year draws to a close. Admittedly, it is a troubled business amid falling sales, and unnecessary forays into politics and a recent CEO change have justifiably cast doubt on the stock.

Nonetheless, Target has become a compelling value, and given the high likelihood that it can turn its business around, it is likely to maintain its Dividend King status and, eventually, begin earning outsized returns.

Image source: Target.

The Target dividend

In June, Target approved its 54th consecutive annual payout hike, increasing the dividend by 1.8% over last year's level to $4.56 per share annually. This amounts to a dividend yield of 5%. Considering that the S&P 500's (^GSPC -2.71%) average dividend yield is under 1.2%, that payout made the stock considerably attractive to me.

Moreover, stocks usually struggle for years if they choose to end such streaks. That factor makes it unlikely to abandon this streak if they can help it. Fortunately, such a move is unlikely, as Target can afford its dividend.

Indeed, the company's struggles seem to have weighed on free cash flow, but not to the point that it undermines its payout. As of the second quarter of fiscal 2025, Target had generated just over $2.94 billion in free cash flow over the last 12 months. Over the same period, Target paid out $2.05 billion in dividends, leaving just under $900 million free for other purposes, including annual payout hikes.

Target stock and the prospects for recovery

Additionally, my total return on Target stock will likely be well above the 5% I earn on the dividend.

Indeed, this part of the value proposition is a leap of faith. Target stock plunged after the announcement that COO Michael Fiddelke would become the new CEO. Certainly, that leadership change brings some unknowns, and Fiddelke will have to turn around its falling sales levels to win the confidence of investors.

In the first half of fiscal 2025, Target's net sales of $49 billion dropped 2% compared to the same period last year, and that includes a 3% decline in comparable sales over the same time frame.

This stands in contrast to its closest competitors. In Walmart's first two quarters of its fiscal year (ended July 31), net sales and comparable sales each rose by 4% yearly. Costco performed even better, increasing net sales by 8% in its latest fiscal year (ended Aug 31), which included a 6% comparable sales increase.

Nonetheless, several factors continue to work in Target's favor. Aside from its brand recognition, over 75% of Americans live within 10 miles of a Target, a feat only exceeded by Walmart. This means that it is only one of the few companies that can offer omnichannel retailing for a wide variety of goods across the U.S.

Moreover, even though it operates 2,000 stores in the U.S., it believes it can add another 300 locations over the next decade. Also, over the next five years, it plans to spend between $4 billion and $5 billion on stores and improvements in its technology and supply chain.

With those moves, the company believes this will yield an additional $15 billion in sales over that time frame. Also, analysts forecast a net sales increase of 2% in the next fiscal year, which may signal the beginnings of a turnaround if that prediction holds.

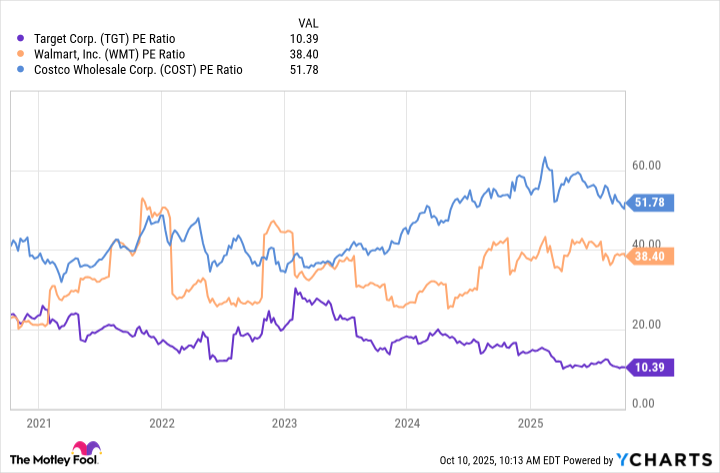

Additionally, the stock appears oversold by just about any measure. Its P/E ratio of 10 is far below that of Walmart and Costco. Thus, if the company revives confidence in the stock, the potential multiple expansion could help bring outsized returns to investors and continued dividend growth.

TGT PE Ratio data by YCharts

Investing in Target stock

Ultimately, if one can stomach what are likely temporary sales declines like I can, they have a chance to earn outsized returns in Target stock.

The basis for this recovery is probably its dividend. Since it holds Dividend King status, investors will benefit from a payout of 5% that is likely to continue rising.

Furthermore, for all of Target's troubles, sales are on track to begin increasing next year, and its investments in supply chains, technology, and stores should enhance such growth.

Finally, its P/E ratio of 10 indicates the retail stock has become oversold, a situation that could spark a turnaround on any sign of improvement. By combining that prospect with the 5% dividend return, I believe Target could become a compelling turnaround story in the making.