Ares Capital (ARCC +0.43%) is what is known as a business development company (BDC). This is a unique corporation that is designed to pass income on to shareholders. That helps explain the lofty yield on offer. But investors shouldn't buy the stock just because it has a large dividend yield.

There's way more to this story than just the yield. If you ignore the full picture by focusing only on the yield, you could end up sorely disappointed over the next five years.

Ares Capital is pretty good at what it does

The problem with Ares Capital isn't really specific to the company. The truth is, it is a very well-respected business development company. For starters, it is backed by Ares Management, a global alternative investment asset manager. As such, it has a large team working to ensure its success.

Image source: Getty Images.

Secondly, Ares Capital has proven to be one of the more resilient BDCs over time. Notably, during the deep recession between 2007 and 2009, it stepped in to buy peers that were struggling. Simply surviving that financial-led downturn would have been impressive. But Ares Capital was actually able to use the downturn to expand its business.

If you're looking for a BDC to buy, Ares Capital should probably be on your short list. But step back and consider the risks before you jump in to buy this stock and its huge 10% dividend yield.

NASDAQ: ARCC

Key Data Points

What does Ares Capital do (and what has its dividend done)?

Without getting too deep into the details, Ares Capital makes loans to smaller companies that can't access capital in more attractive ways. The average interest rate on Ares Capital's loans was a massive 10.9% in the second quarter of 2025. In general, no company is going to sign up for a loan that expensive unless it has no other attractive options.

A 10.9% interest rate is a material financial burden for any company. But for a smaller company that may be trying to build its business, well, it could be extra difficult to afford.

When the economy is growing, a high-interest loan may be something that can be handled. But what about during a recession? If a small company's business is struggling, a high-interest loan from Ares Capital could push it to the brink. It might even put the company at risk of bankruptcy.

Ares Capital is used to working with troubled companies. So a bankruptcy here or there isn't a big deal. But the situation is different when a lot of companies end up in financial straits at the same time, which is basically the definition of a recession.

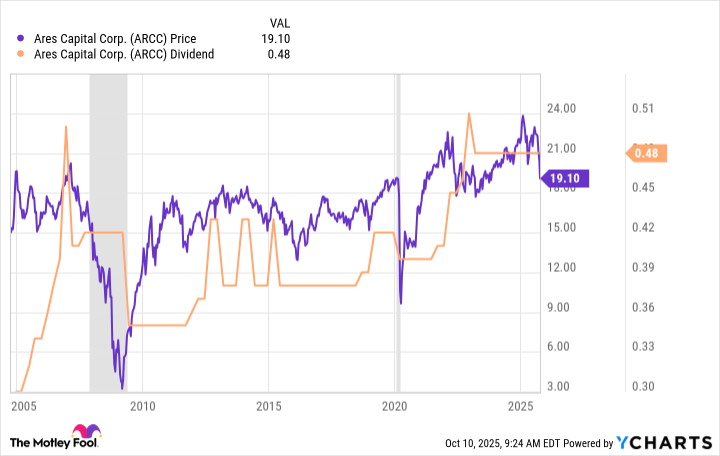

The answer to the dividend question here is in the graph, which highlights how volatile Ares Capital's dividend has been over time. Notice the steep drop in the dividend and the share price during the Great Recession.

Recessions are a fairly normal event for the economy, and it wouldn't be at all shocking to see one pop up over the next five years. This is why I'm confident in my belief that Ares Capital will likely cut its dividend at some point in the next five years. A recession will, basically, leave even the best of BDCs with few options but to adjust their dividends lower.

Make sure you know what you're buying

Here's the thing: Ares Capital is a well-run business development company. It's highly likely that it will still be around in five years, even if there is a deep recession. It might even use a downturn to expand its business.

But it is also highly likely that the dividend will be volatile over the next five years, and particularly so if there is a recession. If dividend consistency is important to you, Ares Capital's lofty yield probably won't be a good fit for your portfolio today or in five years' time.