Some stocks have the potential to deliver extraordinary returns over time. They generally fall into two camps: established players with wide economic moats and growth catalysts, or young companies in red-hot industries that are just starting to take off.

I have identified one compelling stock from each category that looks particularly attractive right now, thanks to the potential for extreme growth in nuclear energy and mining for rare earth minerals. Buying these stocks now and holding them for 5 to 10 years could generate monster returns.

Image source: Getty Images.

This miner for rare-earth elements is taking off

Rare earth elements are all the rage now. They're vital for several key industries such as electric vehicles (EVs), semiconductors, electronics, wind turbines, and medical imaging. Their importance was already well known, but the renewed interest in the stock of rare-earth element miners is largely credited to President Donald Trump's policies targeting supply chains for crucial materials.

Currently, 80% of the rare earth elements consumed in the U.S. are imported, with 77% coming from China. The Trump administration is going all-in to reduce this reliance for such crucial materials, buying stakes in companies to fuel domestic mining and production of rare earth elements.

One rare earth miner whose stock is turning out to be a monster that could be the next Trump target is USA Rare Earth (USAR +3.29%). The stock has soared 250% in just the past three months, and it could rally even higher.

NASDAQ: USAR

Key Data Points

While there are several companies mining for rare earth minerals, USA Rare Earth is a vertically integrated mining-to-magnets company. Simply put, it mines rare earth minerals and manufactures magnets, the end-use products that go into EV motors, hard disc drives, wind turbine generators, MRI machines, and defense and aerospace equipment.

USA Rare Earth holds mining rights to the Round Top Mountain deposit in Texas, but is currently focused on building a rare earth magnet plant in Stillwater, Oklahoma. It expects to begin production as early as next year and is acquiring U.K.-based LCM for $100 million in cash and $6.74 million in stock to scale up production to a full capacity of 5,000 metric tons. LCM's output will be used as feedstock at Stillwater.

USA Rare Earth's new CEO, Barbara Humpton, recently said in a CNBC interview that the company is in close communication with the Trump administration for a potential deal. In July, the U.S. Department of Defense struck a deal to acquire a 15% stake in another producer of rare earth elements, MP Materials (MP +1.54%).

With China recently imposing more-stringent export controls on these raw materials, there's an even bigger incentive for the U.S. government to push domestic miners. With USA Rare Earth already signing up several customers and expecting its first magnet sales next year, the stock could generate explosive returns in the long term.

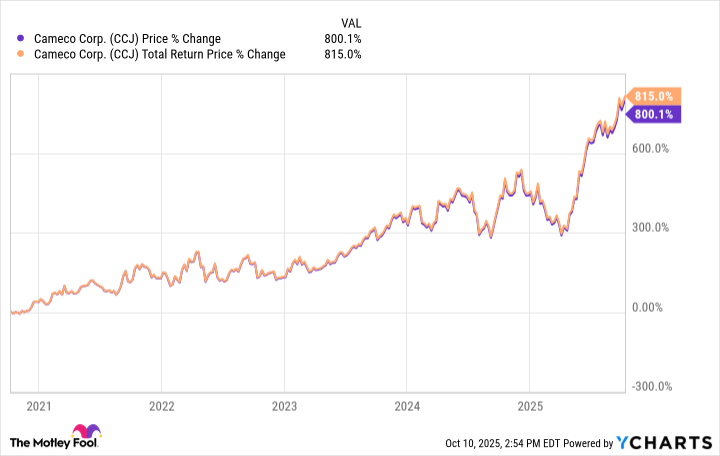

This stock has surged 800% in 5 years

Nuclear energy stocks are on fire, powered by soaring demand for electricity from artificial intelligence (AI) data centers that require enormous amounts of power to keep their servers and cooling systems running around the clock. The International Energy Agency (IEA) projects that global demand for electricity to power data centers will more than double by 2030, surpassing the entire electricity consumption of Japan today.

President Trump has further fueled interest in nuclear energy and uranium stocks by signing multiple orders to expedite the build-out of nuclear reactors and uranium fuel supplies. Nuclear reactors run on uranium fuel, and the U.S. imports 99% of the uranium concentrate used to make nuclear fuel.

The two catalysts present huge growth opportunities for the nuclear power and uranium industries, and one company sitting prominently at the forefront is Canada-based Cameco (CCJ +1.73%), one of the largest uranium miners in the world.

Shares of Cameco had already generated monster returns well before investors caught up with nuclear energy stocks in 2025. The stock has more than doubled in the past six months.

Cameco sells uranium concentrate and fuel services directly to nuclear power utilities in 16 countries under long-term contracts. It also owns a 49% stake in Westinghouse Electric Company, a supplier of technology, equipment, and services for the nuclear power sector. That makes Cameco a top play in two crucial sections of the nuclear energy industry: nuclear fuel, and construction and maintenance of nuclear power plants.

Given the persistently low level of long-term uranium contracting, Cameco believes utilities will have to secure significant amounts of uranium -- in the billions of pounds -- to meet their fuel requirements through 2045. That should set the stage for explosive growth for Cameco and its stock in the coming years. The company has also paid a dividend every year since going public in 1991.