The list of Dividend Kings is not very long, which makes sense. It is difficult to increase a dividend year in and year out for at least five decades. A business has to be resilient and well run, with an operating model that is sustainable over the long term.

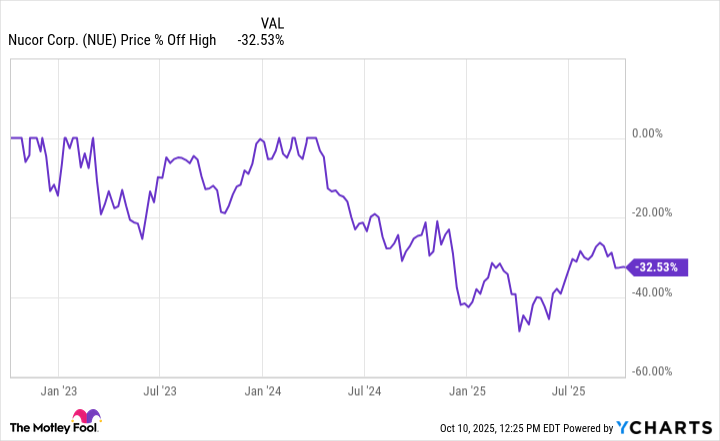

But the Dividend King featured here, which is trading down more than 32% from early 2024 highs, has proven it has what it takes to survive and thrive, while rewarding investors along the way. Now could be a good time to buy it.

What does this Dividend King do?

The Dividend King in question here has an even more impressive attribute that needs to be addressed. Its business is highly cyclical, facing often dramatic and sometimes rapid swings. And yet, despite that inherent risk, it has managed to increase its dividend annually for 52 years. None of its competitors can claim anything close to that record.

Image source: Getty Images.

So what is this company and the industry in which it operates? We're talking about Nucor (NUE +3.07%), which is one of the largest steelmakers in North America. And right now the stock is down over 32% from the highs it reached in April 2024.

That is a sign that the steel industry isn't doing all that well right now, which is true. But the best time to buy a cyclical stock is usually during an industry downturn. This is because investors often get so caught up in the short-term business swing that they overlook the long-term investment opportunity that exists.

In the case of Nucor, it has a proven track record of growing its business over the long term. And the proof of that is the incredible dividend streak the company has built. The dividend yield is a bit miserly at 1.6%, but that isn't the reason to buy the stock. The reason to buy Nucor is that it is a growing business that sells a product vital to the world economy.

Data by YCharts

What's so special about Nucor?

The underlying source of Nucor's reliability is the way in which it makes steel, which is by using electric arc mini-mills. To simplify things, these mills are more flexible than older-style mills that use blast furnaces. As such, mini-mills can be ramped up and down along with demand more easily. That allows Nucor to be more consistently profitable through the industry's normal cyclical swings.

On top of that, Nucor has long focused on using a portion of its own bulk steel to produce specialized steel products. Think things like the racks used to house data center technology and the doors used in warehouses and other large structures. Those are cherry-picked examples because they are both on trend with the artificial intelligence (AI) investment boom that's currently taking place. These products carry higher margins than commodity steel, and often have more resilient demand profiles.

NYSE: NUE

Key Data Points

Meanwhile, Nucor has a long history of investing for growth. That includes internal capital investment projects, like building new mills. But it also involves buying businesses, often in the specialty products space, that expand its operations into new areas.

It doesn't pull its horns in during industry downturns. In fact, management often leans into downturns and spends more, because that's when the best deals are likely to be had. The goal is to produce higher highs and higher lows for the business over time.

Nucor is worth a very close look right now

The proof of Nucor's successful model is, again, the dividend. And with the stock down so much from its most recent peak, now could be a great time to add this Dividend King to your portfolio.

The key, however, is to buy it and hold it for the long term. In fact, forever is probably what you should be thinking about when you invest in this industry-leading steelmaker.

Sure, Nucor is unloved today because the steel industry is in a funk. But that's why you should want to buy it.