Billionaire Stanley Druckenmiller has earned a spot among the best investors ever. Through more than four decades of investing, Druckenmiller has yet to post a year where his investments finished in the red, and that includes during the Great Recession in 2008-09, when his fund at the time posted an 11% gain.

Today, Druckenmiller still invests his personal money through the Duquesne Family Office investment firm. Investors have shown a great interest in seeing what Druckenmiller buys and sells each quarter. What's most interesting is that Druckenmiller and his team have found worthy investments in just about every sector of the market. The fund has purchased exciting artificial intelligence (AI) stocks as well as comparatively boring bank stocks.

In recent quarters, Duquesne has been selling AI winners like Nvidia (NVDA 3.38%) and Palantir Technologies (PLTR 1.04%) and piling into one of Wall Street's hottest drug stocks ahead of 2026.

Image source: Getty Images.

Selling the AI titans

Looking back to the second quarter of 2024, Druckenmiller has completely eliminated his position in the AI chip giant Nvidia, as well as in the AI data decision-making company Palantir. Both stocks have generated superb gains for investors, with Nvidia and Palantir up roughly 36% and 142% this year, respectively.

After getting rid of Nvidia in 2024, Druckenmiller eventually called the move a "big mistake" but also said that he would not be afraid to buy the stock again. "It tripled in a year, and I thought the valuation was rich," Druckenmiller told Bloomberg last October. "Nvidia is a wonderful company, and were the price to come down, we'd get involved again. But right now, I'm licking my wounds from a bad sale."

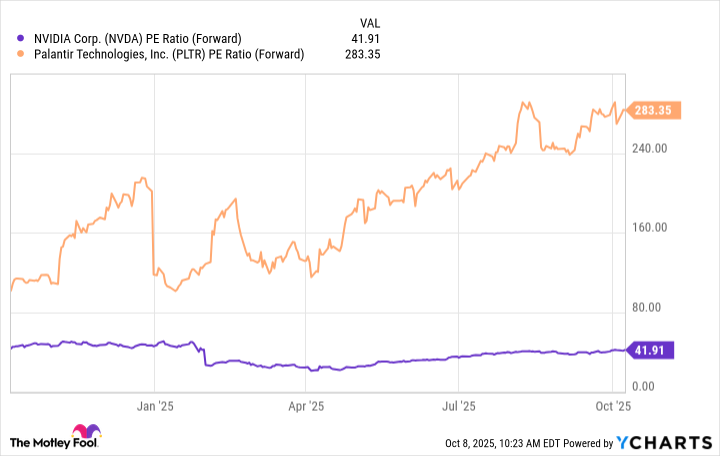

Druckenmiller follows valuation closely, and Nvidia clearly got too rich for him, especially as the company's market cap moved into the trillions. If he was concerned about valuation with Nvidia, then he was likely definitely concerned with Palantir's valuation, which has moved up significantly for several years now.

Data by YCharts.

Honing in on this pharma stock instead

Over the past year, Druckenmiller hasn't purchased more of any stock than Teva Pharmaceuticals (TEVA 0.25%). During this time frame, Duquesne has purchased close to 16 million shares that were valued at over $267 million at the end of Q2 2025.

The international pharma company is one of the worldwide leaders in making generic drugs. Some of its leading brands include Austedo for neurodegenerative and movement disorders like those associated with Huntington's disease, and Ajovy, which is a preventative treatment for adult migraines. Teva also creates drugs for cancer treatment, asthma, and chronic obstructive pulmonary disease.

In recent years, Teva also launched its pivot-to-growth strategy in which the drugmaker is developing treatments for patients with a range of health issues from schizophrenia to migraines to involuntary movements. The company also wants to focus on treatments for diseases that have been on the rise, such as inflammatory bowel disease, asthma, and rheumatoid arthritis.

At the end of Q2, Teva has five new drugs in its late-stage pipeline, three of which are in phase three trials and two in phase two. The three drugs in phase three clinical trials are designed to treat ailments (asthma, inflammatory bowel disease, and schizophrenia) affecting tens of millions of diagnosed patients, and the company plans to submit new drug applications to regulators starting at the end of this year and into 2029.

Druckenmiller must be optimistic about the company's drug portfolio, and he is not alone. Recently, UBS analyst Ashwani Verma raised his price target on the company and maintained a buy rating, raising his 2030 revenue estimate for Teva from $6.3 billion to $6.6 billion, due to expected strength in the company's branded business. In the near term, Verma also expects Medicare pricing on Austedo to carry less of a discount on the drug than some investors currently fear.

While it is not uncommon for large drugmakers to trade at low earnings multiples, Druckenmiller likely finds Teva's valuation of less than 8 times forward earnings as undemanding, considering the growth strategy and late-stage pipeline.