The 6.7% dividend yield on offer from Pfizer (PFE 0.47%) is both a sign of opportunity and risk. A lot will happen over the next five years that will determine if that dividend is sustainable. But even if it isn't, there is a material turnaround opportunity for investors if they take a risk and buy Pfizer today.

What does Pfizer do?

Pfizer is one of the largest pharmaceutical companies in the world. The drug industry is complex, and competition is fierce. Pfizer has been a long-term survivor, but that doesn't mean it hasn't gone through difficult periods. And the lofty yield is a sign that it is in the middle of a difficult period right now. It will almost certainly survive, but it isn't clear that the dividend will -- at least, not in its entirety.

One of the big issues to consider here is the upcoming patent expirations for oncology drug Ibrance and cardiovascular drugs Eliquis and Vyndaqel that will occur in 2027 and 2028. Although Pfizer has a diversified drug portfolio, these are three important drugs, and the patent cliff will be a material headwind to offset.

But management is taking action. After Pfizer's drug candidate in the weight loss niche failed to pan out, it quickly inked a deal to buy Metsera (MTSR +0.00%) for an up-front cost of $47.50 per share in cash, or roughly $4.9 billion. There are three earnouts that could add up to $22.50 per share to that total, in what is a fairly complex deal. However, the swift action here shows that Pfizer is capable and willing to do what is necessary to keep growing its business.

In five years, the patent cliff will be in the rearview mirror. New drugs will be coming to market and hopefully growing their revenue streams. And the Metsera acquisition will be complete, assuming things go as Pfizer plans, with the company's pipeline filled with strong new drug candidates. In other words, there will be a business turnaround, which is the real reason to buy Pfizer today.

It is even dealing with the political and social headwinds that it faces. That has included an agreement to make material capital investments in the United States to avoid tariffs, and to work with the U.S. government to provide more affordable access to Pfizer's drugs. Once again, Pfizer is doing what needs to be done to ensure it not only survives, but thrives over the long term.

NYSE: PFE

Key Data Points

Doing what needs to be done could mean a dividend cut

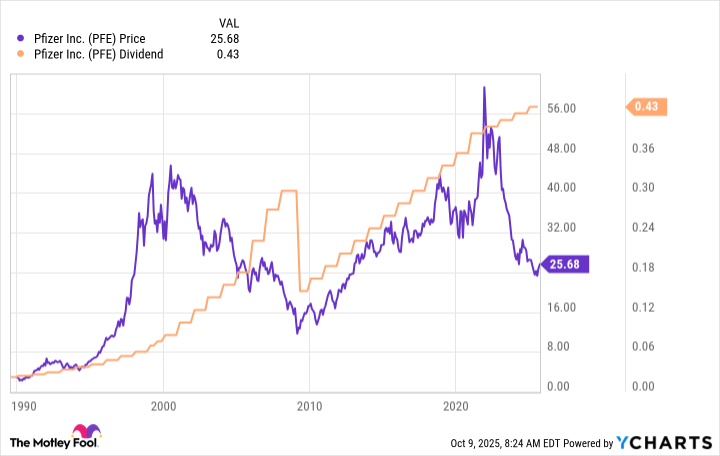

If you have a long-term investment horizon, buying Pfizer while it is down might be a good choice for your portfolio. Notably, the shares are off of their 2021 peak by nearly 60%.

That high-water mark was likely inflated by vaccine demand during the coronavirus pandemic, which analysts extrapolated way too far into the future. And that has now left the company with a less-than-sterling image in the eyes of some investors. But the fallout from that period of exuberance is what has created today's opportunity.

And given Pfizer's long history as a business and the steps it is taking today to effect a business turnaround, it seems highly likely that it will survive. It wouldn't be surprising, in fact, to see the company thrive over the long term. There's just one caveat: You probably shouldn't buy Pfizer for the dividend, which is only paid at the discretion of the board of directors.

The reason for this is because that last time Pfizer was in a deep funk, it cut the dividend. That 2019 decision by the board wasn't a random action; it was tied to the company's acquisition of Wyeth, for roughly $68 billion. While that was a much bigger deal than the one that was just inked for Metsera, it makes clear that the board of directors will do what's right for the company, even if that requires sacrificing the dividend.

Pfizer will be just fine in five years, but will the dividend be OK?

In five years, Pfizer will most likely be in a better position than it is today as a business. That's basically what management is working to set up right now, even as Wall Street sentiment is extremely negative.

If you are a long-term investor, both those facts combine to create a good reason to buy Pfizer today. But given the dividend history, you shouldn't buy this thinking it is a reliable dividend stock. Instead, you'll want to see the dividend as a bonus. If the dividend survives unscathed, you get a cherry on top of what is best seen as a turnaround investment.