On Oct. 6, the world's largest cryptocurrency, Bitcoin (BTC 0.06%), surged above $126,000 per coin for the first time, according to CoinMarketCap. It's pulled back about 9% since then (as of Oct. 13). And investors want to know what's going to happen for the rest of 2025 and in 2026 as well.

One thing's for sure: If Bitcoin is going to be a good investment today for 2026, it's going to have to break a pattern that it hasn't broken before. In fact, the pattern suggests that Bitcoin is due to crash by 66% in 2026. Here's why.

Image source: Getty Images.

Bitcoin's unbreakable pattern (so far)

The price of Bitcoin crashed hard back in 2014, 2018, and 2022, falling 61%, 73%, and 64%, respectively -- 66% on average. These crashes happened every four years, meaning the next one is due in 2026.

Experienced investors know that it's futile to try to time the tops and bottoms in the stock market. Witty investing great Peter Lynch said, "The only problem with market timing is getting the timing right." Simply put, short-term movements in the stock market are unpredictable.

That said, cryptocurrencies aren't stocks. And Bitcoin has some mechanics that stocks don't have, leading to well-defined four-year cycles.

CRYPTO: BTC

Key Data Points

Bitcoin is created by miners, and miners are rewarded in freshly minted coins, which increases the circulating supply. Bitcoin mining is measured in blocks, and each block unlocks 3.125 new bitcoins.

However, Bitcoin miners haven't always received 3.125 bitcoins per block -- it used to be much more. For every 210,000 blocks, the mining reward is cut in half. This is called Bitcoin halving, and it takes about four years for miners to trigger each new event.

This means that every four years, the supply-and-demand dynamics of Bitcoin are greatly disrupted. If the price of Bitcoin is rising, demand outpaces new supply. But then when supply growth slows with the halving, the price can jump even higher.

Historically, Bitcoin's price increases the year before and after the halving as well as the year of the halving itself. But every fourth year, it seems that demand balances back out with supply, leading to a big-time pullback.

To reiterate, the stock market doesn't work this way -- there aren't suddenly fewer shares of your favorite publicly traded company every four years. Moreover, not even all cryptocurrencies work this way. But Bitcoin does.

Bitcoin's most recent halving was in 2024, and the price is rising this year, as it always has in the year after a halving. But next year could be different if Bitcoin sticks to its historical script.

Why it might be different this time

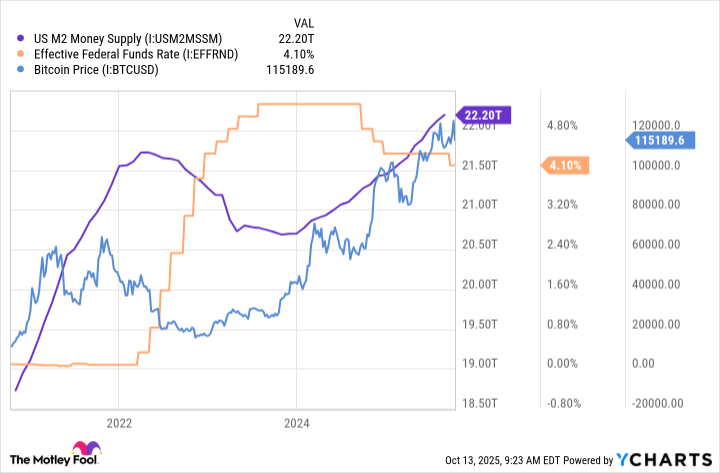

Cryptocurrency entrepreneur Arthur Hayes is on record saying that the four-year cycle for Bitcoin is over. According to his theory, the last crash for Bitcoin coincided with monetary policy changes. For example, the U.S. M2 money supply (cash, checking deposits, and other assets easily converted into cash) decreased, boosting the value of the U.S. dollar. And interest rates increased, discouraging investments in assets that are viewed as more risky, such as cryptocurrencies.

US M2 Money Supply data by YCharts

However, the setup for 2026 is much more favorable for Bitcoin, according to Hayes. M2 money supply is increasing once again, and interest rates are likely to decline in the coming year.

Some investors speculate that Hayes is holding a significant position in Bitcoin, so he's presumably hoping the price will go up in 2026. But there could be other reasons to believe that Bitcoin could break its four-year cycle.

Consider that when Bitcoin crashed in 2014, it had a market cap of less than $10 billion. But today, Bitcoin is worth about $2.3 trillion, and it has attracted the attention of institutional investors, sovereign funds, and more.

In other words, Bitcoin is far more mainstream in 2025 than it's ever been. This legitimizes it to the investor community, possibly stimulating enough demand to sustain the price of Bitcoin through this cycle and break the traditional four-year pattern.

I'm personally cautious in my outlook for Bitcoin in 2026. I do believe that it's more likely to go down than up in the coming year because of the four-year halving cycle.

I do think, however, there's merit to the argument that the cycle is broken now that Bitcoin has become a mainstream investment and now that monetary policy is potentially favorable for the coming year. So I'd be happy to be wrong and see Bitcoin go on to post more gains for investors in 2026 and beyond.