Nvidia is currently the largest company in the world with a market cap of $4.5 trillion. Given Nvidia's dominance in the global artificial intelligence (AI) semiconductor space and the billions of dollars that are going to be spent on building out AI data center infrastructure in the long run, it is easy to see why there are murmurs on Wall Street that it has the potential to achieve a $10 trillion market cap.

It won't be surprising to see Nvidia indeed reaching that mark thanks to its solid moat and the $5.2 trillion that's expected to be invested in AI data centers over the next five years. However, investors should also account for the rising competition that Nvidia is likely to face from competitors such as Broadcom, AMD, and others in the AI chip market, which could pose challenges in the company's quest to achieve a $10 trillion market cap.

Moreover, there's another company that's currently way smaller than Nvidia but is showing signs of breaching the $10 trillion mark before the chip giant. Let's take a closer look at that name.

Image source: Getty Images.

This cloud infrastructure giant has the potential to overtake Nvidia

Oracle (ORCL 4.29%) stock has been in fine form on the stock market in 2025, rising 76% as of this writing. That's well above the 36% gains that Nvidia has registered so far this year. Oracle's impressive rally has brought its market cap to $835 billion, making it the 12th largest company in the world.

NYSE: ORCL

Key Data Points

You may be wondering how Oracle is in a position to race ahead of Nvidia toward the $10 trillion mark. But a closer look at Oracle's business model, the role it is playing in the proliferation of AI, and the pace at which it is building its revenue pipeline will make it clear why it is indeed capable of achieving that feat.

Oracle's global data center infrastructure is being used by major cloud computing companies, governments, and AI companies for running AI workloads. In fact, the company has been receiving more business in the cloud infrastructure segment than it can fulfill. This has led to a massive increase in its remaining performance obligations (RPO), which refers to the total value of the company's contracts that are yet to be fulfilled at the end of a period.

For instance, Oracle's overall revenue grew by 12% year over year in the first quarter of fiscal 2026 (which ended on Aug. 31). Meanwhile, its RPO shot up by a whopping 359% year over year to $455 billion thanks to "four multi-billion-dollar contracts with three different customers." Management remarked in September that Oracle is on track to sign up "several additional multi-billion-dollar customers and RPO is likely to exceed half-a-trillion dollars" in the next few months.

The good part is that it didn't take long for Oracle's next big contract to arrive. It revealed a five-year deal with OpenAI worth a whopping $300 billion on the day following its fiscal Q1 earnings report. The contract goes into force from 2027, and the size of this deal suggests that Oracle's RPO is probably well above a massive $750 billion right now, at least.

Throw in the other multibillion-dollar deals in the pipeline that Oracle management talked about last quarter, and it won't be surprising to see its RPO approaching the $1 trillion mark. The company also offers multicloud database services that allow its customers to run Oracle's database offerings on Google's, Microsoft's, and Amazon's cloud services.

The demand for the company's multicloud solutions is growing at an incredible pace. Oracle reports that its multicloud database revenue shot up a remarkable 1,529% in the fiscal first quarter. Not surprisingly, the company is expecting substantial growth in this segment and plans to take its multicloud data center count to 71 from 34.

Moreover, the AI-focused cloud computing market is expected to hit $3.7 trillion in revenue in 2034, when the overall cloud computing market could hit $5.1 trillion in revenue. Oracle, therefore, can continue to build a terrific long-term revenue pipeline that's going to supercharge its growth for a long time to come.

Here's how Oracle can achieve a $10 trillion valuation

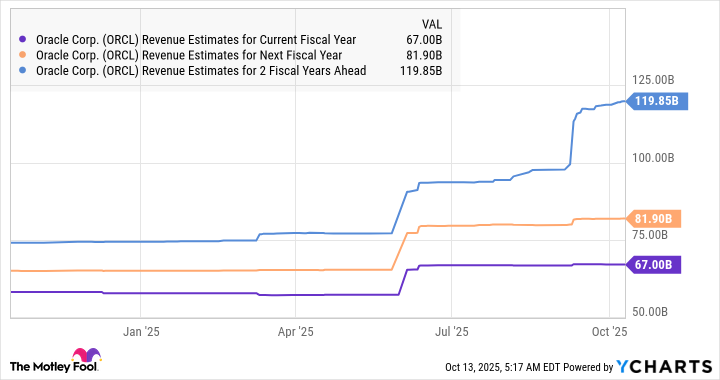

Though Oracle's growth wasn't all that great in the previous fiscal quarter, the company's ballooning revenue pipeline explains why its growth is expected to step on the gas.

ORCL Revenue Estimates for Current Fiscal Year data by YCharts

But what's worth noting is that Oracle's RPO is substantially greater than the combined revenue that the company is expected to generate in the next three fiscal years. Given that the company expects to land new contracts that could further inflate its backlog, don't be surprised to see its revenue growth accelerating beyond the next three fiscal years.

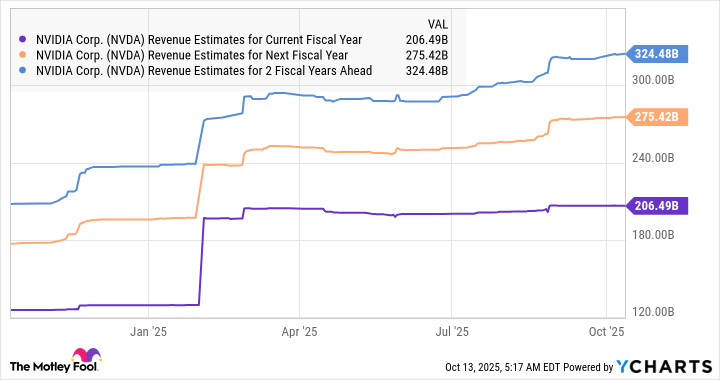

Nvidia's revenue growth, on the other hand, is expected to taper off.

NVDA Revenue Estimates for Current Fiscal Year data by YCharts

If we assume that Oracle's top line increases at an annual rate of 40% in the five-year period following fiscal 2028, its revenue could hit $645 billion in 2033 (using fiscal 2028 revenue of $120 billion as the base). That seems quite possible considering the $5.1 trillion annual revenue that the cloud computing market could hit in 2034, as we saw earlier in the article.

The stock is currently trading at 14 times sales, but it could trade at a bigger premium in the future given the potential acceleration in growth. A price-to-sales ratio of 16 will be enough for the company to hit a $10 trillion market cap. Nvidia, on the other hand, may witness a drop in its valuation considering the forecast slowdown in its growth, indicating that Oracle could indeed become the first company to achieve that milestone.