Artificial intelligence (AI) stocks are having another stellar year, as the heavy spending on this technology is showing no signs of cooling down. That's not surprising, since it looks like everyone wants to get a piece of the productivity and efficiency gains that this technology can deliver.

Not surprisingly, shares of AI stalwarts such as Nvidia and Palantir Technologies have been in fine form in recent months. Nvidia's stock price has jumped 62% in the past six months as the appetite for AI chips that aid in AI model training and inference in data centers remains solid. Meanwhile, Palantir's stock price has doubled in the past six months, driven by an acceleration in the company's growth on account of the rapidly growing demand for its generative AI software platform.

However, the returns of both these companies are overshadowed by a much smaller player, Vertiv Holdings (VRT 0.19%), which gained an impressive 152% in just six months. Let's see why Vertiv stock has crushed both Nvidia and Palantir in recent months, and check if it is still worth buying.

Image source: Getty Images

Vertiv's fast-improving order book points toward a bright future

Vertiv designs, manufactures, and sells power management systems, thermal management systems, data center racks and enclosures, and other software and services that help data centers and communications networks operate reliably. The company's offerings are now in high demand thanks to the complex workloads and high power demand in data centers running high-performance computing and AI workloads.

NYSE: VRT

Key Data Points

For instance, CoreWeave, a fast-growing cloud infrastructure provider, has been partnering with CoreWeave to bring online dedicated AI data centers. CoreWeave recently used Vertiv's cooling distribution units in its Nvidia GB300 NVL72 rack scale system, and the latter will also provide modeling and thermal simulation solutions to ensure operational reliability.

Partnerships with the likes of CoreWeave explain why Vertiv's growth is now accelerating.

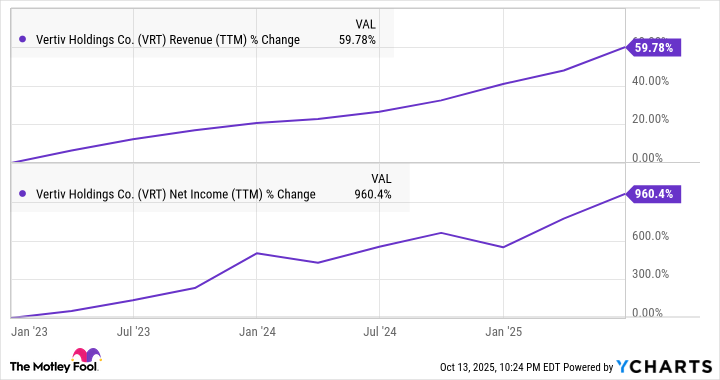

Data by YCharts.

The company's revenue in the first six months of 2025 increased by 30% from the same period last year to $4.67 billion. This shows that Vertiv is on track to deliver significantly stronger growth this year as it delivered a 16% jump in its revenue in 2024 to just over $8 billion. Specifically, Vertiv is projecting organic sales growth of 24% in 2025.

It is worth noting that Vertiv recently completed the acquisition of data racks and cabinets provider Great Lakes for $200 million to bolster its position in the AI data center market. That's a smart move considering that Vertiv has been receiving orders at a faster pace than it can fulfill them.

This is evident from the company's book-to-bill ratio of 1.2 in Q2. The company received orders exceeding $3 billion in the second quarter, which encouraged it to raise its full-year outlook. Another thing worth noting is that Vertiv's non-GAAP earnings increased by 42% year over year in Q2 despite tariff-related headwinds.

The good part is that Vertiv can sustain such healthy growth rates for a long time to come. That's because AI-fueled power demand in data centers is expected to grow by a whopping 165% by 2030, according to Goldman Sachs. This huge jump in data center power consumption will be driven by an expansion in capacity to meet AI workloads.

According to McKinsey, data center capacity could jump by 4x between 2023 and 2030 to 219 gigawatts (GW) in a mid-range scenario. Even then, there's likely to be a deficit in data center capacity to meet AI-fueled demand by the end of the decade. As more AI data centers are built, the demand for Vertiv's cooling, power management, and data center rack solutions should increase.

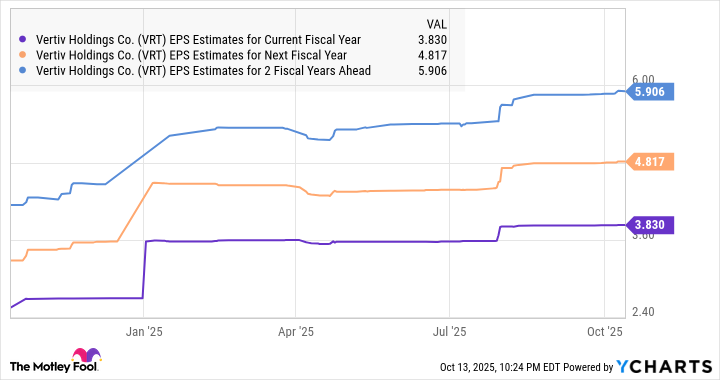

These factors should allow the company to sustain robust earnings growth levels in the long run. This is precisely what analysts are predicting.

Data by YCharts.

The stock is still trading at an attractive valuation

Even though Vertiv stock has shot up phenomenally in the past six months, it can be bought at 34 times forward earnings. That's lower than the U.S. technology sector's average price-to-earnings ratio of 52. Buying Vertiv at this valuation looks like the smart thing to do, considering the terrific pace at which its earnings have been growing.

In addition, the stock has a price/earnings-to-growth ratio (PEG ratio) of 0.91 based on the potential annual earnings growth it can deliver for the next five years, according to Yahoo! Finance. The PEG ratio is a forward-looking valuation metric, and a reading of less than 1 means that the stock is undervalued with respect to its earnings growth potential.

That's why it would be a good idea to buy this AI stock even after the stunning gains that it has delivered of late since it has the ability to fly higher.