Here's our initial take on Taiwan Semiconductor Manufacturing's (TSM 2.66%) financial report.

Key Metrics

| Metric | Q3 2024 | Q3 2025 | Change | vs. Expectations |

|---|---|---|---|---|

| Net revenue | NT$759.7 billion | NT$989.9 billion | 30% | Beat |

| Earnings per share | NT$12.54 | NT$17.44 | 39% | Beat |

| Gross margin | 57.8% | 59.5% | 170 bp | n/a |

| Wafer shipments (thousand 12-inch equiv.) | 3,338 | 4,085 | 22% | n/a |

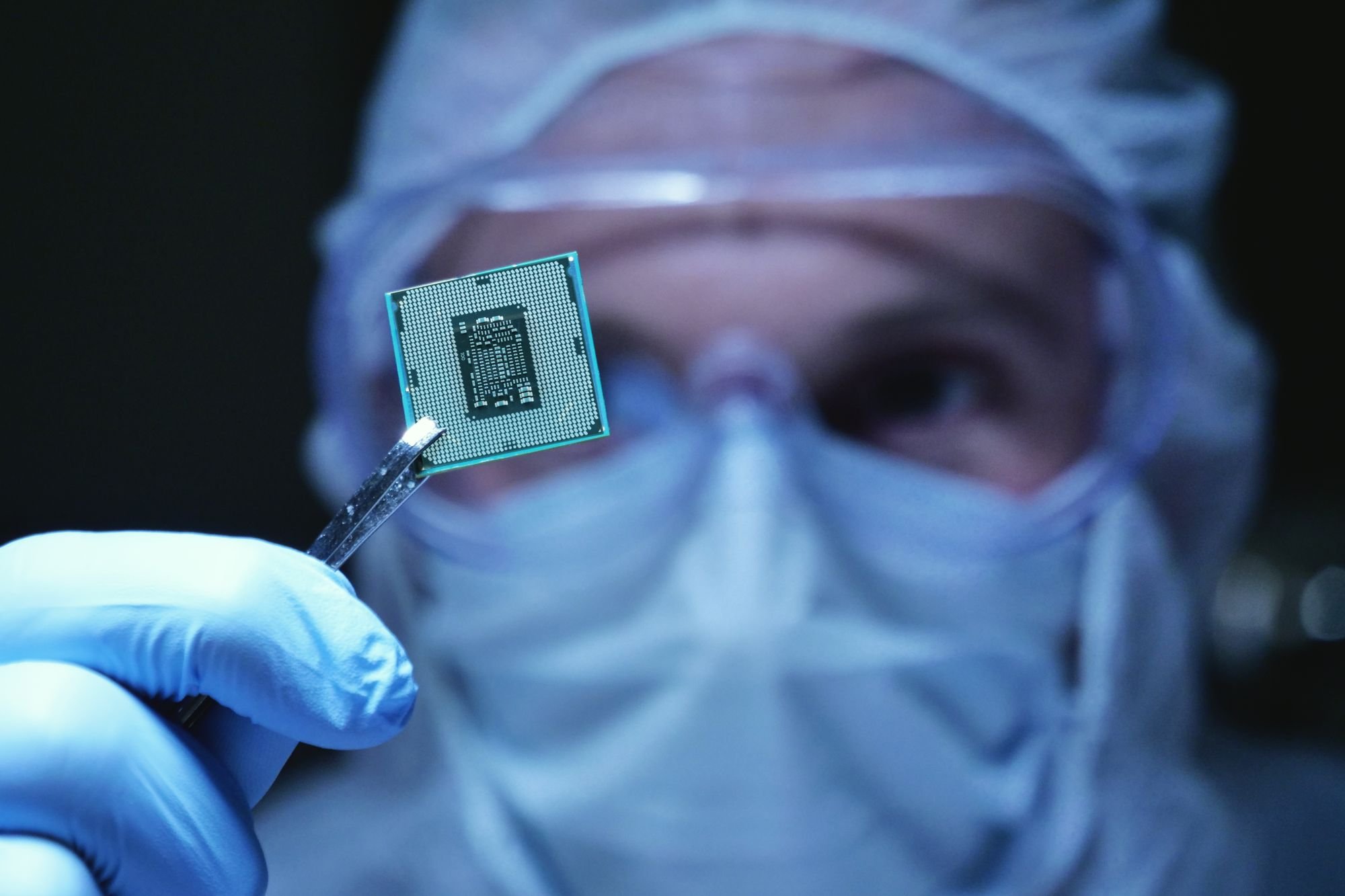

AI Chip Demand Fuels Record Profit at TSMC

Taiwan Semiconductor Manufacturing, or TSMC, generated 989.92 billion New Taiwan dollars ($33.10 billion) in revenue and NT$452.3 billion in net income in the quarter, topping Wall Street expectations and posting new all-time highs.

The company is the go-to foundry for the chips powering the AI revolution. CEO C.C. Wei, on a postearnings call with investors, said recent developments in the AI market "continue to be very positive," strengthening the company's conviction surrounding what Wei called "the AI megatrend."

High-performance computing, which includes AI-related chips, accounted for 57% of revenue, up from 51% a year ago. Smartphone chips contributed 30% of revenue, while chips for Internet of Things and automotive accounted for 5% each.

Customers are paying up for the chips. Gross margin for the quarter came in at 59.5%, up 170 basis points from a year ago, and operating margin of 50.6% was up 310 basis points from the third quarter of 2024.

TSMC raised its full-year revenue guidance from up 30% to the mid-30% range, but Wei did say the company is monitoring "uncertainties" surrounding U.S. tariffs and U.S. restrictions on chips bound for China.

NYSE: TSM

Key Data Points

Immediate Market Reaction

TSMC shares opened higher on Thursday before giving back those gains, in step with the broader market. Shares of Taiwan Semiconductor were down about 1.5% in midday trading on Thursday.

What to Watch

Wei and TSMC see no slowdown in AI demand ahead, but with the stock up nearly 50% already in 2025, investors appear focused as much on the geopolitical risks as they are on the future opportunity. TSMC is investing heavily in the U.S., including new facilities in Arizona, but those investments will take time to translate to the bottom line.

The company is also reportedly in talks with Intel (INTC 4.64%) about potential investments and partnerships.

Overall, TSMC remains both pushed forward by AI tailwinds and also caught up in macroeconomic uncertainty. The AI strength should prevail over the long term, but investors should expect volatility in the near term as headline risks over tariff and export controls continue to dominate the news cycle.