The "Magnificent Seven" cadre of stocks are among some of the best on Wall Street. The group of seven companies -- Alphabet, Amazon (AMZN 0.09%), Apple (AAPL 0.65%), Meta Platforms, Microsoft, Nvidia, and Tesla -- represents megacap companies that are market leaders in their fields, are innovative, and have a strong financial performance. It's not surprising that each of these companies have a market capitalization of more than $1 trillion.

Amazon and Apple are two household names that have a lot in common. Both companies succeed because they have developed huge ecosystems that give them undeniable advantages over their competitors. They disrupted the e-commerce and telecommunications markets, respectively, and became market leaders. Despite their huge sizes, both do an outstanding job of offering personalized experiences that solidify customer loyalty.

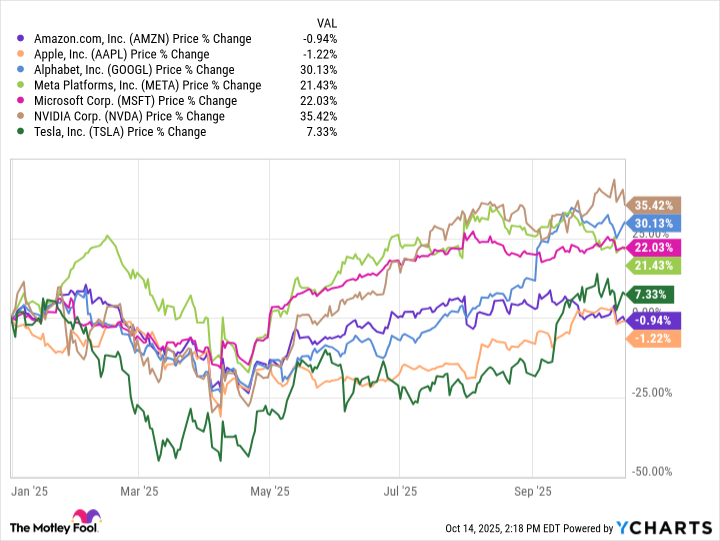

It's not all rosy, though. Amazon and Apple have been the worst-performing members of the Magnificent Seven so far this year, struggling to stay in the black. As we turn toward the fourth quarter of 2025, which of these companies is the better investment today?

Amazon

Is Amazon an e-commerce company or a cloud computing powerhouse? Why not both?

The e-commerce division is perhaps where Amazon is best known. After all, it's nearly impossible not to see all those distinctive blue Amazon delivery trucks on the road every day.

Amazon generated $167.7 billion in sales in Q3, with most of those coming from the company's e-commerce efforts. Amazon saw $100.1 billion of sales in North America, up 11% from a year ago and $36.8 billion in international sales, up 16%. While those numbers are great, the profit margin isn't. Operating expenses for the Amazon.com website was $127.8 billion, leaving the company with only $9.3 billion in profit for its e-commerce efforts.

A better business is the Amazon Web Services (AWS) cloud computing division, which generated $30.8 billion in sales and $20.7 billion in operating expenses, giving it a clean profit of $10.16 billion. That's up from $9.3 billion in the same quarter a year ago.

NASDAQ: AMZN

Key Data Points

AWS is the dominant cloud computing platform in the world, holding a 30% market share, topping Microsoft Azure (20%) and Google Cloud (13%). Cloud computing is becoming more important as companies around the world seek to run critical operations on a cloud or hybrid cloud environment. The AWS infrastructure is critical for companies looking for virtual services, storage, and networking solutions without investing in costly data centers on their own.

Amazon stock carries a pricey 32.8 forward price-to-earnings (P/E) ratio. But when you consider that at the beginning of 2024, the P/E was more than 50, Amazon stock looks more appealing.

Apple

Like Amazon, Apple is best known for its core product -- iPhones, which make up the biggest chunk of company revenue. But it's the services segment that makes me most interested in Apple stock because services is where the money comes from.

Apple's products, including iPhones, iPads, Mac computers, wearables, and smarthome products, generated $66.6 billion in revenue for the fiscal 2025's Q3 and $43.6 billion in operating expenses, giving it roughly a 36% profit margin for those sales. Meanwhile, the services segment generated $27.42 billion in revenue and only $6.7 billion in operating expenses. That's a profit margin of better than 75%, which makes sense because the services segment, including Apple Music, Apple TV, Apple Pay, iCloud, and the lucrative App Store, doesn't have the costs of designing, building, and selling.

NASDAQ: AAPL

Key Data Points

And it should be noted that Q3 in general was a badly needed strong showing for Apple. The company's revenue stagnated in recent quarters thanks to market saturation and rising competition in China, but in Q3 the company's revenue was up 10% to $94 billion. Earnings per share were $1.57, up 12% from a year ago.

Apple is hoping for strong performance from its newly released iPhone 17 line, but I don't know if it will happen. The company's most recent phones improve battery life, camera performance, and storage. But that's a far cry from the iPhone improvements of the past, which included revolutionary advances like touchscreens, the Siri voice assistant, and facial recognition.

Apple stock trades at a forward P/E of nearly 31, similar to Amazon.

The verdict

Both of these are solid companies. They both belong in the Magnificent Seven, and both should continue to reward their investors.

And they both have some advantages. While they have similar P/E ratios, Amazon has a significantly better forward price-to-sales (P/S) ratio of 3.2 versus Apple's 8.3. Apple, meanwhile, pays a small quarterly dividend of $1.04 per share annually, which equates to a yield of 0.4%. Amazon doesn't pay a dividend.

But if you have to pick just one, the choice is Amazon. I appreciate the growing cloud computing division. While there are serious challengers from Alphabet and Microsoft, the cloud computing market share is expected to grow from $752.4 billion in 2024 to $2.39 trillion by 2030, for a compound annual growth rate (CAGR) of 20.4%. That kind of growth engine is impossible to ignore, which is why I think Amazon is the better stock for buy-and-hold investors.