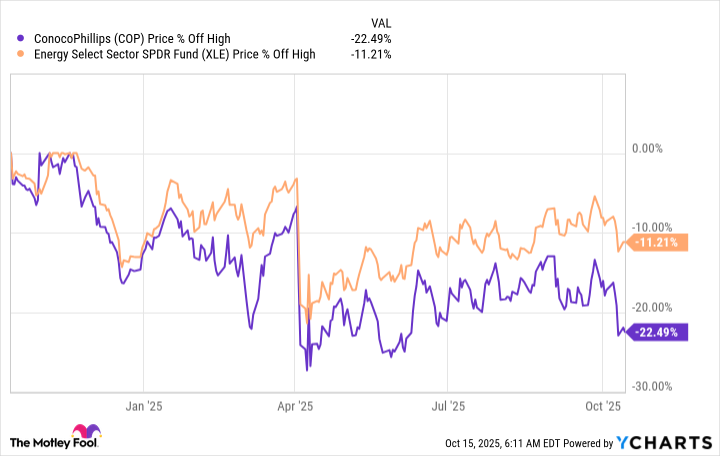

The past year has not been kind to the shares of ConocoPhillips (COP +3.06%). The share price has fallen around 22% or so, which is twice the drop of the broader energy sector, using Energy Select SPDR ETF (XLE +3.24%) as an industry proxy. That divergence might lead some investors to wonder what's wrong with ConocoPhillips right now. The answer is that the stock and business aren't the same thing.

What does ConocoPhillips do?

ConocoPhillips is what is known as an independent energy producer. Essentially, all it does is drill for oil and natural gas. This means it operates in the upstream of the broader energy sector. Energy prices are highly volatile and often move very quickly because of geopolitical news and supply/demand changes. That can lead to swift swings in the sales and earnings of companies like ConocoPhillips.

Image source: Getty Images.

That's the big story today, with energy prices hitting a bit of a weak patch after soaring coming out of the height of the coronavirus pandemic. Simply put, ConocoPhillips' income statement results are a bit weak right now. The company's adjusted earnings per share tallied up to $1.42 in the second quarter of 2025 versus $1.98 in the same quarter of 2024. In some ways, it makes sense that investors are downbeat on the stock.

However, it is important to note that this type of earnings volatility is perfectly normal for ConocoPhillips' business. It is just how the energy industry works. To highlight that, the company's realized price per barrel of oil equivalent (BOE) in the second quarter of 2025 was 19% lower than it was in the second quarter of 2024. That was almost entirely out of the company's control (hedging can sometimes soften the impact of commodity price swings).

Data by YCharts.

ConocoPhillips is executing well as a business

To be fair, ConocoPhillips is not a stock that a conservative investor will probably want to buy. A better option in the energy patch would be a pipeline operator like Enterprise Products Partners, which is a toll-taker paid to move oil and natural gas. With revenue and earnings tied to energy prices, only more aggressive types will want to buy ConocoPhillips.

And ConocoPhillips happens to be a fairly well-run business. The best example of that is the company's dividend history. While the dividend has gone up and down over time, the company has paid a dividend consistently for decades. That speaks to a business that is being operated at a high level despite the fact that its top and bottom lines can be volatile at times.

NYSE: COP

Key Data Points

More specific to today, ConocoPhillips is seeing some notable operating success that is being overshadowed by energy price moves. For example, ConocoPhillips completed its acquisition of Marathon Oil in late 2024, expanding its business. The integration effort has been outdistancing the company's own expectations. There was a 25% uplift in the new resources added versus projections. A 100% increase in cost synergies over expectations. And the company has been able to ink 25% more asset sales than projected, and more quickly than forecast, as ConocoPhillips looks to use the deal to refocus around its best assets.

Basically, ConocoPhillips is doing a pretty good job right now. In fact, despite the revenue and earnings hit caused by lower energy prices, the company actually increased production 3% year over year in the second quarter of 2025.

ConocoPhillips could be a good way to get direct energy exposure

All in, ConocoPhillips as a business is doing just fine. When oil prices recover, as they always have before, it will likely be in a better position to benefit than it was a year ago. The stock, however, is a different story, since investors are focusing on revenue and earnings, which are inherently volatile and relatively weak at the moment. That's what's wrong with the stock, even though there's really nothing wrong with the business. If you are looking for energy exposure, however, ConocoPhillips' business could make it an interesting stock to dig into.