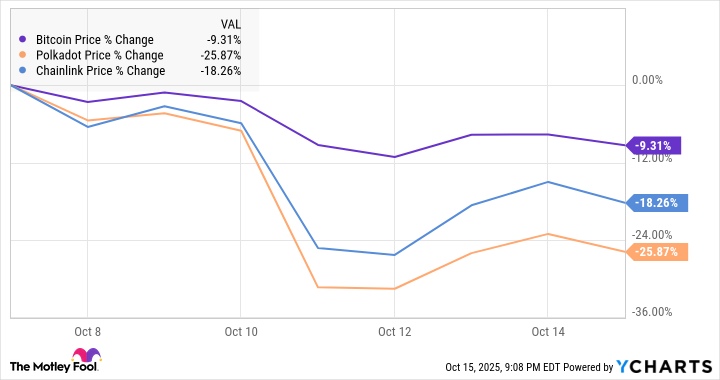

Cryptocurrencies took a hit over the last week. As of this writing on Oct. 15, the total crypto market was worth $3.76 trillion -- down from an all-time high of $4.32 trillion eight days ago.

The ice bath exposed a few overvalued meme coins, but also lowered the price of many high-quality names. The main headwind forcing them down is macroeconomic turmoil, centered around international trade tensions.

This, too, shall pass, and I see several tempting buys right now. Here are the three best crypto ideas I see in this sudden retreat.

Bitcoin Price data by YCharts

1. Bitcoin

The market-defining Bitcoin (BTC +6.62%) is currently down 9.3% since Oct. 7. You know the old adage about buying stocks when there's blood in the street? That's even more true when the asset in Wall Street's bargain bin looks like an effective long-term hedge against the ongoing market threats.

Geopolitical tensions add stress to the global financial system. The very purpose of Bitcoin is to provide an alternative channel for holding or moving monetary value, separated from old-school currencies like the dollar, the yuan, and the euro. Bitcoin's stable supply and potentially rising demand should result in higher prices over time, with or without international trade wars.

Bitcoin isn't risk-free, and I would not recommend parking your life's savings in this digital asset. However, it does look like a reasonable investment at a temporary discount this week.

CRYPTO: DOT

Key Data Points

2. Polkadot

Polkadot (DOT +6.34%) is the functional crypto network of the Web3 project. Its investors have been losing patience with the long-promised Web3 revolution in 2025, so Polkadot traded near multiyear lows before the recent panic. Today, it's 70% below its 52-week highs.

I think that's downright silly.

First, Polkadot is knee-deep in structural changes. It's already one of the fastest smart contract platforms out there, and will gain even more computing muscle over the next few months. These are the final stages of the Polkadot 2.0 upgrade cycle, creating a "supercomputer on the blockchain" that can run pretty much any computer code on a global, high-performance network.

Image source: Getty Images.

After that, Polkadot is shifting to an inflation-resistant staking system that puts a hard limit on the number of coins that will ever be minted. This makes it more like Bitcoin, which famously stops making new coins after 21 million units.

Finally, I'm convinced that the Web3 switch will happen someday. I can't promise that the date will fall in 2026, but it wouldn't surprise me at all. The social media structure is ripe for a new online interaction design, focused on privacy and personal control over your media. Polkadot will benefit from that switch.

CRYPTO: LINK

Key Data Points

3. Chainlink

And then there's Chainlink (LINK +6.52%). The leading oracle coin provides the real-world data that makes smart contracts work. Without it, coins like Polkadot and Ethereum lose their luster.

This coin is down 18% in eight days and 35% from December 2024. It's one thing if you think that cryptocurrencies are useless in general, but Chainlink plays a unique role in the ecosystem. In a world where cryptos and smart contracts are valuable at all, Chainlink should soar in the long run.