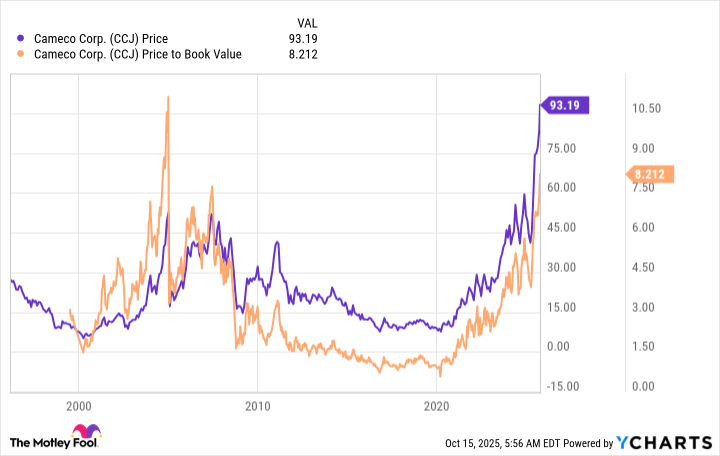

Cameco (CCJ 0.46%) has had a great run so far in 2025, with the stock up a heady 80% year to date at the time of this writing. For comparison, the S&P 500 index (^GSPC 2.05%) is up about 13% over the same span. That's pretty incredible outperformance, but can it continue? The answer to that question requires a deep dive into what Cameco does.

What does Cameco do?

From a big-picture perspective Cameco, is best categorized as a miner. What's interesting here is that it mines for uranium, the fuel used in nuclear power plants. To be fair, it does more than just mine for uranium, it also processes it and, more recently, the company took a 50% stake in Westinghouse, a service provider to the nuclear power industry. But the big thing is still the connection to nuclear power.

Image source: Getty Images.

Nuclear power is, once again, in vogue. As a source of electricity it provides always-on power, also called base-load power, and it doesn't emit greenhouse gases, so it is so-called clean energy. That makes it a valuable companion to intermittent renewable power sources like solar and wind. With huge demand expected from things like data centers and artificial intelligence, the world has started to embrace nuclear power as a desirable energy option.

The problem is that nuclear power has been through periods similar to this before. But high-profile nuclear accidents (Fukushima, Chernobyl, Three Mile Island) quickly changed the world's view of nuclear power when they occurred. Accidents happen, so it is highly likely that another nuclear meltdown will, eventually, take place. That could again shift the view of nuclear power, and Cameco, for the worse. There's no way to avoid that risk if you buy Cameco stock.

NYSE: CCJ

Key Data Points

The long-term picture is attractive for Cameco

Assuming you are willing to take on the idiosyncratic risks associated with the nuclear power niche, Cameco could have a very bright future as a business. Cameco estimates that starting around 2030, the demand for uranium will begin to outstrip the supply of the nuclear fuel. Currently planned supply expansions aren't nearly large enough to bridge the supply gap that is expected to emerge over the decades that follow.

When a commodity sees more demand than there is supply the price of that commodity usually starts to head sharply higher. That's the background that supports a very bright outlook for Cameco. To be fair, high commodity prices generally bring in new investment, so the outlook may not be as rosy as it seems today. But the trend is pretty clear: Higher uranium prices will be in the cards if things don't change with uranium supply or demand.

On top of that, Cameco has diversified its business to include nuclear power services, via its investment in Westinghouse. That business should provide more consistent revenue over time, helping to offset some of the inherent volatility in the company's commodity-driven uranium mining and processing operations. All in, it is a fairly compelling backdrop.

That said, Cameco's price-to-book value ratio has risen dramatically and is now near the highest levels in the company's history. In fact, the P/B ratio is above where it was just prior to the 2011 Fukushima meltdown. It looks like investors have priced in a lot of good news at this point, suggesting that things may need to go very well if there is to be further sustained upside in the stock.

Tread with caution with Cameco

Cameco is a well-run business and if you are looking for a pick-and-shovel play in the nuclear power sector it is a good candidate. But if you buy it you really need to believe that there is material growth ahead for nuclear power and, thus, more demand coming for uranium. You also need to make sure you are comfortable with the headline risk inherent to the industry because of the potential for nuclear meltdowns. This is not a great option for risk-averse investors. And yet, if things go well, the business could continue to see strong demand and earnings for years to come.