Chipotle Mexican Grill (CMG +1.38%) has unwrapped its most serious challenge since the health outbreaks of the previous decade. The stock of the Newport Beach, California-based company is down more than 35% since peaking in December of last year, and with sales growth decelerating rapidly, investors seem less tolerant of its elevated valuation.

This leaves prospective shareholders in a predicament. Should they stay away because shares are going to keep sliding, or is it time to start buying at this discounted stock price?

Chipotle's struggles

Chipotle's struggles may date back to the time former CEO Brian Niccol announced his departure to Starbucks in August last year.

Since Chief Operating Officer Scott Boatwright has taken over as CEO, Chipotle's struggles have become more apparent. The economy remains uncertain, and fast-casual restaurants such as Cava Group and Sweetgreen have captured increased attention.

NYSE: CMG

Key Data Points

That has led to comparable restaurant sales decreasing by 4% in the second quarter of 2025, and, for the year, management has guided to flat comparable restaurant sales compared to last year's results.

Consequently, revenue for the first half of 2025 increased by 5% year over year to just over $5.9 billion. Operating costs and expenses also rose across the board, causing its net margin for the first two quarters of 2025 to fall to 13.9% from 14.4% one year ago. Thus, Chipotle's $823 million in net income increased by only 1% during that period.

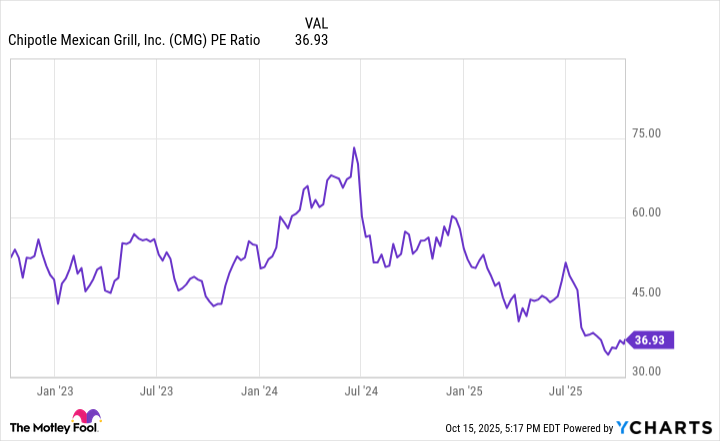

Amid that performance, its P/E ratio, which has rarely fallen below 45 over the last three years, is now down to 37, a valuation it had not seen since the food-borne illness outbreaks in the middle of the previous decade.

CMG PE Ratio data by YCharts

The factor that could spark the comeback in Chipotle stock

Investors should also not lose sight of the attributes that made Chipotle so successful for so long. The company showed the market that restaurants could succeed with the fast-casual concept while offering food that was healthy and flavorful. With that, its loyal following and brand recognition have fostered the growth that has taken it to more than 3,800 restaurants.

Management also believes it can eventually grow to 7,000 locations in North America. This means it will probably have positive growth over the next few years, even under more bearish scenarios.

However, the slowing growth means Chipotle has had to depend on its aggressive store openings to keep revenue growth positive. To that end, it has planned to open between 315 and 345 new restaurants, opening 113 of those restaurants in the first half of the year.

Additionally, even though the company has capitalized on most of the opportunities to be found in the U.S., that country accounts for more than 98% of its locations.

With that, the future growth of Chipotle stock likely depends heavily on international success. It opened a small number of locations in Canada, Western Europe, and Kuwait before Niccol departed. Under Boatwright's leadership, it plans to expand into South Korea, Singapore, and Mexico next year.

That could ultimately lead to the type of success that benefited restaurant chains like Starbucks and McDonald's. Since each of these chains has grown to more than 40,000 restaurants, Chipotle has the opportunity for a massive expansion if it can develop a significant following outside of the U.S.

Should I buy Chipotle stock?

Under current conditions, investors should probably refrain from purchasing Chipotle stock, at least for now.

Indeed, Chipotle is likely to continue adding locations, keeping overall revenue growth positive and probably making the stock a hold. Nonetheless, the real test is how its international expansion will go. If it takes off abroad, it could match Starbucks or McDonald's for the number of locations under more optimistic scenarios. Such a success means that Chipotle has barely scratched the surface of its potential and that investors should buy the stock.

However, if Chipotle fails abroad and is eventually limited to its 7,000-restaurant goal in North America, the slowdown in growth could become permanent, which could ultimately mean the consumer discretionary stock sells at a lower valuation.

Thus, investors should either wait for signs of success abroad or at least hold out for a substantial acceleration in revenue growth before buying Chipotle at current levels.