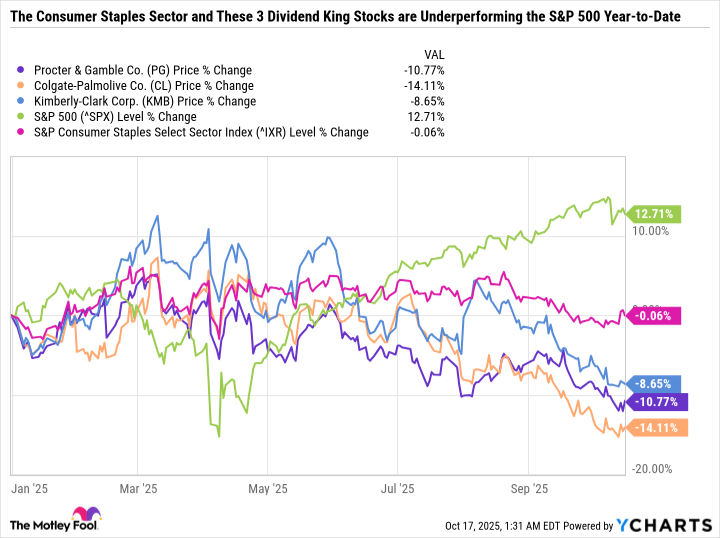

The S&P 500 (^GSPC) is having a great year, led by strong gains in tech, communications, financials, and industrials. But not every sector is performing well.

The consumer staples sector is roughly flat year to date. It would be down even more if Walmart, the most valuable stock by market cap in the sector, wasn't outperforming the S&P 500.

Here's what's driving the sell-off in dividend stocks like Procter & Gamble (PG), Colgate-Palmolive (CL), and Kimberly-Clark (KMB), and why all three companies are compelling buys in October.

Image source: Getty Images.

An industrywide downturn

P&G, Colgate-Palmolive, and Kimberly-Clark make household and personal care products for everyday use.

P&G has leading brands in fabric and home care, baby, feminine, and family care, hair care, skin and personal care, grooming, oral care, and personal healthcare.

Colgate-Palmolive is similar to P&G, but it focuses mainly on oral health with its flagship Colgate lineup. It also owns personal care brands like Palmolive, Softsoap, and Speed Stick, home care brands like Ajax and Murphy Oil Soap, Hill's Pet Nutrition, and more.

Kimberly-Clark specializes in products that use paper or absorbent materials, like toilet paper, paper towels, tissues, diapers, adult care, and feminine care.

Consistent demand, paired with international distribution, makes all three companies reliable performers even when economic growth is slow. But the current operating environment is uniquely challenging.

Procter & Gamble CFO Andre Schulten said the following during the company's fourth-quarter fiscal 2025 earnings call:

The volatility the consumer is seeing, is maybe not necessarily grounded in their current reality, but more on what to expect for the future. So consumers are a bit more careful in terms of consumption. They are using up pantry inventory and they are looking for value either in smaller packs and promotions or in larger pack sizes in the club. That's a behavior we've been outlined before, but it's not stopped. It continued. So the trajectory here could be that we've reached the low point and the consumer gains confidence, the labor market is stable, inflation doesn't pick up.

Weak consumer confidence and pullbacks in spending illustrate the conflict between broader stock market gains and the economy. Record spending on artificial intelligence (AI) is occurring as consumers resist inflation and navigate cost-of-living increases. AI spending is benefiting corporations, not consumers.

"I do see purchasing power under pressure, right, for consumers. And frankly, we don't really see a catalyst for that dynamic to change in the near to medium term," said Kimberly-Clark CEO Michael Hsu on the company's second-quarter 2025 earnings call.

"The Colgate-Palmolive team continues to execute with resilience even as the environment remains difficult with category volatility, geopolitical, macroeconomic, and consumer uncertainty, high raw material and packaging costs, including as a result of tariffs and lower levels of end market inflation," said Noel Wallace, CEO of Colgate-Palmolive, on the company's Q2 2025 earnings call.

After years of relying on price increases, consumer goods companies are looking for new ways to pass along value to customers to boost volume. Larger package sizes and multipacks reduce the price per unit of a product, even if they result in lower margins for the manufacturer. Smaller-sized items lower the out-of-pocket expense for people looking to stretch their paychecks.

Three reliable dividend stocks at compelling valuations

P&G, Colgate-Palmolive, and Kimberly-Clark all face slowing revenue growth and stagnating operating margins. Over the last decade, P&G and Colgate-Palmolive have grown sales by less than 25%, while Kimberly-Clark's sales are roughly flat.

P&G and Colgate-Palmolive have high operating margins at 24.2% and 22%, respectively, but there's little room to grow margins due to pricing pressures on consumers, which are spread thin from inflationary pressures. Meanwhile, Kimberly-Clark's operating margins have fallen from high-teens levels pre-pandemic to mid-teens today.

In today's economy, a strong brand will only go so far. The key for these companies is to focus on what they can control by optimizing their supply chains and pricing structure to offset tariff and inflationary effects.

While it's not an easy operating environment for these companies, there's reason for long-term investors to be hopeful. Falling interest rates and trade resolutions should help reduce costs and spur consumer spending. Short-term-focused investors may dump consumer staples stocks in the bargain bin in favor of red-hot AI growth stocks. But if there's a sell-off, it wouldn't be surprising if investors flocked to consumer staples stocks.

At times like this, long-term investors should filter out the noise and focus on fundamentals. P&G, Colgate-Palmolive, and Kimberly-Clark are well-positioned to grow steadily over time and reward investors with consistent passive income.

All three companies are Dividend Kings -- meaning they have raised their dividends for more than 50 consecutive years. In January, Kimberly-Clark made its 53rd consecutive annual raise, followed by Colgate-Palmolive's 63rd raise in March and P&G's 69th consecutive increase in April. The sell-off in all three stocks, paired with consistent dividend raises, pushed Kimberly-Clark's yield up to 4.2%, P&G's yield to 2.8%, and Colgate-Palmolive's yield to 2.7%.

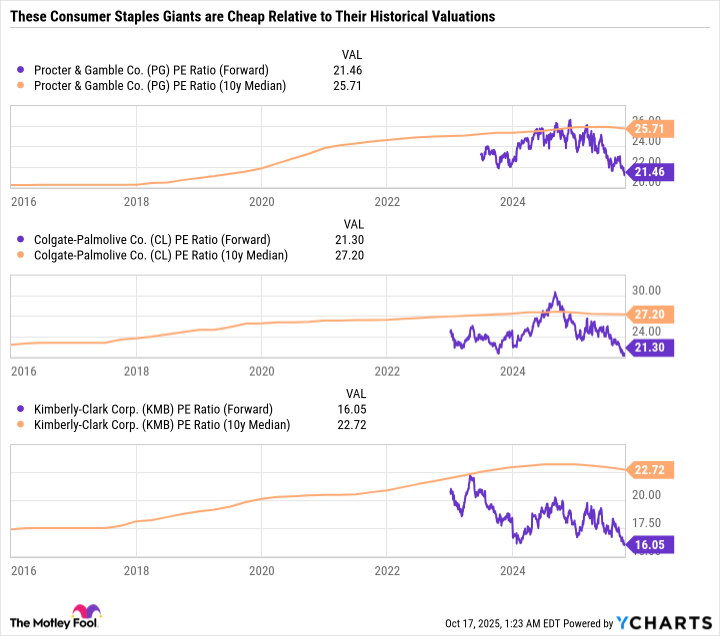

What's more, all three stocks are trading at steep discounts to their historical average valuations.

PG PE Ratio (Forward) data by YCharts. PE = price-to-earnings.

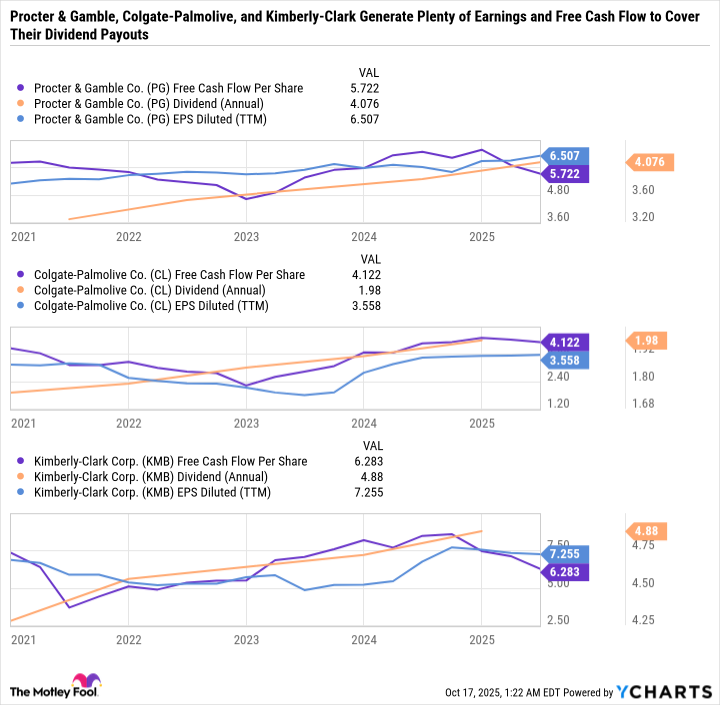

Best of all, all three companies can easily support their dividends with earnings and free cash flow.

PG Free Cash Flow Per Share data by YCharts.

Not only do all three companies have impeccable track records of raising their dividends, they also can afford future dividend raises, even if there's a prolonged period of slower growth due to weak consumer spending.

Power your passive income stream with this regal trio

With growth stocks in the spotlight, long-term investors may want to look backstage at high-quality companies like P&G, Colgate-Palmolive, and Kimberly-Clark that sport compelling valuations, reliable dividends, and high yields.

However, it would be a mistake to expect earnings growth to rebound anytime soon, given the extent of industry challenges.