Everybody loves a good rivalry, especially the rivalries that get a little chippy or testy. There's a little fun rivalry developing between Tesla (TSLA 0.16%) and Lucid (LCID +0.70%) within the highly competitive automotive industry. While Lucid has previously mentioned Tesla is not its main competitor, earlier this year, Lucid's CEO made a comment that there's been an uptick in consumers leaving the Tesla brand and heading Lucid's way.

Taking things a bit further recently, Lucid did a little light trolling at Tesla's expense.

Trolling isn't all bad!

Lucid recently posted a video on social media asking Grok (which is the AI platform of Tesla CEO Elon Musk's xAI), ChatGPT, and Copilot, "What's the best luxury EV?". Grok replied: "The 2025 Lucid Air emerges as the overall leader. It excels in efficiency and acceleration, with a serene, high-end cabin." All in all, AI agreed that Lucid owns the best luxury electric vehicle (EV), and with the 2025 Lucid Air Pure being the world's most efficient car with an EPA-estimated 5 miles per kilowatt-hour (kWh), there's some evidence to suggest AI got this one right -- as well as the consumers swapping to Lucid.

In a September interview with the Financial Times, Lucid's interim CEO, Marc Winterhoff, dropped a hint about Tesla consumers moving brands: "We have seen an uptick, that's definitely the case, in Europe and also here in the U.S. The Model S, nothing has changed in 12 years now." Winterhoff added that buyers are "actively looking for other options."

Trolling aside, Lucid has momentum

Lucid's trolling was a fun jab at the U.S. EV market share leader, but the company also has very real momentum with its deliveries. It's a welcome change of pace for long-term investors who held shares in the early years when production hiccups and delays, among other issues, often drove disappointing results. That's changed recently.

Image source: Lucid.

Lucid recently announced yet another record quarter, powered by both deliveries and production increasing during the third quarter. After finally overcoming supply chain hurdles that impacted production during the first half of 2025, investors had been anticipating the automaker to accelerate deliveries -- and that it did. Lucid delivered 4,078 vehicles during the third quarter, and if you're keeping track, that's the seventh straight quarter with higher deliveries. Also worth noting, Lucid said the automaker manufactured close to 5,000 vehicles during the quarter, the most in its history.

The company certainly needs to crank up production because it already cut its full-year production target from a solid 20,000 down to a less firm range of 18,000 to 20,000. Further, it would need a substantial boost to hit that target as it reached production of only 9,966 vehicles through the first three quarters of the year.

Despite Lucid's recent momentum and the tantalizing potential returns of investing in the right young EV maker, many challenges, hurdles, and concerns remain for the stock.

NASDAQ: LCID

Key Data Points

Is Lucid a buy?

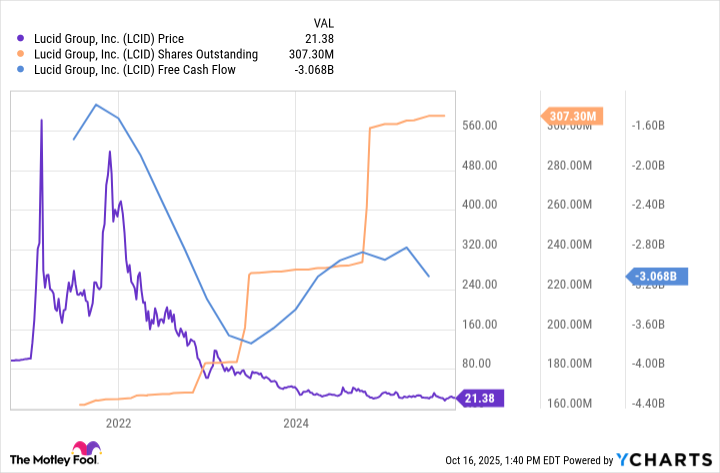

Let's start with a graph that should quickly emphasize a few things for investors.

The key things to note: Lucid's free cash flow has been consistently and significantly negative, it has repeatedly diluted shareholders to raise capital to fund its business, and its share price has consistently declined as the hype from its IPO waned over the years.

In combination with shareholder dilution, the drawback is that Lucid has also heavily relied on its Saudi Arabia backer. The country, through its Public Investment Fund (PIF), owns a majority stake in Lucid with ownership reported at over 60%. The problem for investors is that this can be a double-edged sword. Lucid has depended on Saudi support heavily, but Lucid is but one of many broader investments the PIF is making to develop a robust EV ecosystem in the country, with hopes to foster production of half a million EVs annually by the end of this decade.

That essentially means Saudi Arabia's PIF could, in theory, decide it has better investment opportunities and pull the plug on its dealings with Lucid -- which would have largely devastating effects on the automaker. Not only would it be a large overhang on the stock, its share price, and demand, but it would also almost certainly raise the company's cost of capital as raising funds would become more difficult.

Taking things a step further, Lucid has plenty of other headwinds to deal with, including its relatively low production volume compared to larger competitors, leaving it with a long road to building scale that enables profitability. There's also increasing EV competition with larger competitors quickly bringing prices down, potentially offering more compelling products than Lucid's higher-priced vehicles. One could even argue that the company's management shakeup has been a negative, with Lucid founder and former CEO Peter Rawlinson stepping down from his roles in February of this year.

Ultimately, Lucid is absolutely not a stock for conservative investors. Owning shares is high-risk, volatile, and for a company posting persistent losses and cash burn, many investors should watch this intriguing stock from the sidelines.