A lot of people want to invest like Warren Buffett. The self-made investor turned himself into one of the richest people in the world through a lifetime of value investing while also creating immense wealth for longtime shareholders of Berkshire Hathaway (BRK.A 1.13%) (BRK.B 1.46%), which he has run for over 50 years and now has a market capitalization of $1 trillion.

But how can you build a Buffett-inspired portfolio for yourself? The keys are to focus on competitive advantage, valuation, and not being overly diversified. Here's how you can build an investing portfolio like Warren Buffett with as little as $500 today.

NYSE: BRK.B

Key Data Points

Search for competitive advantages

The first thing Buffett looks for when analyzing a buy-and-hold stock investment is a competitive advantage, or moat. Competitive moats are qualities of a business that give it a leg up over the competition. For example, we can look at one of Buffett's enduring holdings, Coca-Cola (KO 0.23%), which has an advantage over competitors in branding, scale, and distribution. This allows the company to consistently raise prices without impacting customer demand, which has led Coca-Cola to be a huge winner for Buffett and Berkshire Hathaway.

Competitive advantages can arise in many forms. Maybe a company, such as a pharmaceutical business, has an exclusive licensing agreement or patent. Or it could have huge economies of scale like Amazon. Or it may be a beloved consumer brand that gives it pricing power. Whatever the competitive moat is, Buffett is hunting for them in his portfolio.

Image source: Getty Images.

Aim for a reasonable price

Another core tenet of the Buffett investment process is valuation. Historically, Buffett aims to buy a stock at a price-to-earnings ratio (P/E) of between 5 and 15, giving him a margin of safety if he is wrong about the company's business prospects. This may seem like a difficult proposition when the S&P 500 trades at a P/E ratio of over 30 today, but that just forces Buffett to be highly selective when adding new stocks to his portfolio.

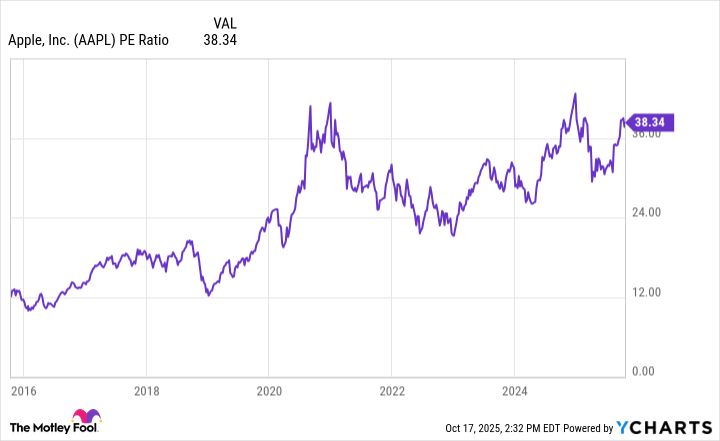

For example, we can look at Buffett's successful investment in Apple (AAPL 1.74%). When he initially bought his stake in Apple 10 years ago, the stock had a P/E ratio of between 10 and 15. Today, Apple's P/E ratio is pushing toward 40, and Buffett is now beginning to sell off the position. Valuation matters in stock price performance, which is why Buffett never ignores it when making a new purchase. You shouldn't ignore it either when building out your own portfolio.

AAPL PE Ratio data by YCharts. PE Ratio = price-to-earnings ratio.

Diversify, but not too much

Diversification is a hotly debated topic in investing. Buffett's long-term stance is that too much diversification can actually hurt investors. If you own dozens of stocks, you may as well just buy an index fund instead. It will require much less work to manage.

Instead, Buffett puts his eggs in a few baskets but generally does not go all-in on one investment at any one time. Looking at his U.S. stocks, Berkshire Hathaway's top four positions are 63% of its investment portfolio. This is not entirely apples-to-apples for individual investors since Berkshire Hathaway has wholly owned operating businesses for further diversification, but it illustrates Buffett's concentration when making stock investments.

For an individual looking to invest like Buffett today, you should aim to own 10 to 15 stocks as the majority of your stock portfolio. If this feels too risky for you, then index funds are perhaps a better avenue for your investment needs.

But how does one invest just $500 like Buffett? Well, the good news is, it is very simple to do so even with large sums of money in 2025 due to the growth of fractional share investing. This is when a brokerage allows you to buy less than one share of a stock. For example, you could allocate just $50 to Apple, which has a stock price of $250 today, giving you one-fifth of a share.

To begin investing like Buffett with $500, an individual should find 10 stocks they believe have a competitive advantage and trade at a reasonable valuation. Then, you should allocate $50 to each stock to make sure you have proper (but not too much) diversification.