Drone stocks have been doing well in 2025, and Kratos Defense & Security Solutions (KTOS +4.58%) is one of the top performers. It's up 229% on the year as of Oct. 20's market close and has delivered impressive revenue growth -- 17% year over year in its second-quarter earnings.

Those are both positive signs. But if you're thinking about investing in Kratos right now, here's why you may want to reconsider.

NASDAQ: KTOS

Key Data Points

Low earnings, high valuation

After the rise in its share price, Kratos now has a market cap of $14 billion. Its net income, on the other hand, was just $16 million last year, and it may not surpass that number in 2025. Over the first six months of 2025, it reported $7.4 million in net income, a 20% year-over-year decrease.

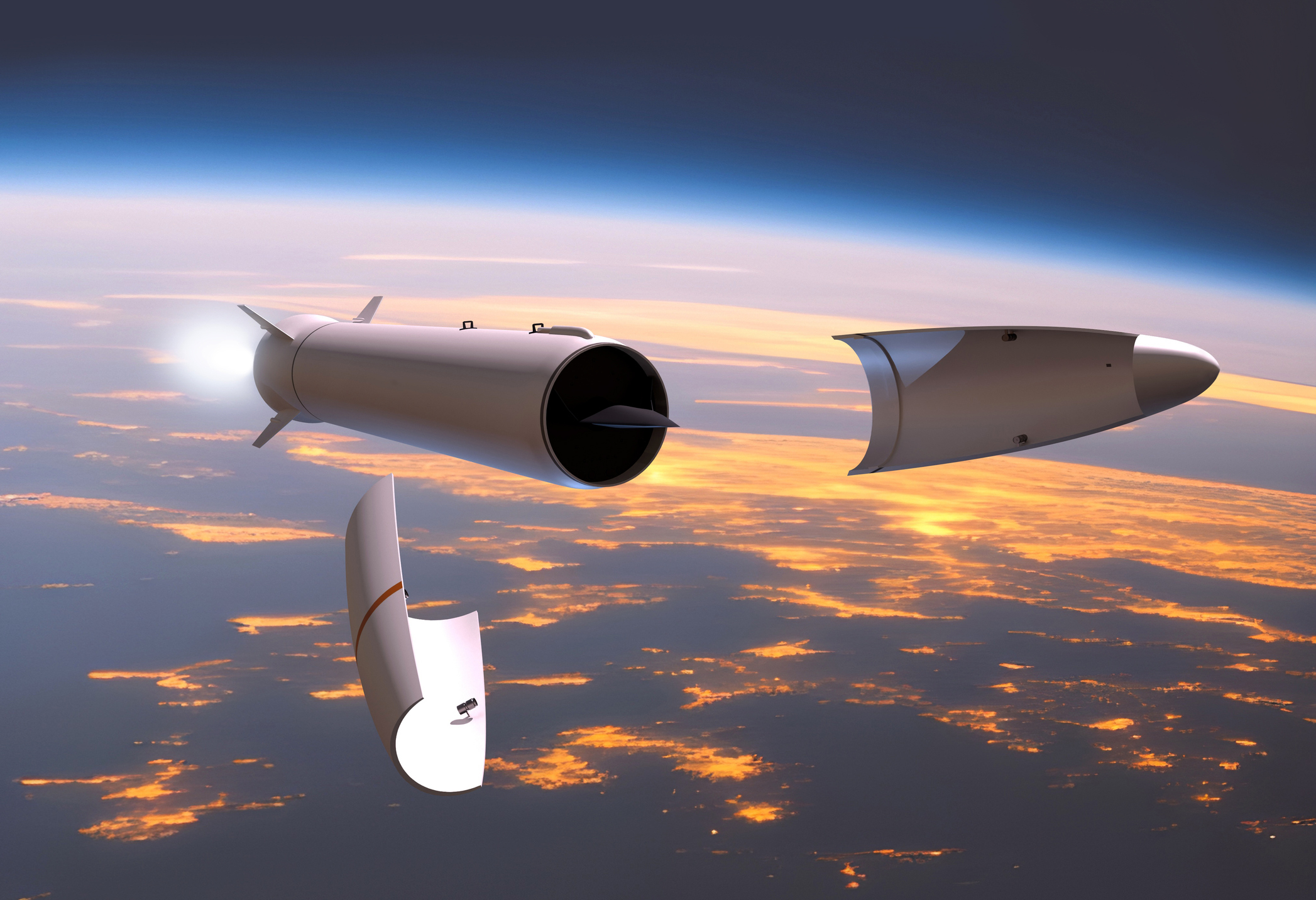

Image source: Getty Images.

Kratos is currently trading at nearly 900 times trailing earnings. To this defense company's credit, it has landed some big contracts recently. Earlier this month, Kratos received a contract worth up to $175 million to upgrade radar systems for the U.S. Navy. And in January 2025, it won a five-year, $1.45 billion contract from the U.S. Department of Defense to develop hypersonic weapons testing.

Paying a premium for growth stocks isn't always a bad decision. Still, Kratos is extremely expensive right now and has only recently begun making a small profit. It could be best to wait for a more reasonable valuation -- and for some growth in this company's bottom line.