Some investors might be tempted to avoid the largest stocks on the market -- those worth more than $1 trillion, for instance -- due to their sheer size. Smaller companies surely have much more room to grow and can provide stronger returns over the long run, or can they? In my view, most trillion-dollar companies remain among the most attractive long-term investments on the market.

Take Meta Platforms (META +0.10%), the leader in the social media industry. The tech giant boasts prospects that would make most significantly smaller companies envious. And even after providing life-changing returns, it has plenty more in the tank for investors who stay the course.

Image source: Getty Images.

Powered by an impenetrable moat

There are about 8.1 billion people in the world. Almost half of them, 3.5 billion to be exact, visit at least one of Meta Platforms' famous websites or apps daily. Few corporations have an ecosystem of users that even approaches this number.

And it's not just sheer size. Meta Platforms benefits from a strong economic moat that allows it to grow its user base continuously. Meta's apps display powerful network effects. Take Instagram, a platform people use to keep up with friends and family members, influencers use to build an audience, and businesses utilize to market products. The more people are on Instagram, the more attractive it is for all those purposes.

The same can be said about Facebook. And once people (or businesses or influencers) have built a significant presence on these apps, leaving makes little sense, as it would often force them to start from scratch.

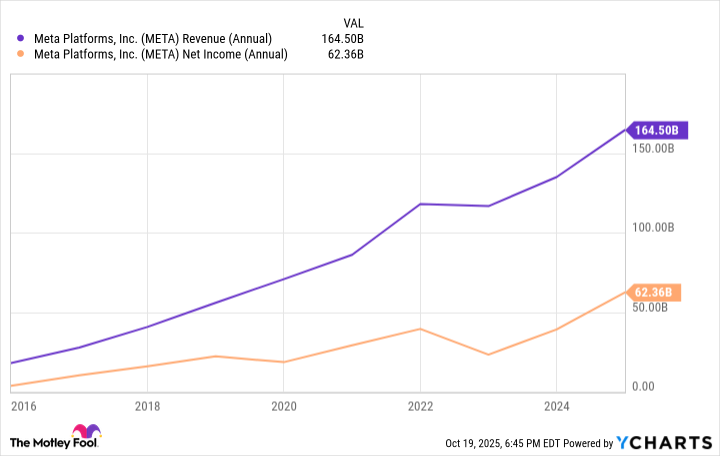

In other words, Meta Platforms also benefits from high switching costs. The tech leader's deep ecosystem grants it significant monetization opportunities. It continues to make most of its sales from advertising. And despite some obstacles, such as a slowdown in ad demand a few years ago, Meta Platforms' revenue and earnings growth have been strong.

Further, Meta Platforms has terrific growth opportunities. The company has significantly improved its advertising business thanks to artificial intelligence (AI). AI-powered algorithms are helping boost engagement on its apps by recommending the kind of content that keeps viewers glued to their screens. That automatically makes the company's platforms even more attractive to advertisers. On the other side of the equation, it has used AI to improve the ad launch process, leading to higher return on ad spend for companies.

Meta Platforms is planning to automate the advertising process entirely by the end of next year, thanks to AI, which could provide yet another boost to its business. Meanwhile, by allowing people to use its large language model, Llama, which powers much of its internal AI initiatives free of charge, Meta Platforms thinks it will attract talented developers who will make Llama the market leader, leading to significantly positive spillover effects throughout its entire business.

NASDAQ: META

Key Data Points

There are also other potential opportunities for the company. Meta Platforms is a leader in AI glasses, a business that could eventually have a meaningful impact on its financial results. The company is still working on ways to monetize WhatsApp, which has significantly lagged its other platforms in its contributions to the top line. Businesses can now start channels on the platform and charge subscribers for exclusive premium features (Meta Platforms will take a cut).

There are also paid messaging features that allow businesses to communicate directly with customers, while Meta Platforms announced it will start posting ads on the "Updates" tab of the app. WhatsApp boasts about 3 billion monthly active users, but we are still arguably in the early innings of Meta's efforts to monetize the platform. That's a great sign for the future.

Buy and forget

Meta Platforms will encounter headwinds. President Trump's tariff policies could affect ad demand in Asia. In fact, it already has. Meta Platforms could also continue to face intense scrutiny from regulators like it has in recent years.

None of these potential obstacles should scare off investors, though. Meta Platforms' business and financial results are excellent (and generally improving), its competitive edge is rock solid, and it has demonstrated its ability to overcome challenges before, including economic issues that led to a slowdown in ad demand, as well as damage to its public image.

On top of all that, Meta is now a dividend stock, having initiated a payout last year. For all those reasons (and more), Meta Platforms is a fantastic forever pick.