Spending on artificial intelligence (AI) hardware and software is showing no signs of slowing down. Market research firm Gartner forecasts global AI spending will hit a whopping $1.5 trillion in 2025, up by 50% from last year. Even better, the firm expects that figure to jump to $2 trillion in 2026. What's worth noting is that a nice chunk of that spending is set to go toward semiconductors. Spending on data center graphics processing units (GPUs), custom AI processors, central processing units (CPUs), and other AI processors could together generate close to $600 billion in revenue in 2026, up from an estimated $477 billion this year.

One of the best ways to make the most of this lucrative opportunity is by investing in shares of Taiwan Semiconductor Manufacturing (TSM +0.32%), the world's largest semiconductor foundry. Popularly known as TSMC, the Taiwan-based company fabricates all kinds of AI chips that are mentioned above for multiple clients. Not surprisingly, it has been growing at an incredible pace, which seems sustainable going forward as well.

Let's look at the reasons why buying TSMC stock is a no-brainer right now.

Image source: TSMC.

TSMC's latest results make it clear that it is winning from the AI chip boom

TSMC released its third-quarter results on Oct. 16. The company's revenue and earnings, unsurprisingly, were ahead of Wall Street's expectations. TSMC's earnings jumped 39% year over year to $2.92 per share on a 41% increase in its revenue to $33.1 billion. What's more, the company now expects 2025 revenue to increase by mid-30% as compared to the earlier forecast of 30% growth.

NYSE: TSM

Key Data Points

It is easy to see why that's the case. The demand for AI chips is growing across multiple verticals, ranging from data centers to smartphones to computers. For instance, sales of AI PCs are forecast to jump by 60% in 2026, along with a 32% increase in shipments of generative AI smartphones. TSMC's position as the world's largest semiconductor foundry, with an estimated share of 70% means that it manufactures chips for almost all the companies involved in different AI verticals.

From AMD to Qualcomm to Nvidia to Broadcom to Apple to MediaTek, the list of TSMC's customers is very long. All these companies benefit from the AI boom. While AMD, Nvidia, and Broadcom capitalize on the growing adoption of AI in data centers and PCs, Qualcomm, Apple, and MediaTek benefit from an improvement in generative AI smartphone sales.

In fact, the demand for TSMC's fabrication facilities is so strong that the company has increased the midpoint of its capital expenditure guidance for 2025 to $41 billion from the earlier estimate of $40 billion. What's worth noting is that TSMC will allocate 70% of its capex toward building advanced chipmaking facilities, with another 10% to 20% going toward advanced packaging.

This isn't surprising, considering the sharp increase in sales of AI chips and related devices that's anticipated in 2026. The impressive end-market potential should ideally allow TSMC to sustain stronger growth levels next year, and beyond that as well, when compared to the growth that analysts are expecting from it.

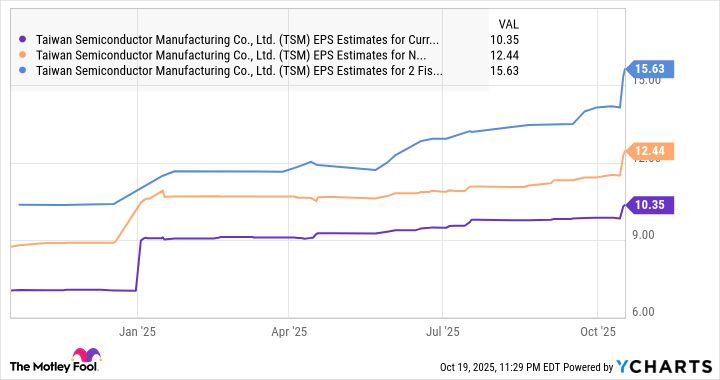

Data by YCharts.

The stock is primed for more gains

Share prices of TSMC have jumped 49% this year. Even then, the stock trades at an attractive 25 times forward earnings. That's a steal for a company expected to clock 46% growth in earnings this year. Analysts, however, expect TSMC's bottom-line growth to slow down to 20% in 2026.

But the continued strength in AI chip spending, along with TSMC's potential to increase the price of its advanced chip nodes by 5% to 10% next year, will pave the way for stronger growth in TSMC's bottom line. Assuming that the company manages to increase its earnings by even 30% in 2026 to $13.45 per share (based on the 2025 earnings estimate of $10.29 per share), its stock could hit $450 (based on the tech-laden Nasdaq-100 index's average earnings multiple of 33.5).

That points toward a potential jump of 50% from current levels, making TSMC a no-brainer AI stock to buy right now as it isn't done soaring yet.