The list of trillion-dollar companies isn't large. Currently, there are 11 worldwide, but a large majority of them are also involved in artificial intelligence (AI). Of the 10 U.S.-listed trillion-dollar stocks, only Berkshire Hathaway and Apple aren't actively involved in the AI megatrend. While the Apple inclusion may be debatable, the reality is that Apple hasn't really participated in the AI race and has yet to launch meaningful AI features.

Even if I yield and include Apple, that's a huge chunk of the trillion-dollar court that's involved in the artificial intelligence arms race. And all of them can trace their roots back to one company that controls it all: Taiwan Semiconductor Manufacturing (TSM +0.38%). All nine of these companies are either direct customers of Taiwan Semiconductor or indirectly connected based on the computing units that they're purchasing to outfit their data centers.

Taiwan Semiconductor has earned this leadership position through years of innovation and fantastic production results. Still, I think there's one underrated reason to buy the stock now, and it could be what powers its next leg of growth.

Image source: Getty Images.

Taiwan Semi's new technologies could save a ton of energy

One of the biggest problems facing AI-focused data centers is energy consumption. Consumers in some parts of the country are seeing their electricity prices skyrocket as demand for electricity rises, and this could cause a massive hurdle for the AI infrastructure buildout to occur. While the AI hypescalers are starting to invest in ways to deliver increased electricity to the grid to make up for their usage, Taiwan Semiconductor has another way to help out.

Its new chip generation, 2nm (nanometer) chips, massively improves a chip's power consumption. These chips are entering production now and have a massive amount of pre-production demand already scheduled. When configured to run at the same speed as previous generation 3nm chips, 2nm chips consume 25% to 30% less energy. That's a massive gain, and could lessen the strain on the power grid.

NYSE: TSM

Key Data Points

Furthermore, the increased cost of 2nm chips could be a cheaper alternative than building new electricity generation stations. Still, I think that most AI hyperscalers will take an all-inclusive approach and do everything they can to become more energy-efficient and increase electricity output. Regardless, these new technologies bode well for Taiwan Semiconductor, and are an underrated reason to scoop up more shares of this chip giant.

But it's not stopping there. After its 2nm chip launch, it plans to release its A16 chip node later on in 2026. This will result in a 15% to 20% power consumption improvement over 2nm chips. Beyond that, its A14 chip, scheduled for 2028, offers a 25% to 30% power consumption improvement over the already impressive 2nm chips.

As AI hyperscalers look to increase computing capacity while being constrained by energy availability, Taiwan Semiconductor looks positioned to benefit. This could drive incredible growth over the next few years, yet the stock isn't priced to realize those gains.

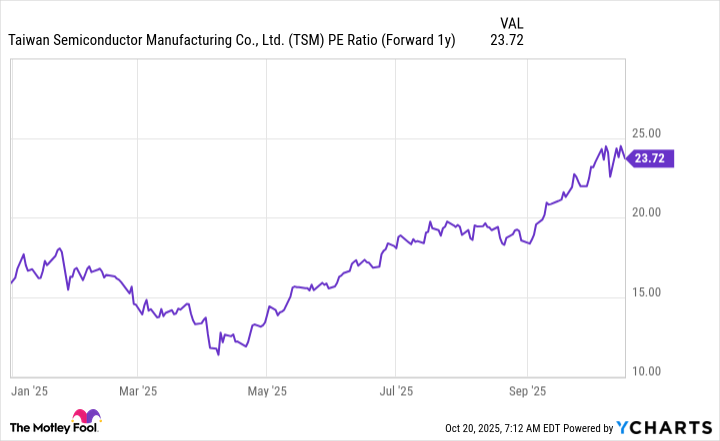

Taiwan Semiconductor is far cheaper than its peers

Outside of Berkshire Hathaway, Taiwan Semiconductor is among the cheapest trillion-dollar stocks, trading for 24 times 2026 earnings. However, it's possible that Wall Street analysts aren't accurately accounting for the massive demand for 2nm chips that have improved energy consumption, which could drive the price of these chips higher, improving margins.

TSM PE Ratio (Forward 1y) data by YCharts

We'll see how this plays out in 2026, but 24 times forward earnings isn't a terrible price to pay in this already expensive market. Taiwan Semiconductor is already in an excellent position to be the major chip supplier in the AI market. With it developing energy-saving technology that will allow more computing capacity to be built, it's setting itself up nicely for future high-margin growth.