In 1976, fast-food giant McDonald's (MCD +0.11%) issued a dividend of $0.025 per share, after its chairman, Ray Kroc, announced a 27% jump in profits for the first quarter.

Because of the seven stock splits and 49 annual dividend hikes since, McDonald's dividend has grown from a split-adjusted payout of $0.0006 per share to $1.86 per share today. That's a 310,000% increase, and it means that anyone who invested $1,000 in McDonald's in 1976 would be receiving almost $500,000 a year in dividends today.

NYSE: MCD

Key Data Points

These gains are, alas, in the past. But McDonald's has raised its dividends at a respectable rate in recent years, too. As you can see below, its dividend growth has generally outpaced the inflation rate this decade, sometimes handily so.

| McDonald's Dividend Hikes | ||

|---|---|---|

| Year | Inflation Rate | Dividend Growth |

| 2020 | 1.2% | 3% |

| 2021 | 4.7% | 4.2% |

| 2022 | 8% | 7.8% |

| 2023 | 4.1% | 10.1% |

| 2024 | 2.9% | 8.8% |

| 2025 | 2.9% | 5% |

Table by Author. Source: Company filings.

McDonald's 5% dividend increase for 2025, announced on Wednesday, is its 49th dividend increase since 1976. That means that this time next year, it may have raised dividends 50 times in 50 years, giving it "Dividend King" status.

Dividend Kings are extremely rare. Of the 53,800 publicly traded companies worldwide last year, only 56 had earned that distinction, so barely one in 1,000 stocks made the cut. Examples include global retailer Target, tobacco giant Altria, and soft drink icon Coca-Cola.

How big might McDonald's historic dividend hike for 2026 be? Recent history and some fundamentals offer clues.

Three clues on McDonald's 50th dividend hike

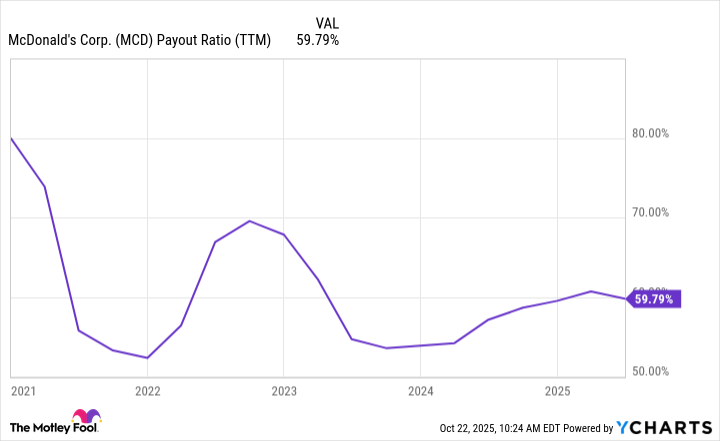

One of the best indicators of a company's ability to increase dividends is the payout ratio, or the percentage of net income it delivers to shareholders as dividends. The lower the payout ratio, the more easily a company can raise payouts.

As you can see below, McDonald's payout ratio has trended lower over the last five years, albeit not in a steady decrease. This is good news for investors and makes sense when you consider that net income has nearly doubled from $4.7 billion in 2020 to $8.2 billion in 2024, outpacing McDonald's dividend growth of 37% in that timeframe.

MCD Payout Ratio (TTM) data by YCharts

Another indicator that bodes well for a healthy dividend hike is robust earnings growth. McDonald's grew quarterly earnings by 11.4% year over year last quarter, which makes a similarly healthy dividend increase easy to envision.

Third, if a company is growing its operating margins, it's a strong sign that it's efficient and profitable enough to continue rewarding shareholders. Operating margin is the percentage of revenue that's available to cover non-operational expenses, such as interest on debt, share buybacks, or dividends, so it provides insight into how sustainable a company's payouts are.

In McDonald's case, operating margin is a healthy 47.7%. For context, Coca-Cola, an official Dividend King, has an operating margin of 34.7%. The historical average operating margin for S&P 500 companies is 10.8%, so the number for McDonald's indicates a truly special company.

There's also a bonus reason to feel confident that McDonald's can keep up its dividend hot streak.

Image source: Getty Images.

Share buybacks provide breathing room

The company spent $2.8 billion on share buybacks in 2024, after spending $5.3 billion on buybacks in 2023. McDonald's habit of buying back shares, which is shareholder-friendly because it increases earnings per share, also makes its dividend more sustainable, as it means the company owes payouts on a smaller number of shares. It also means that, should the company come under pressure in the years ahead, it can dip into the billions of dollars earmarked for share buybacks rather than sacrifice its hard-won status as a dividend powerhouse.

No one can know what the next half-century will bring to McDonald's. But for the near term, the company is well-positioned to join the Dividend King club in 2026 and continue growing payouts for years after that. Because its current 2.3% dividend yield is nearly double the S&P 500 average, this could mean a very powerful income stream down the road for investors who act now.