The trillion-dollar market-cap club is an exclusive club that not too many companies are a part of yet. When Apple became the first company to hit the mark in 2018, it was a major feat in the business world. Now, it's currently joined by 10 other companies, including the likes of Nvidia, Microsoft, Alphabet, Amazon, and Meta Platforms.

Looking at the companies that currently have at least a market capitalization of $1 trillion, there's one obvious theme: they're mostly tech companies (nine out of the 11). However, there is one non-tech company that has a good chance at becoming the newest member of the trillion-dollar club, and that's retail giant Walmart (WMT +2.94%).

At the time of this writing, Walmart's market cap is just over $850 billion. This means its stock price would need to increase by around 18% to reach $1 trillion. It's not guaranteed, but Walmart's business is well-positioned to make it happen.

Image source: Getty Images.

Going beyond just retail

Walmart's mission has remained consistent throughout its history: to provide everyday products at low prices. It's a mission that has remained strong and made it the go-to for millions of people globally. It also helps that Walmart has over 5,200 U.S. retail stores, making it accessible for most of the U.S. population.

Walmart's retail business speaks for itself, but it's growing in areas that should help improve its profitability and margins -- like memberships, e-commerce, and advertising.

NASDAQ: WMT

Key Data Points

Walmart+ is Walmart's membership service that offers customers perks like same-day delivery, fuel discounts, Scan & Go checkout, and streaming service benefits. Growing Walmart+ memberships has two main benefits: It's recurring, high-margin revenue since it doesn't rely on products being sold, and it also encourages customers to shop at Walmart to take advantage of the perks that come with the membership.

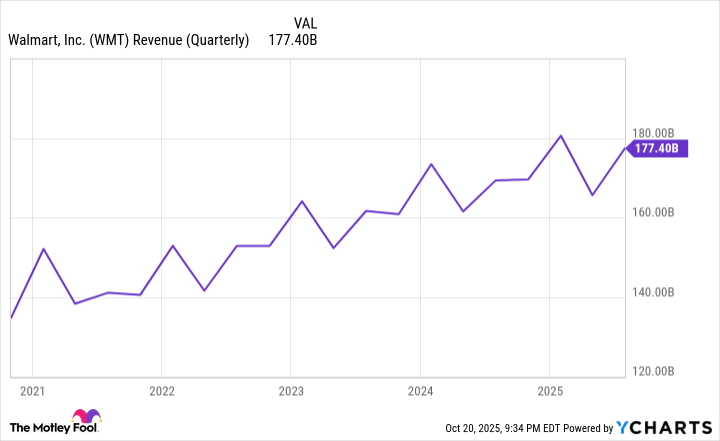

The convenience of Walmart's same-day delivery has been a spark for its e-commerce business. In-store sales will likely always be its bread and butter, but it's encouraging to see the growth of its e-commerce business. In its latest quarter, Walmart's global e-commerce sales were up 25% year over year. This far outpaced the 4.8% its total revenue increased by in the quarter.

WMT Revenue (Quarterly) data by YCharts.

You may not think of advertising when you think of Walmart, but that has also been a promising area for the company. Walmart has tons of customer shopping data that it can use to help brands target their ads more effectively through its Walmart Connect platform.

Walmart also acquired smart TV manufacturer Vizio last year for $2.8 billion, which gives it another means of selling ads. In the latest quarter, Walmart's global advertising sales grew 46% year over year (including from Vizio).

The stock market is notoriously irrational, but Walmart's stock should be rewarded if the company continues to grow in these areas and improve its financial health. That's the main reason I'm confident it can make the trillion-dollar club in the relatively near future.

You can't overlook Walmart's dividend reliability

Walmart has posted impressive gains over the past decade, up over 445%. However, if you consider its dividends paid during that time, its total returns are over 560%. For perspective, the S&P 500 is up 230% (290% with dividends) in that span.

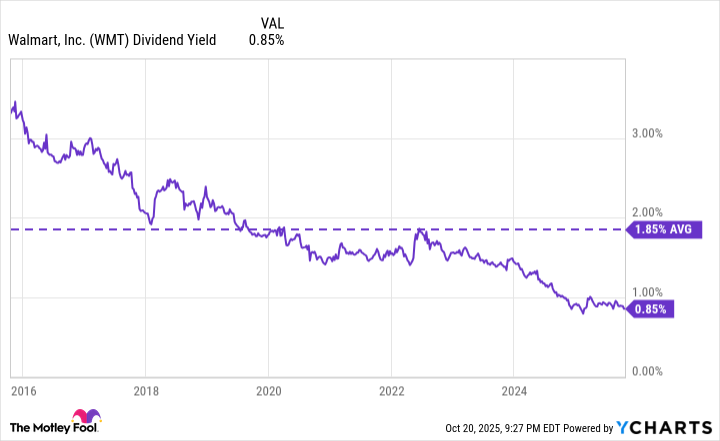

It's worth noting Walmart's dividend because it's one of the selling points for investing in the stock. It's a Dividend King (a company with at least 50 consecutive years of dividend increases), with 52 years of straight increases under its belt. Its recent stock price growth (up 19% year to date through Oct. 20) has reduced its dividend yield, but one thing you can count on is the annual increase.

WMT Dividend Yield data by YCharts.

In the past decade, Walmart has increased its annual dividend by around 44% to $0.94 per share. There are no guarantees when it comes to stock price performance, but Walmart's dividend is as reliable as they come. It's an added bonus as Walmart chases the trillion-dollar mark.