There have been some amazing stories in the New York Stock Exchange surrounding artificial intelligence (AI). This technology is changing seemingly everything about how we live and work. AI is used by businesses to simplify the supply chain, improve production, and even take over some jobs. Customer-facing applications include voice assistance, chatbots, AI-powered advertisements and content recommendations, and even autonomous vehicles.

And this isn't going away. Grand View Research estimates that the global AI market size was $279.22 billion in 2024 and will reach $3.49 trillion by 2033, with a compound annual growth rate of a whopping 31.5%. For investors, that means some companies stand to make tens of billions -- or more -- on AI in the next decade. It's just a matter of choosing which stocks are best.

Two interesting names right now in the AI space are Palantir Technologies (PLTR 0.13%) and Advanced Micro Devices (AMD 0.45%). Palantir has been one of the stars in AI stocks for the last two years, but many question whether it can sustain its momentum. AMD, meanwhile, has been overshadowed by rivals like Nvidia, but the stock jumped in the last month after the company reported some key wins.

Which is the best AI stock to buy now?

Image source: Getty Images.

The case for Palantir

If this were a prize fight, Palantir would take the role as the defending champion -- but one with some significant weaknesses that an up-and-coming contender could exploit.

Palantir is a data mining company that uses artificial intelligence to gather information from hundreds, if not thousands, of sources to provide real-time insights. Until recently, the company was primarily used by militaries and intelligence agencies to get an advantage in battlefield situations.

NASDAQ: PLTR

Key Data Points

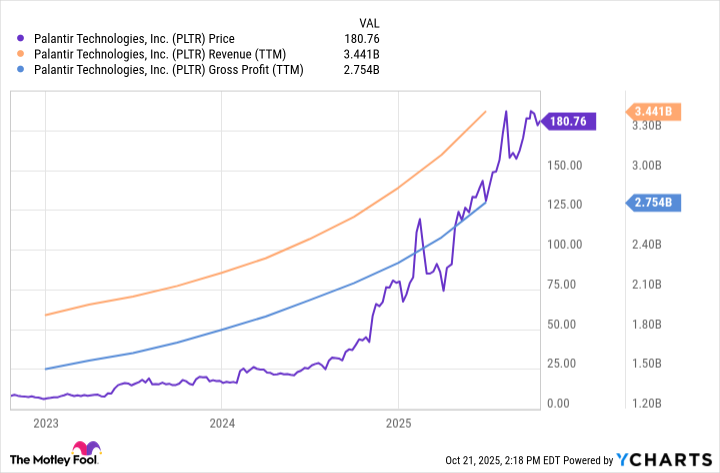

But shares took off like a rocket in 2024 when Palantir introduced its Artificial Intelligence Platform (AIP). By incorporating generative AI and integrating large language models, Palantir's AIP became much more functional for other governmental agencies, as well as commercial enterprises. The company's stock exploded, as did its revenue and profits.

In the second quarter, Palantir topped $1 billion in revenue for the first time with a 48% increase from a year ago. U.S. government work continued to be Palantir's biggest revenue source, with $426 million in revenue (up 53% from last year). But commercial contracts grew even faster, up 93% on a year-over-year basis to reach $306 million for the quarter. Palantir closed 157 deals in the quarter valued at least $1 million.

The problem for Palantir, however, comes with its valuation. While the stock is up 2,100% in the last three years, the price-to-earnings ratio and price-to-sales ratio are unsustainable. Palantir currently trades at a forward P/E of 217 and a P/S ratio of 137. Even if Palantir continues 50% revenue growth in the next several quarters, it's hard to imagine that investors are willing to pay such a premium.

The case for AMD

Advanced Micro Devices, or AMD, is a semiconductor stock whose work has been important in the development of AI. While Nvidia makes graphics processing units (GPUs) that handle AI training, inference, and simulations, AMD is better known for central processing units (CPUs) that are equally important in data centers for running lighter processing tasks. Some of the top cloud computing providers in the world are AMD's customers.

But AMD also makes GPUs, and it got a huge lift in October when it scored a massive deal with OpenAI, the developer of ChatGPT. AMD signed a deal to sell up to 6 gigawatts of GPU compute capacity to OpenAI, which will involve several generations of AMD GPUs. OpenAI, meanwhile, receives warrants that allow it to purchase 160 million shares of AMD stock, which would give it a 10% stake in the company.

NASDAQ: AMD

Key Data Points

AMD is already seeing massive revenue increases, and this deal will just multiply that. Revenue in the second quarter was $7.68 billion, up 32% from a year ago. Gross profits of $3.06 billion were up 7%, and net income of $872 million was up a whopping 229% from Q2 2024. Earnings per share was also up big, going from $0.16 last year to $0.54 in this quarter.

Advanced Micro Devices stock is up 97% so far this year, with a lot of that gain coming after the OpenAI announcement. AMD appears unstoppable right now.

Why AMD is the pick

Palantir's next earnings report, scheduled for Nov. 3, will be a big one for the company. If AIP continues to drive revenue growth and if the company continues to bring in contracts hand over fist, the stock will likely go to new heights. But a slowdown in growth will see investors start taking profits.

AMD, meanwhile, looks to be a surer thing. The stock is expensive, to be sure, with a P/E of 101. But the forward P/E is a reasonable 28.5 and the P/S ratio is only 9.3.

I love Palantir and I'm holding on to my shares. But if I were betting on an AI stock today, given these two -- I would go with AMD as the better stock to buy.