Industry experts still treat quantum computing as speculative science, but the smartest capital allocators are betting billions that it's the next trillion-dollar frontier. BlackRock, Temasek, and Nvidia just backed PsiQuantum's $1 billion funding round at a $7 billion valuation. When Nvidia, which saw the potential of artificial intelligence (AI) before anyone else, starts writing checks to quantum start-ups, it's validation of the ecosystem.

The disconnect between public market skepticism and private market euphoria creates opportunity. Governments are treating quantum supremacy as existential, terrified of losing encryption advantage when "Q-Day" arrives.

That's the point when quantum computers become powerful enough to break widely used encryption standards. Enterprises are already paying for quantum services today, proving demand exists before the technology even matures.

Image source: Getty Images.

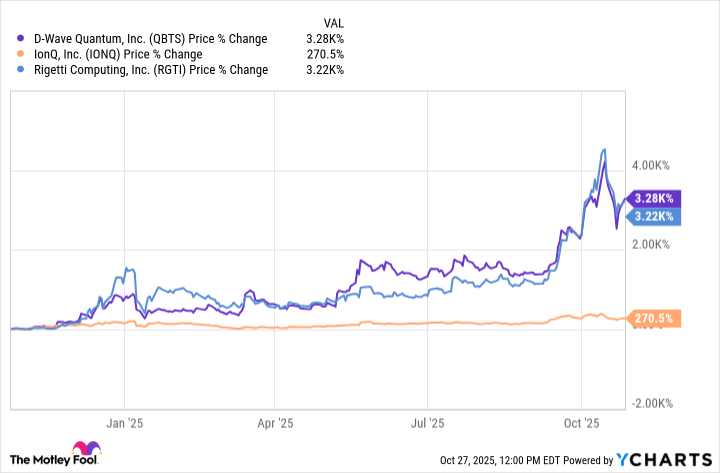

The three pure-play quantum stocks -- IonQ (IONQ 8.93%), D-Wave Quantum (QBTS 8.51%), and Rigetti Computing (RGTI 7.73%) -- have delivered staggering returns over the trailing 12 months, respectively, underscoring Wall Street's sudden interest in this group.

Read on to find out more about these top quantum computing stocks.

The acquisition engine pushing quantum infrastructure

IonQ agreed to acquire Oxford Ionics for $1.075 billion and received U.K. Investment Security Unit approval in September. Oxford Ionics' Electronic Qubit Control integrates ion-trap control onto a classical chip, strengthening IonQ's trapped-ion road map.

NYSE: IONQ

Key Data Points

The company also moved to build quantum networking via acquisitions of Lightsynq and Capella, and in July, it completed a $1 billion equity offering, bringing pro forma cash and investments to about $1.6 billion as of July 9.

With strong cash reserves and aggressive acquisitions building both hardware and quantum networking infrastructure, IonQ scans as a top infrastructure play in the quantum computing landscape.

The contrarian play making money

D-Wave Quantum skipped the race for universal quantum computers and doubled down on quantum annealing, a practical approach to optimization problems that enterprises can use today. Its new Advantage2 system (Zephyr topology) increases qubit connectivity from 15 to 20, improving embeddings and solution quality for supply chains, portfolio management, and research and development.

NYSE: QBTS

Key Data Points

Over the last four quarters, more than 100 customers generated revenue, proving demand exists beyond pilots. With approximately $819 million in cash as of June 30, 2025, D-Wave has a runway to keep building. It isn't profitable yet, but it's the contrarian quantum play with real systems, real customers, and early commercial traction.

The pure-play on quantum supremacy

Rigetti Computing is the high-stakes quantum play with one of the boldest road maps. The company recently hit a technical milestone: Its Cepheus-1-36Q system, launched in August, achieved about 99.5% median two-qubit gate fidelity, halving the two-qubit error rate versus the prior Ankaa-3 system.

NASDAQ: RGTI

Key Data Points

With $571.6 million in cash and investments as of June 30 -- after completing a $350 million at-the-market equity offering in the second quarter -- Rigetti has a long runway to push its superconducting, chiplet-based scaling strategy.

For investors, this is high risk, high reward: If even one road map breakthrough sticks, upside could be substantial. The company's vertical integration -- allowing it to design and fabricate quantum chips in-house at its Fab-1 facility -- gives complete control over innovation cycles.

The quantum leap worth taking

Billion-dollar funding rounds, rapid regulatory clearances, defense urgency around encryption, and (most crucially) the number of paying customers are all stacking up. These dynamics echo early AI investments circa 2015: outrageous until they weren't.

The risks remain obvious: The technology could stay perpetually "five years away" while conventional systems keep advancing. But with businesses deploying quantum computing for optimization, governments treating it as strategic, and big tech validating the ecosystem, the technology is moving from theoretical to tactical.

IonQ offers infrastructure dominance, D-Wave provides near-term revenue, and Rigetti has moonshot upside. Buying a small position in each of these names and holding them indefinitely could generate life-changing returns, given the tech's awe-inspiring potential.