Amazon (AMZN 0.68%) announced Tuesday that it's cutting 14,000 corporate jobs, shedding roughly 4% of its workforce in a bid to shift more resources to artificial intelligence (AI) and other high-profile priorities.

And while the announcement is a blow to workers in a struggling job market, it's important for investors to realize that Amazon is wildly inefficient compared to other "Magnificent Seven" companies -- and the layoff may be exactly what's needed to help Amazon trim costs and free up money to pursue its AI ambitions.

Image source: Amazon.

The layoff announcement

Amazon's announcement came from Beth Galetti, a senior vice president in human resources. She said most employees would get at least 90 days to seek a new role internally, and other workers would receive severance pay.

"What we need to remember is that the world is changing quickly," she wrote in a message to employees. "This generation of AI is the most transformative technology we've seen since the Internet, and it's enabling companies to innovate much faster than ever before (in existing market segments and altogether new ones). We're convinced that we need to be organized more leanly, with fewer layers and more ownership, to move as quickly as possible for our customers and business."

NASDAQ: AMZN

Key Data Points

Amazon stock has lagged behind the market this year, gaining only 3% versus a 23% gain for the Nasdaq Composite. The company has been under pressure to reduce expenses since it engaged in a hiring spree during the COVID-19 pandemic.

In addition, Amazon is facing pressures in both its e-commerce and its lucrative cloud computing division. The e-commerce division is perhaps what Amazon is best known for, and it generated $136.8 billion of revenue in the second quarter, but operating expenses accounted for $127.8 billion, leaving Amazon with a small profit margin of only 6%.

Amazon Web Services (AWS) is much more lucrative, with revenue of $30.8 billion and a profit margin of 32.9%. But AWS is also in a fierce competition with Microsoft Azure and Alphabet's Google Cloud for market share. Currently AWS has the No. 1 position at 30%, but Microsoft Azure and Google Cloud are making inroads. That's why Amazon is spending roughly $100 billion this year on AI.

Why is Amazon so inefficient?

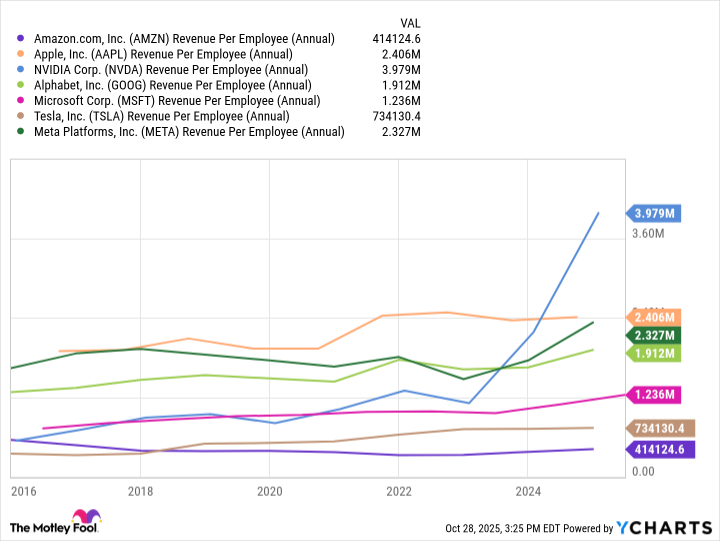

A striking comparison is to look at Amazon's revenue per employee, in comparison to other members of the Magnificent Seven cohort that make up the most influential tech companies in the world.

AMZN Revenue Per Employee (Annual) data by YCharts

Amazon ranks far below the rest, with $414,000 per employee, while most of the other companies are over $1 million. Nvidia, of course, stands out for its dynamic revenue growth over the last two years.

Today's layoff announcement will be difficult for employees. But it seems to be a necessary step as Amazon looks to be more efficient and to free up badly needed money to invest in AI.