The big selling point for Ares Capital (ARCC 0.15%) is its huge 9.6% dividend yield. Part of the reason for that is that, as a business development company (BDC), Ares Capital's corporate structure is designed to pass income on to investors.

However, there's an important wrinkle with BDCs that you can't ignore if you are considering buying Ares Capital because of its lofty yield.

Image source: Getty Images.

What does a business development company like Ares Capital do?

From a high-level view, Ares Capital makes loans to smaller businesses. There's nothing inherently wrong with this, but it is notable that the average interest rate on the BDC's loans in the second quarter was a huge 10.9%. These are, on average, very costly loans for the companies to which Ares is providing capital.

The second-order issue here is that the companies to which Ares Capital is lending don't have other more attractive options. If they did, they would probably raise capital differently, such as issuing stock, selling debt publicly, or taking out a loan from a bank. In other words, Ares Capital is dealing with relatively risky loans. The hope is that providing loans to a large number of companies (566 at the mid-point of 2025) will spread the risk around.

To some extent, the company's diversified portfolio does help to minimize the risk posed by any one company's loans. But go back to the lofty interest rates on Ares Capital's loans again. The vast majority of the companies it works with are higher risk for some reason. And that changes the dynamics during economic downturns.

The logic isn't particularly complicated. When the economy falls into a recession, smaller and more financially stressed companies tend to suffer more than others. And since Ares Capital's portfolio is focused on such companies, well, it usually has to deal with a large collection of problems within its portfolio at the same time during business downturns. The high rates it charges on loans don't help the situation.

This isn't actually good or bad, per se. It is just a fact of life. However, there are big implications for dividend investors.

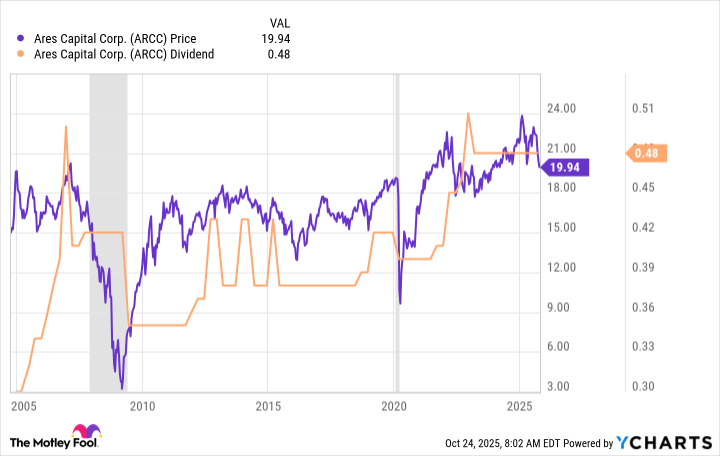

Data by YCharts.

Ares Capital's dividend moves around

Most dividend investors try to find well-run companies that have sustainable, if not growing, dividends. The goal is often to provide a reliable income stream to help support retirement spending. This is why being a Dividend King, which means a company has 50-plus consecutive annual dividend increases under its belt, is such an important achievement. Ares Capital is no Dividend King, as the chart above clearly highlights.

The first key thing to notice is that Ares Capital's dividend has fallen notably during both of the recessions it has lived through. That's true even though the recession surrounding the coronavirus pandemic was extremely short. The second issue to pay attention to is that the dividend, even outside of those two periods, has bounced around a bit. This is not a dividend you can rely on quarter after quarter.

NASDAQ: ARCC

Key Data Points

That isn't a criticism of Ares Capital as a business. It is actually a fairly well-run BDC. In fact, during the Great Recession, it ended up acting as an industry consolidator, using its strong business foundation to buy weaker BDCs. There's no reason to believe it won't be able to do the same again if there's a deep downturn. But that doesn't change the fact that the dividend, simply because of the nature of Ares Capital's business, is volatile.

Is Ares Capital a buy now?

If you want to own a well-run business development company, Ares Capital is a solid option. However, if you want to own a reliable dividend stock, you would probably be better off avoiding it and BDCs altogether. As for the opportunity right now, the Federal Reserve is lowering interest rates in an effort to prop up economic growth. If it fails in that effort, a recession could be in the cards. And that is one of the worst environments for BDCs to operate in.