2025 has thrown its fair share of curve balls to automakers such as Detroit icon General Motors (GM 0.11%). For instance, the company has had to deal with tariffs on imported vehicles and automotive parts, as well as ever-changing trade policies from the Trump administration.

GM also now has to account for the removal of the federal $7,500 tax credit on electric vehicle (EV) purchases, which is expected to reduce EV profitability and buyer demand in the near term. General Motors is managing to navigate these headwinds, and it just recorded a better-than-expected third quarter. Given its success, this stock should be on investors' radar.

Here are three reasons why.

Image source: General Motors.

1. GM is competitive in returning value to shareholders

General Motors is often compared to Ford Motor Company (F 1.52%), and rightfully so as the two have very comparable strategies and results. However, one narrative that tends to need adjusting is that Ford returns much more value to its shareholders. Investors likely think this because of Ford's lucrative dividend yields over 5% and it often dishes out an annual supplemental dividend. Ford should be lauded for its dividend.

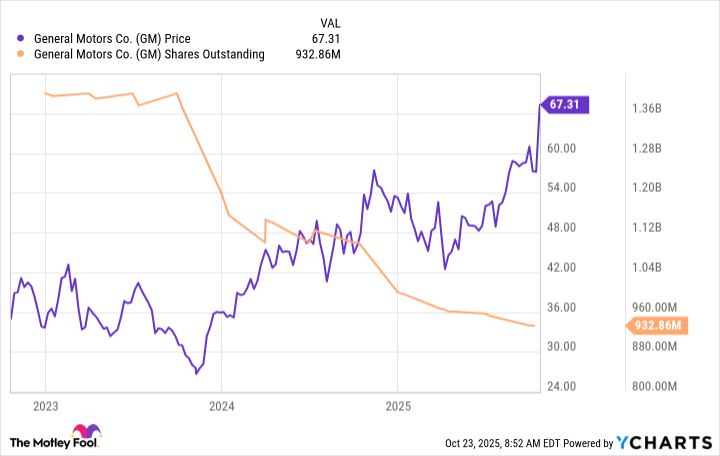

However, investors often overlook just how much value GM returns to shareholders via share buybacks. In fact, GM has announced $16 billion in share buybacks since 2023 alone and significantly reduced its shares outstanding.

Data by YCharts.

Another way to look at the value GM returns to shareholders is through total yield, which includes not only the dividend yield but includes the impact of share buybacks. While GM's dividend yield is a modest 0.9%, its total yield jumps to 14.93%. That compares favorably to Ford's 4.9% dividend yield and 6.6% total yield.

General Motors is returning massive value to shareholders, and it's time investors made a note of it.

2. GM is managing the troubles that all automakers are seeing in China

General Motors isn't alone in its China pain, as the country is embroiled in a brutal price war rooted deep in its electric vehicle (EV) industry. With the light-vehicle market increasingly moving toward electric, and with many competitive young EV domestic companies, foreign automakers struggled to maintain market share and profits.

This led to General Motors restructuring its entire China business in a move that cost the company more than $5 billion. Late in the fourth quarter of 2024, the automaker noted it would take a noncash charge of $2.7 billion for the restructuring and $2.6 billion to $2.9 billion to account for the decreased value of an equity stake in a 50-50 joint venture with China's SAIC Motor Corp.

NYSE: GM

Key Data Points

The good news is that the restructuring is paying off. General Motors and its joint ventures in China delivered a 10% year-over-year sales increase during the third quarter, and it marked the third consecutive quarter of growth. General Motors has returned to profitability in China and, more importantly, expects to be profitable for the full year and going forward.

3. GM is seeing success across its vehicle lineup

What's really driving GM's current success is strong demand for its vehicles across the entire lineup. General Motors' third-quarter vehicle sales were up 8% compared to the prior year, and sales through the first three quarters were up a higher 10% to 2.2 million vehicles, the best pace in a decade.

GMC is on pace for its best year ever. Chevrolet Trax was the No. 1 in the small SUV segment during the third quarter, and Buick was the fastest-growing mainstream brand calendar year to date. Cadillac recorded its best third quarter and calendar year-to-date sales since 2013, and GM Envolve, the company's fleet business, reported a 20% increase in third-quarter sales thanks to demand for its OnStar Services.

The strength in GM's full product portfolio powered its results during the third quarter when the automaker reported operating profit of $3.1 billion on revenue of $48.6 billion, which easily topped analysts' estimates and enabled management to raise full-year guidance.

What it all means

General Motors is doing a lot of things right these days, and is a far better business and company than it was two decades ago. The market hasn't realized it yet and has yet to reward the company with a proper valuation -- it currently trades at a paltry 10 times price-to-earnings -- and that's partly why the company repurchased so much of its stock. GM is buying its shares, and it's probably time investors started considering the same.