Long-term investing has many advantages over day trading. It turns out that most who engage in the latter don't make much -- if any -- profit. That's not that surprising, since it's hard to predict the market's day-to-day movement. In contrast, we know that in the next decade, broader equities will deliver competitive returns relative to other asset classes.

So, buying shares of excellent companies and holding them through good and bad times, versus looking for an opportunity to make a quick profit, is the way to go. But which stocks should investors buy? Let's consider two that could produce superior returns during the next decade: Berkshire Hathaway (BRK.A 1.85%) (BRK.B 1.82%) and MercadoLibre (MELI +3.79%).

Image source: Getty Images.

1. Berkshire Hathaway

Berkshire Hathaway is changing. Charles Munger, Warren Buffett's longtime friend and business partner and one of the conglomerate's architects, died a few years ago. Buffett himself is stepping down as chief executive officer at the end of this year. With the two men most responsible for Berkshire Hathaway's success over the past few decades no longer at the helm, can the company continue performing well?

My view is that it can. Buffett and Munger built a rock-solid, highly diversified business with subsidiaries in many different industries, from insurance to energy, apparel, and more. The company also has a fantastic portfolio with more than three dozen holdings.

NYSE: BRK.A

Key Data Points

More importantly, Buffett and Munger trained the next generation of leaders. They imparted their knowledge and investing philosophy to men like Greg Abel, the company's next CEO; Ajit Jain, the vice chairman of insurance operations; and Todd Combs and Ted Weschler, who are investment managers with the company and have been responsible for 10% of the conglomerate's portfolio for some time.

The next few years might be a bit challenging for Berkshire Hathaway as this next generation of leaders tries to show that, despite Buffett and Munger's absence, they can still get it done. But in my view, Berkshire Hathaway could still deliver monster returns over the long run, and the stock is still worth investing in today.

2. MercadoLibre

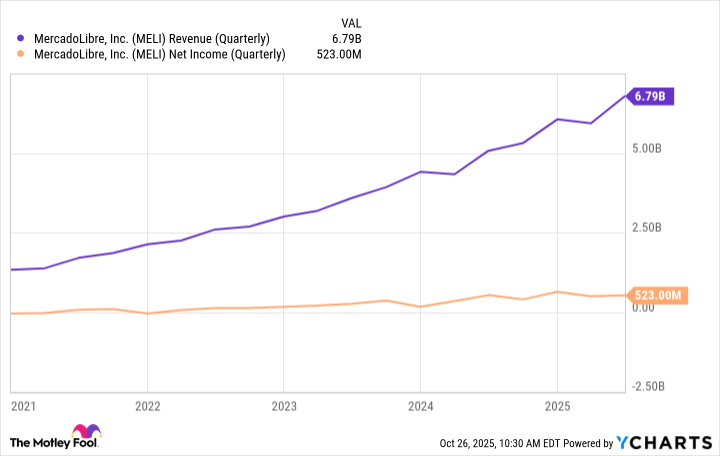

MercadoLibre is the leading e-commerce player in Latin America, a region where operating isn't always easy for various reasons. Having a presence and a functioning logistics network across multiple countries with varying laws and cultures is challenging enough, but the political instability that sometimes affects some Latin American countries makes it even harder. Still, MercadoLibre has found tremendous success despite all that. Revenue growth remains strong, and it has been consistently profitable during the past few years.

MELI Revenue (Quarterly) data by YCharts.

MercadoLibre's long-term outlook looks attractive for several reasons. First, there is the strong economic moat the company has built. As the leading e-commerce platform in the region, it benefits from strong network effects. The more merchants use its platform, the more attractive it is to consumers, and vice versa. Since the company offers a range of services beyond e-commerce, including shipping solutions, fintech, and a platform that helps merchants create online storefronts, MercadoLibre also benefits from high switching costs.

NASDAQ: MELI

Key Data Points

These dynamics help explain why it has been able to survive competition, even from a giant like Amazon. And although other platforms, such as Sea Limited's Shopee, are making a push in the region, MercadoLibre is well-positioned to remain the leader over the next decade.

Second, there is a long runway for e-commerce opportunities. While we should see the sector expanding steadily in most regions, Latin America has been one of the fastest-growing regions in recent years. The increased shift to online retail will be another powerful tailwind for MercadoLibre.

Third, a growing middle class in Latin America means higher incomes and more spending on goods and services, which should buttress the retail landscape, including online. These factors should help power MercadoLibre in the next decade and beyond. The stock looks like a no-brainer for growth-oriented investors.