Target (TGT +2.56%) has long been one of the premier discount retailers in the U.S., but its stock has struggled in recent times. Over the past 12 months alone, the stock is down by around 37%, and is off by about 40% from its high during that span. For perspective, its biggest rival, Walmart, is up close to 27% over the same period.

There have been several reasons Target has struggled recently, including declining sales and in-store traffic, shrinking margins, and community boycotts. We definitely shouldn't look past those. However, if you're looking for a beaten-down stock you can hold in your portfolio for the long haul (and receive an attractive dividend while doing so), Target is a good option to consider.

Its turnaround, if it happens, won't be quick, but there are signs pointing to better days being ahead.

Image source: Target.

A dividend worth being patient for

Target is a Dividend King, meaning it has increased its annual payouts for at least 50 consecutive years. Its dividend-hiking streak currently stands at 54 years. This is a testament to the company's sustained strengths and management's focus on shareholder-friendly policies amid the inevitable ups and downs Target experienced over that period.

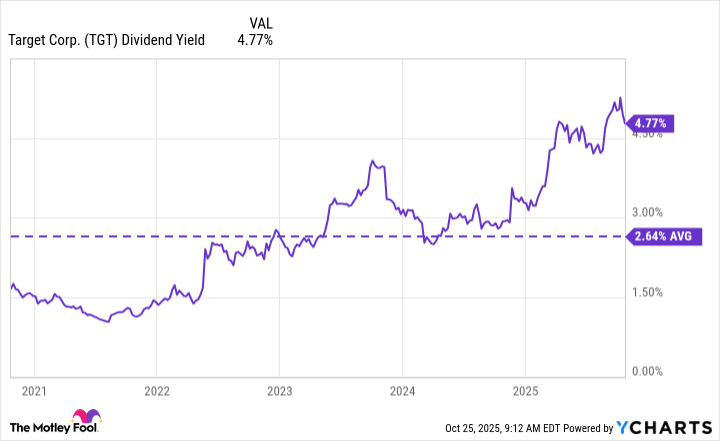

At its current share price, its dividend yield is just over 4.7%, which is well above its 2.6% average over the past five years. But that's what happens when your stock price is down by over 31% year to date (through Oct. 24).

TGT Dividend Yield data by YCharts.

Even with Target's struggles, it's hard to imagine management cutting or eliminating the dividend, especially at a time when the stock is performing poorly and management is well aware that the payouts are keeping many shareholders around. The dividend payout ratio is around 55%, which is sustainable.

Expanding beyond just retail

Retail is obviously the core of Target's business, but it has been making strides in non-retail areas, such as memberships (Target Circle 360), advertising (Roundel), and its marketplace (Target Plus).

Target Circle 360 is essentially its version of Amazon Prime or Walmart+. The membership costs $99 annually (or $10.99 monthly) and offers benefits like same-day delivery from Target and partner stores, access to members-only items, and monthly freebies.

Increasing memberships not only provides Target with high-margin revenue because it doesn't require selling products, but it also incentivizes members to shop at Target versus competitors, so they can take advantage of their membership perks.

NYSE: TGT

Key Data Points

Roundel and Target Plus are Target's other high-margin businesses. Roundel is Target's in-house advertising platform that allows its brands to reach millions of customers online, in Target's app, and even in-store in some cases. Target Plus expands Target's online presence through third-party sellers, reducing some of the inventory risks associated with storing and managing its own products.

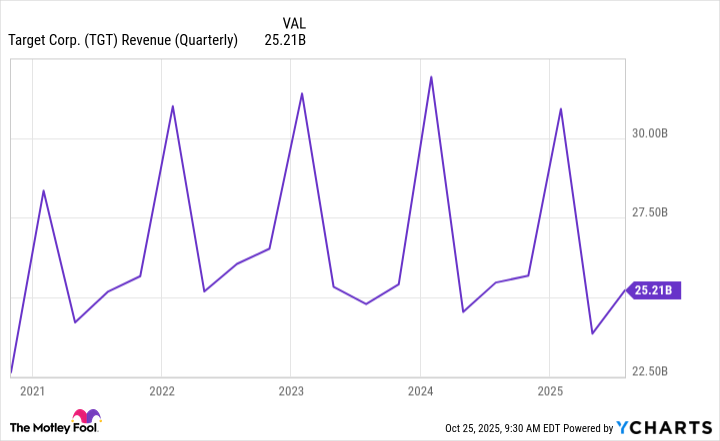

In its fiscal second quarter, Target's revenue fell by 0.9% to $25.2 billion, while its non-merchandise revenue increased by 14.2%. Memberships, Roundel, and marketplace revenue all grew by double-digit percentages.

TGT Revenue (Quarterly) data by YCharts.

New leadership at the helm

Amid its struggles, Target is shaking up its top leadership. On Feb. 1, its current CEO, Brian Cornell, will hand that job off to Michael Fiddelke and transition to the role of executive chairman. Fiddelke has been with Target for 20 years and served as CFO from 2019 to 2024, so he's definitely familiar with the company and its finances.

Target is making this move for two main reasons: to keep leadership in-house and, hopefully, accelerate the execution needed to return the business to its previous standing. Only time will tell how effective Fiddelke's leadership turns out to be, but it's worth making the change to try and spark changes at the stagnating company.

Again, I want to emphasize that Target's turnaround won't be a quick fix, especially when it comes to rebuilding its brand after community backlash. However, its high-yielding dividend should buy it some patience from investors as its leaders work to right the ship.