SentinelOne (S 0.96%) developed a cybersecurity platform called Singularity, which protects the entire enterprise, from cloud networks to endpoints (computers and devices). It uses artificial intelligence (AI) to autonomously identify and neutralize threats, which reduces the burden on human cybersecurity managers.

SentinelOne stock is down 76% from its 2021 record high, when a frenzy in the technology sector drove its valuation to a completely unsustainable level. However, according to Wall Street, it might be a great buy at the current level.

The Wall Street Journal tracks 38 analysts who cover SentinelOne stock, and the majority have assigned it a buy rating, with none recommending selling. Here's why they are right to be bullish.

Image source: Getty Images.

AI is the future of cybersecurity

On average, large companies deal with over 1,000 cybersecurity alerts and incidents every single day, and more than half are left uninvestigated because human managers are simply overwhelmed. Automation is the only way forward, and AI is powering the transition.

SentinelOne's Singularity platform blocks attacks at machine speed, often within seconds. But in the event of a successful breach, features like one-click rollback allow managers to instantly restore networks to their pre-breach state once the incident is contained. The platform's integrated virtual assistant, Purple AI, can also reduce the time it takes to find the root cause of the breach, so vulnerabilities can be patched much faster.

Earlier this year, SentinelOne upgraded the assistant and renamed it Purple AI Athena. It now uses advanced reasoning to identify, analyze, and remediate threats just like a security operations analyst, in order to thwart more attacks in real time. The goal is to continue reducing the number of incidents that require manual intervention by a human manager, which will ultimately result in fewer successful breaches.

NYSE: S

Key Data Points

SentinelOne recently raised its fiscal 2026 revenue forecast

SentinelOne generated $242.2 million in revenue during its fiscal 2026 second quarter (ended July 31), which was up 22% from the year-ago period. The result was driven by high-spending customers, with the number of enterprises with an annual contract value of at least $100,000 jumping by 23%.

The solid result prompted management to increase its full-year revenue forecast for fiscal 2026, from $998.5 million to $1 billion at the midpoint of the guidance range.

But things might get even better from here. During the second quarter, SentinelOne launched a new subscription option called Flex, which will allow customers to adjust their deployments as their needs change without signing an entirely new contract.

For example, instead of initiating a separate purchase agreement to try out a new Singularity module, the Flex subscription would allow the enterprise to shift some of its existing spending to accommodate it. Other cybersecurity providers like CrowdStrike have had enormous success with this subscription format, because it encourages more spending in the long run by enticing customers to constantly try different products.

As a result, Flex adoption is likely to be front and center for Wall Street analysts when SentinelOne releases its operating results for the fiscal third quarter (ending Oct. 31) in late November.

SentinelOne stock looks like a bargain compared to its peers

Twenty-two of the 38 analysts who cover SentinelOne stock rate it a buy, according to The Wall Street Journal. Two others are in the overweight (bullish) camp, while the remaining 14 recommend holding. None recommend selling.

The analysts have an average price target of $23.65, which implies the stock could gain 34% over the next 12 to 18 months. The Street-high target of $30 points to even more potential upside of 70%.

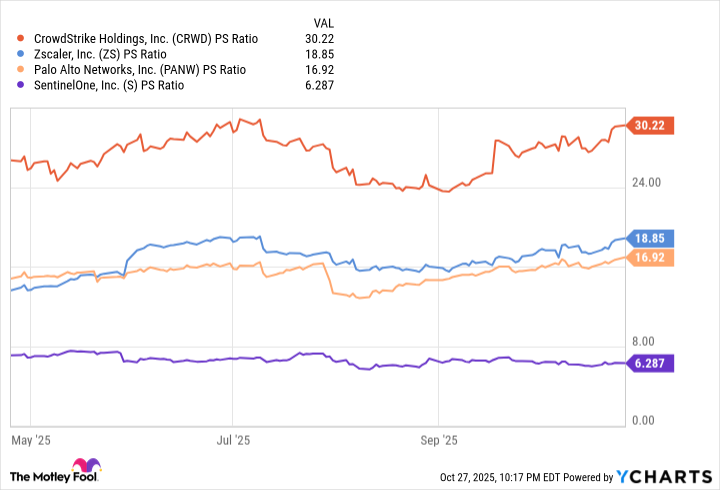

I think both of those targets could be realistic given SentinelOne's current valuation. Its stock is trading at a price-to-sales (P/S) ratio of 6.2 as I write this, making it significantly cheaper than its peers in the AI-powered cybersecurity space, which includes CrowdStrike, Palo Alto Networks, and Zscaler:

CRWD PS Ratio data by YCharts

To be clear, SentinelOne is the smallest of the four providers as measured by market capitalization and annual revenue. However, it's currently growing slightly faster than each of them. Its 22% revenue growth in the recent quarter was faster than CrowdStrike's growth of 21%, Zscaler's growth of 21%, and Palo Alto Networks' growth of 16%.

This suggests SentinelOne might be slowly taking market share, and new initiatives like the Flex subscription could accelerate the current trend. As a result, I think Wall Street's bullish consensus on the stock is justified, so it could be a great buy for investors who want some exposure to the cybersecurity space.