Investing in the stock market may seem complicated and overwhelming for beginners, but it really isn't. You can even start with a very small amount of money, thanks to several brokerages that permit their investors to buy fractional shares.

If you just opened a brokerage account and have some investible cash that isn't needed to pay bills, clear high-interest debt, or save for an emergency fund, you might want to consider investing it. As for where it should be invested, you will want to find a few strong companies with competitive advantages that can grow at healthy rates in the long run.

Let's look at two such names that could be ideal buys for investors at the beginning of their portfolio development since they have the potential to deliver impressive long-term upside.

Image source: Getty Images.

1. Advanced Micro Devices

If you had invested just $100 in shares of Advanced Micro Devices (AMD +2.29%) a decade ago, your investment would now be worth more than $12,000. The stock's strong returns over the past 10 years were helped by a variety of catalysts, including personal computers (PCs), gaming consoles, cryptocurrency mining, and data centers.

NASDAQ: AMD

Key Data Points

Those catalysts should continue to help AMD clock outstanding growth going forward. For instance, the chip designer will develop the semi-custom processors for the next generation of gaming consoles from Microsoft and Sony. Both tech giants are developing their upcoming gaming consoles, which are expected to be released in 2027. The arrival of a new console cycle has historically been a tailwind for AMD, and a similar scenario could unfold in a couple of years when the new consoles arrive.

Another unmissable catalyst for AMD is its growing prominence in the AI accelerator market. Though Nvidia has been the dominant player in AI chips, AMD has also started making strong progress in this space. The company ramped up its product development and is expected to catch up with Nvidia next year when it launches its MI450 data center graphics processing units (GPUs). AMD's efforts are bearing fruit, with the company set to supply chips to OpenAI from 2026 to power 6 gigawatts (GW) of AI computing capacity. This partnership could be a big deal for AMD, which could add an estimated $36 billion to the company's data center revenue. For comparison, it reported $12.6 billion in data center revenue in 2024.

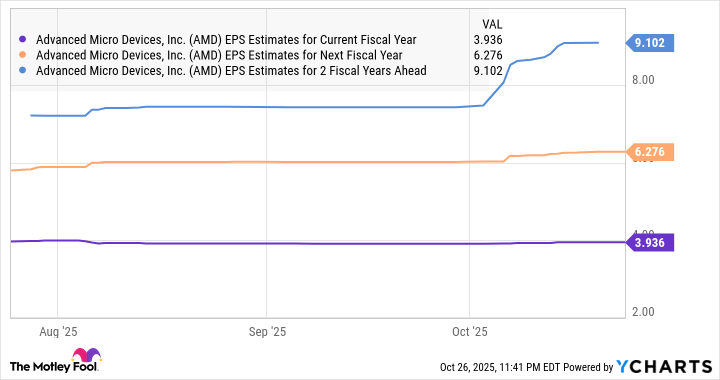

Sales of generative AI-capable PCs are expected to clock a compound annual growth rate of 32% over the next decade. This is great news for AMD investors since it has been eating into Intel's share of the PC processor market. AMD's revenue share of client PC processors stood at almost 28% in the second quarter of 2025, up by nearly 10 percentage points from the year-ago period. It has central processing units (CPUs) and graphics cards capable of running AI workloads locally on PCs. They could win a bigger share of the client CPU market in the long run. That's why AMD's earnings are expected to take off from next year, following a projected increase of 19% in 2025 to $3.94 per share.

Data by YCharts; EPS = earnings per share.

That strong acceleration in earnings can pave the way for more upside, which is why beginner investors might want to consider buying this semiconductor stock while it is trading at an attractive 28 times forward earnings, a discount to the Nasdaq-100 index's average earnings multiple of 33.

2. CoreWeave

The global AI boom has sparked the need for more data centers capable of running AI workloads in the cloud. There is a shortage of such data centers right now, and it's expected to persist.

The consulting firm McKinsey projects that global data center capacity could increase at an annual rate of 19% to 22% by 2030 to a range of 171 GW to 219 GW. That would be a huge jump over last year's data center capacity demand of 60 GW. The firm says that "at least twice the data center capacity built since 2000 would have to be built in less than a quarter of the time" if a deficit is to be avoided.

This puts CoreWeave (CRWV +1.30%) in an ideal situation to sustain the outstanding growth that it has been achieving. The company offers dedicated data centers for high-performance computing (HPC) and AI workloads powered by GPUs from the likes of Nvidia. Customers can rent GPU capacity from CoreWeave based on their requirements to build, customize, and deploy AI applications in the cloud.

NASDAQ: CRWV

Key Data Points

This business model is a success as major hyperscalers and AI companies queue up to purchase AI data center capacity from the company. The company's contracts with OpenAI alone add up to $22.4 billion, while Meta Platforms also gave CoreWeave a five-year $14 billion contract recently.

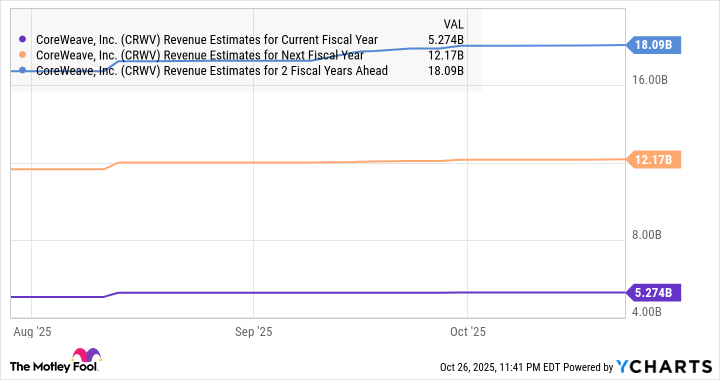

These new contracts, along with a $6.3 billion Nvidia deal, will add to CoreWeave's backlog, which was already $30 billion at the end of the second quarter. For some perspective, the company expects to generate $5.25 billion in revenue in 2025. The new contracts that CoreWeave landed point toward a much brighter future, especially considering that the company sees its total addressable market growing to $400 billion in 2028.

The company is working to scale up its data center capacity to convert that backlog into revenue. It had 470 megawatts (MW) of active capacity at the end of the second quarter, but its total contracted capacity stands at 2.2 GW. As CoreWeave brings more capacity online, it should see more top-line growth.

Data by YCharts.

Given the company's backlog is bigger than the revenue it expects to generate over the next three years, it should have no problem sustaining healthy levels of growth. All this makes CoreWeave a strong growth stock that new investors should consider adding to their portfolio, as it looks like a long-term winner.