Investors have fallen in love with the big technology stocks yet again. But did you know that one of the big tech stocks -- Amazon (AMZN 2.28%) -- has severely underperformed the broad market S&P 500 Index over the last five years? Amazon stock is up less than 40% over that period compared to a total return of the S&P 500 of 110%, as Wall Street gets wary about the company's position in the artificial intelligence (AI) race.

Despite these concerns, I believe Amazon is one of the smartest growth stocks you can buy with $1,000 right now, because of its dual engines of growth that should keep this business chugging along for the rest of this decade. Here's why Amazon stock may be the cheapest "Magnificent Seven" stock you can buy today.

NASDAQ: AMZN

Key Data Points

Amazon's accelerating AWS growth

The largest risk facing Amazon today is how AI will impact its position in the cloud computing sector. Its Amazon Web Services (AWS) subsidiary has dominated cloud computing infrastructure for close to two decades, leading the pack in both revenue and profitability. However, in the last few years, its competitors, Microsoft Azure and Google Cloud, have been growing revenue faster on a percentage basis due to their relationships with AI start-ups such as OpenAI.

There is a narrative that AWS is falling behind when it comes to AI cloud relationships, which is holding back the stock. Right now, AWS's quarterly revenue is growing 17.5% year over year compared to 32% growth at Google and 29% growth at Microsoft Azure.

I believe AWS may accelerate its revenue growth over the next few quarters due to its relationship with the fast-growing AI company Anthropic. AWS is one of the cloud providers for Anthropic, a company that is leading in enterprise AI deployment. It is projecting $9 billion in annual recurring revenue (ARR) by the end of 2025 and growth to $26 billion by the end of 2026, which is insanely fast growth considering that ARR was only $5 billion in August.

More than this annual revenue will be spent on AWS cloud services each year, since Anthropic is losing a ton of money. With $116 billion in trailing-12-month revenue, adding potentially more than $10 billion in revenue from Anthropic in just a few short quarters could help AWS accelerate revenue growth above 20%. Over the long term, investors should expect this division to keep climbing higher and higher, eventually reaching $200 billion in revenue by the end of the decade.

Image source: Amazon.

Automation and profit margins

All everyone can talk about today is AI, making Wall Street hyper-focused on AWS when analyzing Amazon stock. We cannot forget its original online retail business, which is still being underrated by investors.

With fast delivery and a vertically integrated model, Amazon's e-commerce network has a vast competitive advantage in North America that allows it to consistently take market share. Revenue grew 11% year over year to $100 billion last quarter in the region, along with 11% constant currency growth internationally.

Automation and AI will help Amazon's North American retail division keep expanding its profit margins in the years to come. This will be a team effort across the business with innovations such as AI-generated advertisements, robot-powered warehouses, and AI-search enhancements on the Amazon website and application.

Over the past 12 months, Amazon's operating margin in North America for retail was 7%. I believe this number can climb significantly higher in the years to come, along with steady revenue growth as e-commerce keeps taking market share in the United States.

Investors are discounting Amazon too much

With the stock trailing the S&P 500, Amazon now "only" has a market cap of $2.4 trillion compared to some of its big tech competition at over $3 trillion. This makes Amazon undervalued because of the continued profit inflection that will occur over the next two to three years.

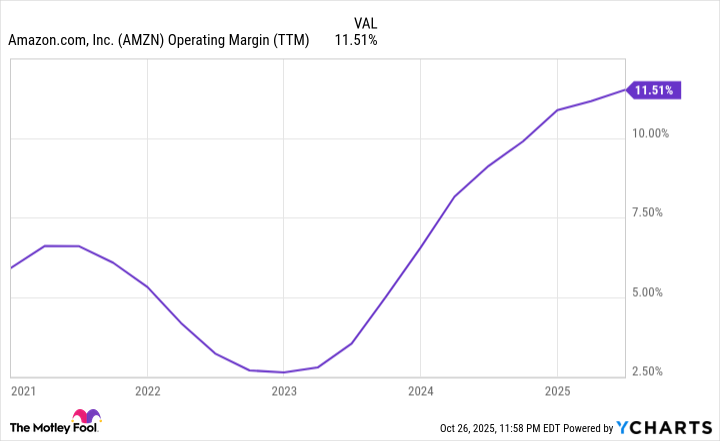

Amazon's overall revenue grew 13% last quarter, a number I think they can sustain for the next few years with accelerating AWS revenue growth and sustained growth in e-commerce. A 13% average annual revenue growth rate would bring total revenue to $855 billion two years from now. Assuming its operating margin can increase from 11.5% today to 15%, that would be $128 billion in earnings for Amazon two years from now compared to $76 billion over the last 12 months, a significant jump and a rather cheap earnings ratio compared to its current market cap of $2.4 trillion.

Taken together, Amazon looks like a rock-solid pick with a high chance of working out well for investors who buy today and plan to hold for many years.