Look at the S&P 500 index (^GSPC 0.01%) today and you might feel a little queasy. It is, 100%, in the nosebleed seats, after skyrocketing in value over the past few years. In fact, the index's price-to-sales ratio is near the highest level in two decades at nearly 3.4 compared to the average of 1.9 over the span. You haven't missed out. Here's why you should still invest in stocks despite the market being expensive right now.

The price-to-sales ratio

Sales are the revenue that a company generates. Sales tend to be much more consistent over time than earnings and, thus, some believe sales provide a more reliable gauge of value. The price-to-sales ratio basically compares the price of an asset to its sales; the higher the ratio, the more you are paying per dollar of sales. Lower is better with this metric. As noted in the intro, the ratio is rather high today and well above the average over the past 20 years.

Image source: Getty Images.

It is completely reasonable to see that and decide that investing right now could lead to near-term losses if the P/S ratio reverts to the mean. The only way that can happen is for the sales number to grow while stock prices do nothing or for stock prices to fall dramatically. Either way, you are likely to end up with not-so-great financial results in the near term.

Sorry to say, one of those two outcomes is highly likely since trees don't grow to the sky. But, here's the important part: That's normal in the investing world. Stock prices tend to be highly volatile over the short term. But over the long term, stock prices have tended to rise.

Bulls and bears take turns

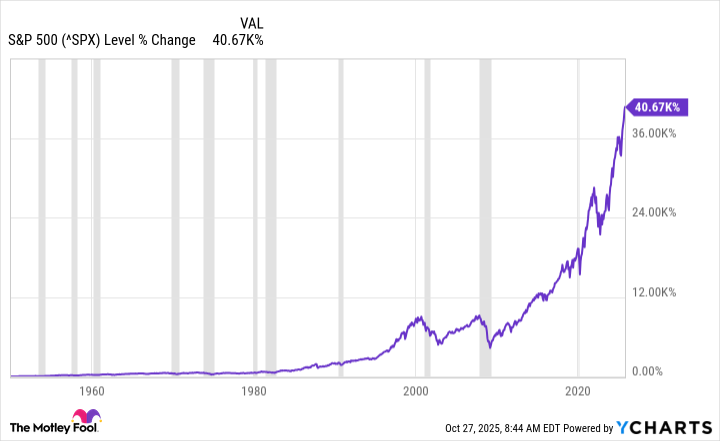

The proof is in the chart above, which shows the S&P 500 index's performance over the long term. Notice that every big price drop (a bear market) is followed by a rise in prices to new highs (a bull market). Bull and bear markets are largely driven by investor emotions and there's not a whole lot to do about it other than recognize the pattern.

So there are very clearly better and worse times to invest, but the really important thing for most people is just to get in the game. And then, once you've started, to keep investing regularly. That lets you benefit from things like dollar-cost averaging (buying more every month) and the compounding that comes from dividend reinvestment (using dividends to buy more stock). The key to each is that you buy more when the market is low and less when the market is high, but you keep buying just the same, building your wealth over time.

NYSEMKT: VOO

Key Data Points

One of the best ways to buy the S&P 500 index is with Vanguard S&P 500 ETF (VOO 0.02%). This is an exchange traded fund that has an ultra-low expense ratio of 0.03%. This could be the only stock investment you need if you want to keep your life simple. But the key is still to just get started and then keep investing.

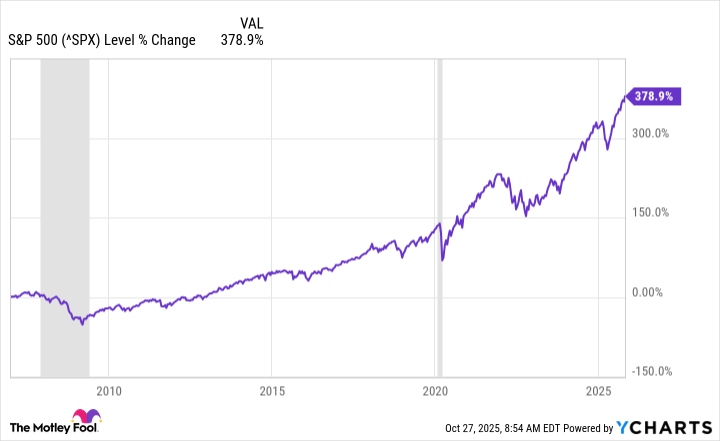

Look back at the long-term graph of the S&P 500 for a second. Even if you had the bad timing to buy just before the Great Recession at the start of 2007, one of the worst periods for stocks in recent history, you would still be in the green today. In fact, that drop, while brutal when it occurred (there were concerns the entire global finance system might collapse!), looks like little more than a blip on the path higher today.

Get in the game ASAP

Building wealth isn't something you do in a day or even a few years. It is something that is best done over decades. You are far better off if you just get started instead of trying to time the market's gyrations. History suggests that you haven't missed out on the wealth-building power of stocks. The only way to do that is to never start investing. It is time in the game, not timing, that really matters the most. And all you need to do is start now and keep investing no matter what happens.