Data streaming is the technology behind many live digital experiences each day. Investing and sports betting platforms use it to feed real-time prices to smartphones. Retailers use it to feed live inventory information to their websites, so customers know whether products are in stock.

Data streaming is also critical in artificial intelligence (AI) applications, which need access to real-time data to give users up-to-date outputs. Confluent (CFLT 0.02%) developed one of the industry's leading data streaming platforms, and AI could be an enormous opportunity for the company.

Confluent stock remains 76% below its 2021 record high, when a frenzy in the technology sector drove it to an unsustainable valuation. However, when investors look back on this moment in a few years, here's why they might wish they had bought the dip.

Image source: Getty Images.

Data streaming is a critical tool for running AI applications

AI is as powerful as it has ever been, but a study from the Massachusetts Institute of Technology (MIT) suggests a surprising proportion of businesses are struggling to maximize its potential. Simply put, an AI application is only as capable as its data pipelines.

For example, practically any business can adopt a large language model (LLM) from a leading third-party developer like OpenAI or Anthropic, but to configure it to serve customers or make employees more efficient, the model needs access to clean internal data. Unfortunately, that data is often scattered across dozens of digital applications, which makes it difficult for the LLM to read, analyze, and process it to produce accurate outputs in a timely manner.

Think of those digital applications as country towns, and think of their data as cars. Using Confluent, a business can build a set of highways to connect each town, which facilitates the seamless flow of traffic. This makes the data more accessible to the LLM, thus resulting in a more effective AI application.

But it gets better, because Confluent can also optimize the data so it always arrives in the right format. Plus, it doesn't transport the data in batches -- it constantly streams it. That means the AI application always has access to the latest information in real time, which it can use to deliver more accurate outputs.

NASDAQ: CFLT

Key Data Points

Confluent just increased its 2025 revenue forecast

Confluent generated $286.3 million in subscription revenue during the third quarter of 2025 (ended Sept. 30), which was a 19% increase from the year-ago period. It was comfortably higher than management's forecast of $281.5 million, which highlights the momentum in the business right now.

The strong result was driven by a couple of factors. First, Confluent's net revenue retention rate was 114%, which means existing customers spent 14% more money with the company than they did in the same period last year. Second, Confluent continued to attract new high-spending customers. The number of customers with an annual contract value (ACV) of at least $100,000 increased by 10% during the third quarter, and those with an ACV of at least $1 million soared by 27%.

The growth rate in million-dollar customers accelerated from 24% in the second quarter just three months earlier, which emphasizes how important data streaming has become for large, complex organizations.

Confluent's solid quarter prompted management to increase its guidance for 2025 overall. The company is now expected to generate $1.114 billion in subscription revenue (at the midpoint of the forecast range), up from the previous guidance of $1.107 billion.

Confluent stock is trading at a very attractive valuation

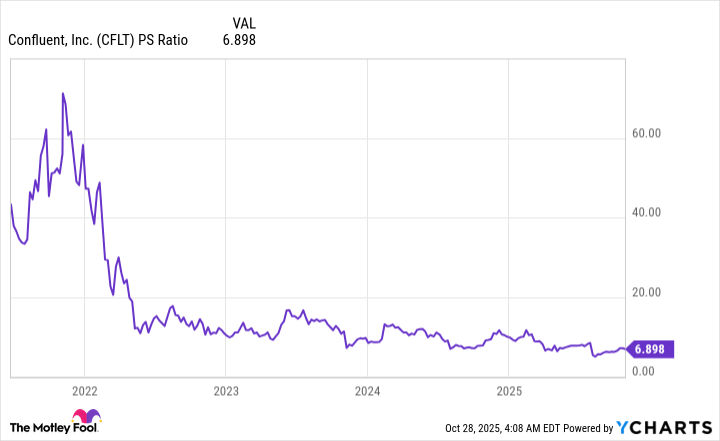

Confluent stock was trading at a price-to-sales (P/S) ratio of around 60 when it peaked in 2021, which was completely unsustainable. But the 76% decline in the stock since then, combined with the company's consistent revenue growth, has pushed its P/S ratio down to a more reasonable level of 6.8.

In fact, that is close to Confluent's cheapest valuation since it went public four years ago.

CFLT PS Ratio data by YCharts

But here's the kicker: Confluent values its total addressable market at $100 billion, and the company's current revenue is a drop in the bucket relative to that opportunity. In other words, there is a long runway for growth.

Therefore, when investors look back on this moment in a few years' time, they might regret not taking this chance to buy Confluent stock.