It's always a good sight to see price appreciation on your holdings because it's a straightforward way to see how much money you're making (at least on paper). However, one of the most effective ways to make money in the stock market is to invest in dividend stocks.

Dividend stocks don't usually get the attention of growth stocks, but they can be just as lucrative. There are thousands of dividend stocks to choose from, but not all are created equal. Some stocks' dividends are at risk of being reduced or eliminated, and some stocks' yields are being propped up by falling share prices.

If you're looking for reliable dividend stocks to add to your portfolio and let ride for the long term, the following two options are great choices. Both are Dividend Kings (companies with at least 50 years of consecutive annual dividend increases), so you know they have stood the test of time.

Image source: Getty Images.

1. Coca-Cola

Coca-Cola (KO +0.03%) has one of the most recognizable brands in the world, and its business has been a staple in the beverage world for well over a century. It didn't become this way by luck, either; it's the product of decades of strong execution and forming key partnerships with distributors around the world.

When it comes to nonalcoholic beverages, the company is the undisputed leader, with a U.S. market share of over 47%. Its flagship Coke brand can be found virtually everywhere around the globe, but its portfolio contains dozens of other products, including traditional sodas, water, coffee, tea, juices, plant-based options, and even alcoholic drinks.

NYSE: KO

Key Data Points

The current quarterly dividend is $0.51, with a yield of around 2.9% at the time of this writing. Its average yield over the past decade has been just over 3%. When it raised its dividend earlier this year, it was the 63rd consecutive year it had done so.

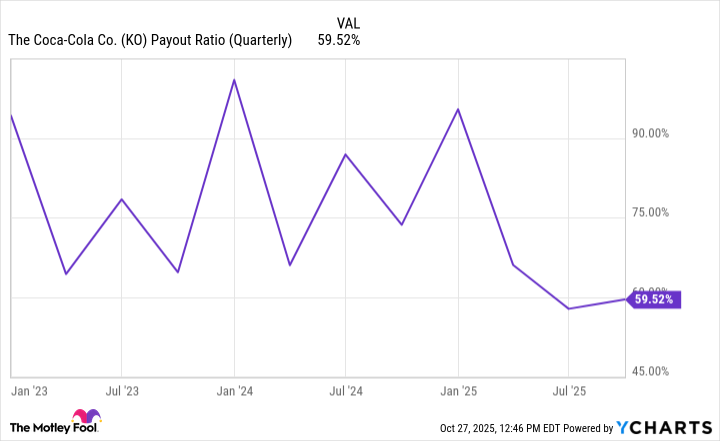

The payout is one you never have to second-guess. The company routinely brings in enough cash flow to cover its dividend obligations with enough left over to ensure it can continue investing in growth areas and adjusting its portfolio as needed.

KO Payout Ratio (Quarterly) data by YCharts.

To really reap the full benefits of dividend stocks, you need time. And with that being the case, you want to invest in dividend stocks that you know will stand the test of time, and Coca-Cola checks that box.

2. Altria

Tobacco giant Altria Group (MO +0.19%) has a solid portfolio under its belt, including brands like Marlboro, Black & Mild, Copenhagen, Skoal, and Parliament.

Altria routinely has one of the highest dividend yields that you'll find in an S&P 500 stock. Its current quarterly dividend is $1.06, with a yield close to 6.5%. That's below its five-year average of around 7.8%, but I'm sure investors don't mind too much, given the share price is up over 26% in the past year.

NYSE: MO

Key Data Points

The main cause for concern with the business is the broader decline in U.S. adult cigarette smokers. Cigarettes are by far Altria's largest segment, so declining numbers of smokers definitely impact its business. Luckily for Altria, the tobacco industry affords it a lot of pricing power because people tend to buy their go-to tobacco products regardless of cost.

The company's pricing power and industry-leading position have allowed it to maintain its cash flow despite declining volume in key areas. In the second quarter, its revenue declined 1.7% to $6.1 billion, but its adjusted earnings per share (EPS) increased 8.3% to $1.44. Management says its goal is to keep its dividend payout ratio around 80% of its adjusted EPS.

Even with declining volume in some areas, the company is a safe bet for income investors. Its products sell no matter the economy, it has a reliable cash flow, and it's been making intentional efforts to expand its business beyond cigarettes and smoking tobacco.

You probably shouldn't invest in Altria expecting its recent gains to be the norm, but if there's one thing you can count on, it's the company prioritizing its shareholders with a lucrative dividend.