The "Magnificent Seven" is a collective name for Nvidia, Apple, Microsoft, Amazon, Alphabet, Meta, and Tesla. Together, these are some of the most influential companies in the world, with a combined market cap of around $21.5 trillion.

Their past success and growth potential have made the Magnificent Seven stocks among the most sought-after on the market. The Vanguard S&P 500 ETF (VOO +0.08%) is heavily weighted toward the Magnificent Seven, making it a good way to get exposure to those companies without having to be completely all in.

If VOO continues at its historical pace, investors could find that $500 monthly investments could push them over the $800,000 mark.

Image source: Getty Images.

"Magnificent Seven" stocks leading the charge

VOO mirrors the S&P 500 index, which tracks the performance of around 500 of the largest American companies on the market. The index is weighted by market cap, meaning larger companies account for more of the index than smaller ones. Because of this, the Magnificent Seven stocks have a large presence in VOO.

| Company | Percentage of VOO |

|---|---|

| Nvidia | 7.95% |

| Microsoft | 6.73% |

| Apple | 6.60% |

| Amazon | 3.72% |

| Meta (Class A) | 2.78% |

| Alphabet (Class A) | 2.47% |

| Tesla | 2.18% |

| Alphabet (Class C) | 1.99% |

Although VOO holds 504 stocks, the Magnificent Seven account for about 34% of the ETF (and eight of the top 10 holdings). This may not be ideal if your goal is diversification, but if you're looking to get high exposure to Magnificent Seven companies while also having hundreds of other high-quality businesses involved to help balance it out, then VOO is a great option.

The tech sector is much of VOO, but the top five sectors are rounded out with financials (13.5%), consumer discretionary (10.5%), communication services (10.1%), and healthcare (8.9%).

Great performances over the past decade

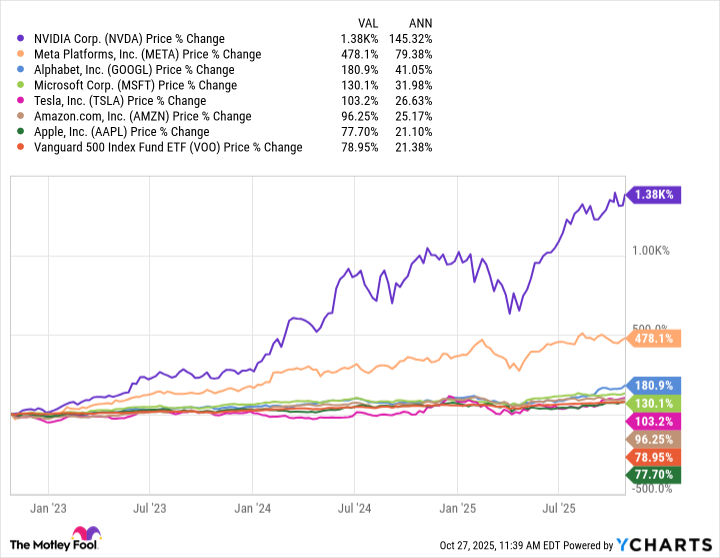

The concentration in Magnificent Seven stocks has worked well for VOO, especially over the past few years. The worst-performing stock in that span is Apple, and it's still up around 77% in the past three years. The best-performing has been Nvidia, up over 1,380%.

There's no doubt that a lot of the growth in the past few years has come from the artificial intelligence (AI) boom. As technology has evolved and become mainstream, investors have rushed to invest in tech companies that develop or use it.

That's how Nvidia has become the world's most valuable public company, and how Apple has underperformed the market because investors have been disappointed by its lack of AI development.

How VOO can turn $500 monthly into $800,000

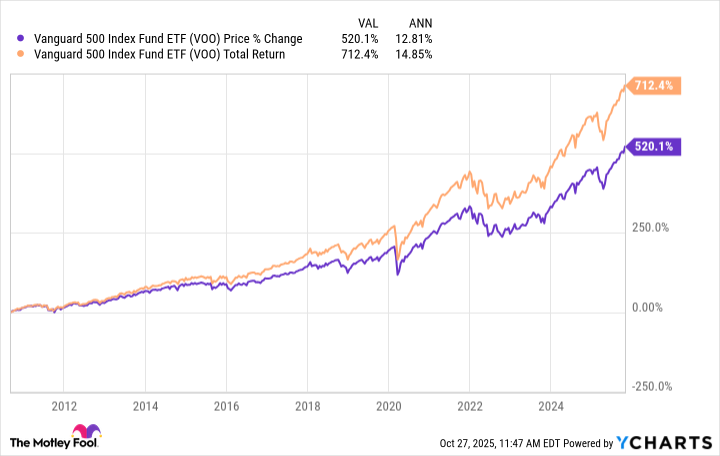

Since it hit the market in September 2010, VOO has averaged 12.8% annual returns, or 14.8% when including dividends. Those are impressive gains for a 500-plus-stock ETF.

Past performance doesn't guarantee future performance by any means, but for the sake of illustration, let's imagine VOO can keep up its impressive run. Below is how much $500 monthly investments into VOO could grow over different numbers of years and different annual average returns:

| Years | 12% Annual Returns | 13% Annual Returns | 14% Annual Returns |

|---|---|---|---|

| 10 | $105,100 | $110,300 | $115,800 |

| 15 | $223,100 | $241,900 | $262,400 |

| 20 | $430,800 | $483,900 | $544,200 |

| 25 | $796,300 | $929,300 | $1.08 million |

Data source: Calculations by author. Returns are rounded down to the nearest hundred and include VOO's 0.03% expense ratio.

Specific returns aside -- because those will inevitably vary -- the biggest takeaway from this table is how powerful compound earnings can be with time. Reaching $800,000 by strictly saving is a tough ask. Reaching $800,000 by investing and giving yourself time is doable in many cases.

To add a cherry on top, an $800,000 portfolio could pay a nice amount in annual dividends. Even at a modest 1% dividend yield, having $800,000 in VOO could pay out $8,000 annually.