Right now, Rivian (RIVN +4.46%) stock is hovering just above $13 per share. But if Rivian stock were valued like Tesla (TSLA +3.74%) stock, it would trade at $70.49.

Of course, Rivian is a long way away from becoming the next Tesla. But there are two compelling reasons to believe shares should trade much higher than they do today.

NASDAQ: RIVN

Key Data Points

Rivian stock trades at a surprising discount to Tesla and Lucid Group

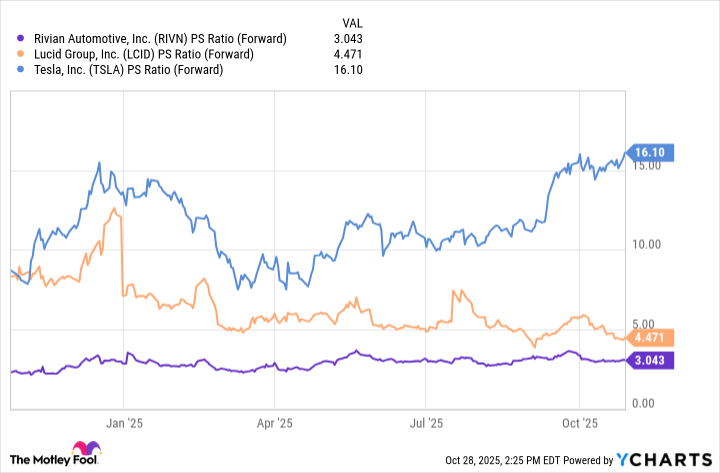

Looking at the relative valuations of EV stocks, including Rivian, Tesla, and Lucid Group (LCID +1.25%), two trends become obvious. First, Tesla trades at a huge premium to the rest of the industry. Second, Rivian trades at a consistent discount to the rest of the industry. Understanding why this is can give investors a meaningful edge in their next stock pick.

The chart below covers forward price to sales ratios. That means that based on analyst predictions, the next 12 months of growth are already accounted for in these figures.

If Rivian shares traded at Tesla's price-to-sales ratio, the stock would be above $70 apiece. Instead, they're stuck below $15. Why? For two reasons.

First, Tesla has a massive capital advantage. Its $1.4 trillion market cap allows it to sell stock easily, raising large amounts of cash with minimal share dilution. For example, it could raise $16 billion -- roughly Rivian's entire market cap today -- by diluting shareholders by just 1%. In a capital-intensive industry where scale is king, Tesla's dominance in this category is unparalleled.

But it's not just scale that Tesla has over Rivian. It's also its newly adopted position as an AI stock. Many Wall Street analysts are calling Tesla the next big name in artificial intelligence, thanks to its early investments and ability to apply its technology to its vehicles. The robotaxi market could be worth trillions of dollars, and owning both the manufacturing and software ends of its robotaxi division gives Tesla an enviable edge on the competition.

These two advantages -- scale and a new reputation for AI -- are what account for most of Tesla's valuation premium. But as we'll see next, Rivian could soon make waves in both of these categories.

Image source: Getty Images.

Rivian could soon replicate Tesla's success

In terms of scale, Rivian will soon give Tesla significantly more competition. That's because early next year, three new models are expected to start production: the R2, R3, and R3X. Importantly, all three are expected to be priced under $50,000. A big majority of American consumers are hoping to spend less than $50,000 on their next vehicle purchase. And when it comes to EVs priced under this threshold, there's little competition for Tesla's Model 3 and Model Y. Tesla controls nearly half of the U.S. market for EVs, with the vast majority of its sales coming from two affordable models: the Model Y and Model 3.

Currently, Rivian has just two luxury models, which can often cost upwards of $100,000 depending on options. With three far more affordable vehicles in its lineup and a fairly consolidated competitive landscape, Rivian has the chance to rapidly catch up to Tesla's domestic EV dominance.

But it's not just manufacturing scale that investors should be excited about. While competitors like Lucid Group and Tesla have been very vocal about their robotaxi and AI aspirations, Rivian has been fairly quiet. That could change in 2026. Rivian has long been transparent about its focus on technology and software. And while its AI investments haven't been as publicly touted, there's no doubt that Rivian has invested heavily in the space. As a report from Constellation Research concludes, "The journey for Rivian's integrated vehicle stack includes a hefty dose of artificial intelligence (AI), machine learning (ML), and cloud computing."

We know for sure that Rivian is expected to begin production of its new models in the first or second quarter of 2026. Along with this milestone, I also expect meaningful updates on its technology stack, with a specific focus on AI. Higher growth rates from new models could get analysts and investors excited about Rivian once again, giving more spotlight to its AI efforts, ultimately helping shares close the valuation gap with both Tesla and Lucid Group.