Quantum computing has become a hot, fast-moving sector, with various investments made in the field alongside significant technological breakthroughs. This has caused stocks to have massive drops and spikes within the same week, giving investors in this space whiplash.

However, many stocks in the quantum computing sector are down around 25% from their all-time highs, leading investors to believe that now would be a great time to scoop up shares.

So, is now the time? After all, if you pick the right horse in this race, it could be a millionaire-maker.

Image source: Getty Images.

Quantum computing companies come in all shapes and sizes

When most people refer to quantum computing investments, they're thinking of the pure plays, like IonQ (IONQ 3.55%), Rigetti Computing (RGTI 2.56%), and D-Wave Quantum (QBTS 1.18%). These three are some of the most popular pure-play quantum computing companies and have no backup business. For these three, it's quantum computing relevancy or bust, making them a high-risk, high-reward style of investment.

In addition to the pure plays, there are also legacy businesses coming into the quantum computing arms race. Some noteworthy competitors are Alphabet and International Business Machines. Companies like this have nearly unlimited resources to invest in quantum computing that the pure plays can only dream about having. Quantum computing technology isn't cheap, and this funding advantage that the legacy players have may be enough to allow them to win the quantum computing arms race outright.

If they do, it's unlikely there will be any millionaires created by this trend, unless you've already got a sizable chunk of money invested in the legacy players. These companies are already quite large and won't be able to benefit from a much smaller division that's rapidly growing.

On the other hand, it's possible that any one of these pure plays could be a massive winner, turning a meager investment into more than $1 million.

NASDAQ: RGTI

Key Data Points

Even in perfect conditions, these stocks will have a difficult time producing a millionaire

Rigetti Computing estimates that the annual market for quantum processing units will be about $15 billion to $30 billion between 2030 and 2040. If one of these companies captured all of the high end of the market and generated profit margins akin to what Nvidia does (50%), the resulting business would generate $15 billion annually in profits. If the company gets a 40 times earnings valuation, that would value the resulting business at $600 billion. For a company to provide 100x returns (what's required to turn $10,000 into $1 million), that would mean the stock must be valued at $6 billion today.

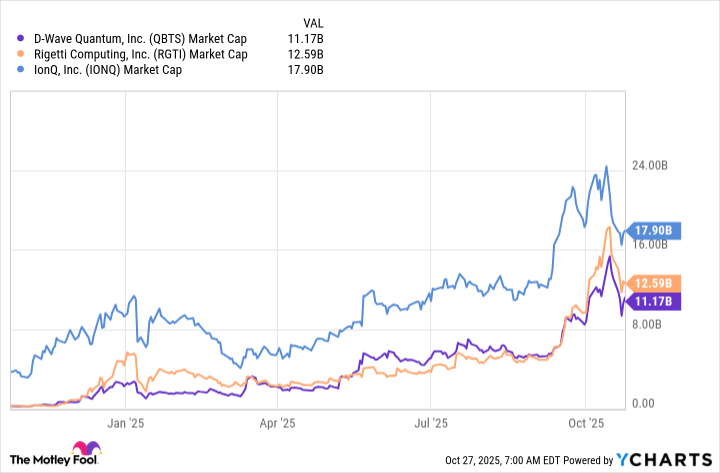

All three of these pure plays are valued at a higher level than that right now, so even in the best-case scenario, none of these stocks has the potential to make investors a millionaire, if we use Rigetti Computing's estimate.

QBTS Market Cap data by YCharts

However, there's an even larger market that these quantum computing companies are targeting, and it could result in an even bigger potential market.

Could QPUs replace GPUs?

In an interview, IonQ's CEO Niccolo de Masi stated that he thinks QPUs could replace graphics processing units (GPUs) someday.

The world's largest GPU provider, Nvidia, is currently the largest company in the world, with valuation of neraly $5 trillion. If one of these quantum computing companies could produce the technology that dethrones Nvidia and captures all of its market share, this could allow one of these stocks to generate a massive return. However, that's still wishful thinking, as quantum computing has yet to prove its commercial relevance.

Time will tell if any of these quantum computing companies pan out, but they all have a long road ahead of them. There will be unexpected hiccups and complications from companies with massive R&D budgets. Furthermore, the odds of all three working out are slim, and there will be many losers along the way, which could result in a total loss for investors.

I think the best way to invest in this space is to stay patient with the proposals and let them cool off a bit. In the meantime, companies like Alphabet look like leaders in this space and could make for an excellent buy right now to gain some quantum computing exposure.