Warren Buffett steps down as CEO of Berkshire Hathaway (BRK.A +0.67%) (BRK.B +0.55%) in less than two months. Don't expect any stock market predictions from the legendary investor during his remaining time at the helm of the huge conglomerate. That's not his style.

However, Buffett's actions often speak louder than his words. And what he's doing -- and not doing -- could be worrisome to many investors. Here are three signs that Buffett might be bracing for a stock market storm.

Image source: The Motley Fool.

1. Extending the selling streak

Buffett once famously wrote, "We simply attempt to be fearful when others are greedy and to be greedy

only when others are fearful." There's ample evidence that others are being greedy and Buffett is being fearful these days.

Exhibit A for the argument that many investors are being greedy is a market valuation metric named after Buffett himself. The Buffett indicator measures the ratio of total stock market capitalization to GDP. In 2001, Buffett wrote in an article published by Fortune magazine that investors are "playing with fire" when this ratio approaches 200%. It's at roughly 221% now.

What's the evidence that Buffett is being fearful? Berkshire's latest quarterly update confirmed that it has been a net seller of stocks for 12 consecutive quarters. The conglomerate sold $12.5 billion of stock in the third quarter of 2025, while buying $6.4 billion. When Buffett goes for three years selling more stock than he's buying, that's a pretty good sign he anticipates potential trouble ahead for the overall market.

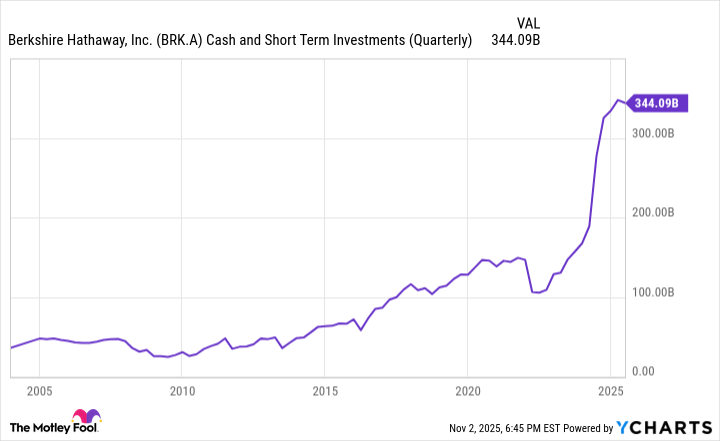

2. A record-high cash position

Another major hint that Buffett is hunkering down for a possible stock market storm is that he has built a massive cash position. Berkshire Hathaway reported cash, cash equivalents, and short-term investments in U.S. Treasuries of roughly $382 billion as of Sept. 30, 2025.

To put that number in perspective, it's the biggest cash stockpile in Berkshire's history. Furthermore, $382 billion is the most cash that any U.S. publicly traded company has ever had.

BRK.A Cash and Short Term Investments (Quarterly) data by YCharts

Buffett has been adamant in the past that he would rather invest Berkshire's money than hold it in cash. In his annual letter to Berkshire Hathaway shareholders this year, he wrote, "Berkshire will never prefer ownership of cash-equivalent assets over the ownership of good businesses, whether controlled or only partially owned."

Despite his desire to own all or part of "good businesses," Buffett has hoarded an unprecedented amount of cash. That seems to be a big clue that the "Oracle of Omaha" sees dark clouds on the horizon.

3. No more buybacks

What's the stock that Buffett loves to buy the most? Berkshire Hathaway itself. The company's policy is that no special authorization from the board of directors is required for Buffett to initiate stock buybacks. He can repurchase shares at any time he thinks the share price is below Berkshire's intrinsic value. The only caveat is that the conglomerate's cash position can't fall below $30 billion (which, as we've already seen, isn't a problem at all right now).

The last time Buffett bought back Berkshire shares was in mid-2024. He has now gone five quarters without repurchasing even a single share of his favorite stock.

Granted, Berkshire's share price is much higher than it was at the time of the most recent stock buyback. Also, Buffett mentioned in the company's annual shareholder meeting earlier this year that Berkshire has to pay more for buybacks now than in the past due to a 1% tax. Still, the absence of any stock buybacks is another sign that Buffett might be bracing for turbulence ahead.

What should investors do?

If one of the greatest investors of all time seems to be bracing for a stock market storm, should other investors follow suit? Maybe, but it's important to fully understand how Buffett is preparing.

For one thing, he isn't panic-selling. Berkshire's portfolio remains heavily invested in stocks. The conglomerate owned roughly $314 billion worth of equities as of the market close on Oct. 31, 2025.

While Buffett has been a net seller of stocks, he's still buying some stocks. The key thing here, though, is that any stocks he buys must meet his stringent criteria.

Copying Buffett's approach isn't a bad idea for investors who are concerned about a potential stock market downturn. Raise additional cash to be able to buy stocks when valuations are more attractive. Sell stocks for which you don't have a high conviction or that no longer meet your original investment thesis. Buy stocks only when they meet all of your investing criteria. Those are good steps to take, no matter what happens with the market.