Warren Buffett will step down from his role as chief executive officer of Berkshire Hathaway (BRK.A 0.13%)(BRK.B +0.07%) at the end of this year, capping off an incredible six-decade tenure that started in 1965. Fortunately for investors, he will continue to serve as the company's chairman, so his successful brand of long-term value investing will likely endure.

Had you parked $500 in Berkshire stock when Buffett took the helm, it would have grown to a staggering $22.3 million by the end of 2024. The same investment in the S&P 500 (^GSPC 1.23%) would have returned just $171,453, so it's no surprise Wall Street watches Buffett's every move.

Berkshire owns a number of subsidiaries, in addition to a $311 billion portfolio of publicly traded stocks and securities. The conglomerate is also sitting on a record $381 billion in cash right now, which Buffett would normally deploy into new opportunities. In the past, he would also return some of it to shareholders through stock buybacks.

Buffett authorized $77.8 billion of buybacks between 2018 and mid-2024, which is twice as much as he ever invested in any single stock. But strangely, there haven't been any repurchases during the past five quarters. Does Buffett foresee a stock market crash, or does he no longer believe in Berkshire? Here are two plausible reasons for the buyback hiatus.

Image source: The Motley Fool.

Why Berkshire is sitting on so much cash

Before we explore why Buffett paused Berkshire's buyback program, we should briefly look at why the conglomerate is holding a record amount of cash.

First, Berkshire generates truckloads of operating profits because it wholly owns several businesses in the insurance, utilities, and logistics industries, which deliver reliable income streams. It also earns substantial dividends from its stock portfolio; for example, Berkshire owns 400 million shares of Coca-Cola which will net the conglomerate $816 million in dividends in 2025 alone. It also owns 151.6 million shares in American Express, which will yield $479 million in dividend payments this year.

Second, Buffett and his team have been on a selling spree, reducing Berkshire's exposure to stocks for 12 consecutive quarters. They even sold more than half of the conglomerate's stake in Apple last year, and since its peak value was more than $170 billion, this move alone raised a mountain of cash.

With so much dry powder piling up, why has Buffett hesitated to return some of it to Berkshire's shareholders through buybacks?

NYSE: BRK.A

Key Data Points

The first possible reason: Berkshire's valuation

Berkshire stock delivered a compound annual return of 19.9% between 1965 and 2024, crushing the S&P 500 which gained 10.4% per year during the same period. Therefore, Berkshire is likely to outperform any other stock Buffett could potentially invest in, so the opportunity cost of performing buybacks is relatively small.

That explains why Berkshire's share repurchases since 2018 are double the $38 billion it invested in Apple between 2016 and 2023. However, Buffett is a value investor, so he still wants to get a good deal on behalf of the shareholders he represents.

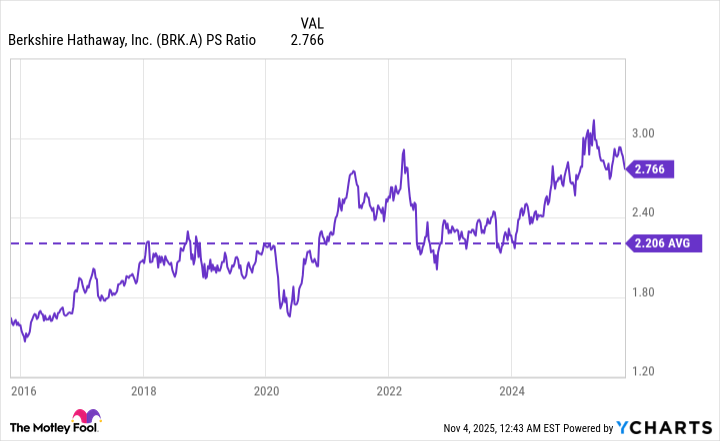

Berkshire stock is trading at a price-to-sales (P/S) ratio of 2.7 as I write this, which is a 25% premium to its 10-year average of 2.2. So that could be why Buffett is hesitant to buy.

BRK.A PS Ratio data by YCharts

Berkshire stock last traded in line with its average P/S ratio in early 2024, and Buffett stopped authorizing buybacks in the second quarter of that year, which supports the idea that valuation could be a factor.

The second possible reason: Succession

At Berkshire's annual meeting on May 3, Buffett announced he will step down from his role as CEO of Berkshire at the end of this year, and hand the reins to his chosen successor, Greg Abel. Since the conglomerate is in a really strong position, Buffett might feel reluctant to make any big financial decisions knowing his tenure is drawing to a close.

Berkshire can repurchase shares at management's discretion as long as the balance of its cash and equivalents is above $30 billion, and since it's sitting on $381 billion in dry powder right now, that definitely isn't an issue. Therefore, Buffett might want to give his successor the opportunity to decide what to do with Berkshire's cash pile.

After all, maybe Abel won't see any value in performing buybacks. Perhaps he will prefer to put Berkshire's $381 billion to work by making new corporate acquisitions, or by expanding the conglomerate's stock portfolio. It's impossible to know for sure, but the impending leadership change is certainly a plausible reason Buffett is sitting on his hands right now.