Whether you're a veteran investor or just beginning your journey, chances are you're familiar with the name Warren Buffett. What you might not know, however, is just how incredible Buffett's investment performance has been throughout his career.

Between 1965 and 2024, Buffett's investment conglomerate -- Berkshire Hathaway -- generated a cumulative gain of 5,502,284%. By comparison, the S&P 500 rose by 39,054% -- and that includes the reinvestment of dividends!

Buffett did not amass generational wealth by relying on hope or luck. Leave those "strategies" for the day traders. The Oracle of Omaha, as he is also known, is not one to chase narratives or follow the crowd. Rather, Buffett's investing playbook revolves around investing in businesses you understand that are led by quality management teams.

Against that backdrop, it's not surprising that Buffett once told the investment community, "You want to be greedy when others are fearful, and you want to be fearful when others are greedy."

Image source: Getty Images.

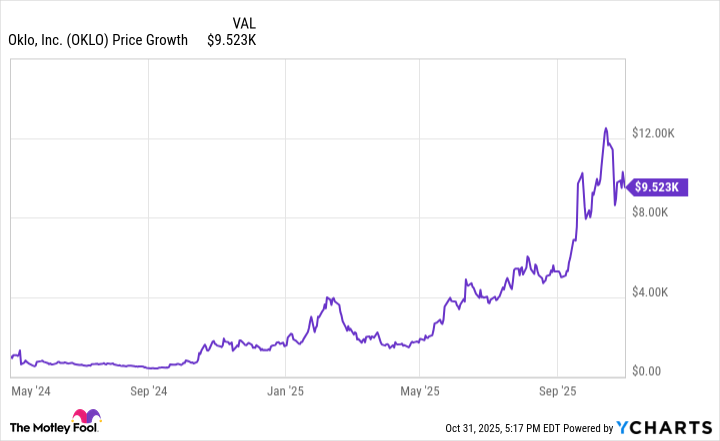

When it comes to nuclear energy stock Oklo (OKLO +5.95%) -- whose share price has risen 525% so far this year as of the closing bell on Oct. 31 -- the time to be fearful has arrived. Read on to find out why.

NYSE: OKLO

Key Data Points

Why did Oklo stock rise in 2025?

Throughout 2025, cloud hyperscalers, infrastructure services companies, and of course, chip designers, have been inking deals with one another left and right. While this is great for hardware and software developers, another pocket of the artificial intelligence (AI) realm that's recently seen more attention is energy.

The reason is simple: Building AI applications is incredibly demanding on the power grid. Nuclear is a potential alternative to traditional power sources -- conveniently operating at the intersection of AI infrastructure and sustainable energy.

In my eyes, Oklo's ascent begins with Sam Altman -- the CEO of OpenAI. Oklo went public last year through a special purpose acquisition company (SPAC) backed by Altman.

Notably, a University of Florida study pointed out that SPAC stocks have dramatically underperformed the broader market over a long-term time horizon. In fact, between 2009-2025, the median return of renewable energy SPAC stocks was negative 44%. Yikes!

However, if you had invested a modest sum of $1,000 when Oklo went public, you'd have roughly $10,000 today -- an abnormally high return given the short time duration.

The question remains: Why has Oklo been such an anomaly?

In combination with Altman's magnetism, Oklo has been able to attract a number of partners in the private sector as well as land on the radar of the Department of Energy (DOE). Like its big-tech counterparts, Oklo's share price has largely been tied to positive buzz around its press releases.

In other words, Oklo primarily trades on news and narratives. And given the overwhelmingly bullish support for the broader AI thesis in combination with the emerging role of nuclear energy, it's easy to see why so many investors have poured into Oklo stock.

Nevertheless, smart investors understand that stocks do not rise in perpetuity. As I predicted just a few weeks ago, a nasty descent in Oklo stock could be on the horizon. Let's dig into why.

Why Oklo stock could be on the verge of plummeting

On Oct. 30, Oklo filed a Form S-3 with the Securities and Exchange Commission (SEC). In the prospectus, the company outlined plans for a $3.5 billion mixed shelf offering.

In simple terms, Oklo may choose to sell stock in an effort to meet liquidity needs. Translation: Management recognizes that Oklo is trading at a considerable premium and is looking to capitalize on these favorable market conditions to raise capital.

The consequence of the shelf offering could be dilution to existing shareholders -- potentially souring the sentiment around the company and sending Oklo stock into a downward spiral.

Image source: Getty Images.

Is now a good time to sell Oklo stock?

I've often expressed that I think valuation can be just as much of an art as it is a science. With Oklo, that idea is on full display. The company remains years away from generating revenue, yet requires hefty sums of capital expenditures (capex) to fund the research and development of its future products.

One of the most common mistakes a beginner investor can make is chasing a hot stock without understanding what's actually influencing the stock's movements. Investing in a pre-revenue company like Oklo at a $20 billion market capitalization -- hoping to flip it at a higher price for a quick gain -- is a classic example of the Greater Fool Theory.

For now, I think Oklo remains nothing more than a meme stock. This time next year -- or perhaps even sooner -- Oklo could very well be trading for a fraction of what it is today.

Given that dilution is likely on the way, which could be followed by a prolonged sell-off, I'd use whatever momentum is helping prop Oklo up to exit and take gains off the table.