The data center business has been the cornerstone of Nvidia's (NVDA +0.03%) outstanding surge in the past three years. This business accounts for the majority of Nvidia's top line, and that can be attributed to its dominant presence in the market for artificial intelligence (AI) chips.

According to one estimate, Nvidia commands a whopping 90% share of the AI chip market. This explains why the company's data center revenue is substantially higher than the competition.

Image source: The Motley Fool.

The good part is that Nvidia's data center business could soar to new heights in the next couple of years. Let's see why that's likely to be the case.

Nvidia CEO Jensen Huang suggests there is a huge backlog for its AI chips

Nvidia's data center business has generated just over $80 billion in revenue in the first half of the ongoing fiscal year 2026, accounting for 88% of its top line. The company is expecting $54 billion in revenue in Q3. Assuming the data center segment's share remains in line with what we have seen in the first half of the year, this business is likely to account for $47.5 billion in fiscal Q3 revenue.

NASDAQ: NVDA

Key Data Points

The quarterly revenue run rate based on Nvidia's data center revenue for the first nine months of the year suggests that it could end fiscal 2026 (which ends in January 2026) with $170 billion in data center revenue. CEO Jensen Huang pointed out at a recent developer conference in Washington, D.C., that the company has secured over $500 billion worth of orders for its current generation of Blackwell processors and the upcoming Rubin graphics processing units (GPUs), which will be launched next year.

Now, Huang didn't point out if all of these orders are pending, or if they include the revenue that Nvidia has already generated from the sale of its current generation Blackwell processors. But even if we assume that the $500 billion figure is inclusive of the Blackwell orders already fulfilled, Nvidia will still have a sizable backlog.

Nvidia's Blackwell GPUs went on sale in the fourth quarter of calendar 2024, which coincided with two months of its fiscal 2025 fourth quarter. Nvidia sold $11 billion worth of Blackwell processors in that quarter. Assuming the entire $170 billion data center revenue that Nvidia is projected to generate in fiscal 2026 is from sales of its Blackwell GPUs, it has sold around $180 billion worth of these processors since they were launched.

That still leaves the company with a potential $320 billion in backlog for fiscal 2027 (which will begin in January next year). If Nvidia manages to convert all of that backlog into revenue during the fiscal year, its data center revenue could jump by an estimated 88% next year (from fiscal 2026's estimated sales of $170 billion).

You may be wondering if Nvidia can indeed convert the entirety of its projected backlog into revenue next year. The good part is that the company's foundry partner, Taiwan Semiconductor Manufacturing Company, is expected to increase its advanced chip packaging capacity by 33% next year. With Nvidia reportedly securing 60% of that capacity for itself, there is a good chance that it could indeed turn that massive order backlog into revenue.

Hefty data center spending will be a tailwind in 2027

Nvidia estimates that data center capital spending is likely to grow at an annual pace of 40% between 2025 and 2030, with annual spending estimated to land between $3 trillion and $4 trillion by the end of the decade. The company estimates that data center capital expenditures (capex) could land at $1 trillion next year before approaching $1.5 trillion in 2027.

So, there is ample incremental revenue opportunity for Nvidia to sustain its data center growth beyond next year. Even if we assume that the company's data center revenue grows in line with the estimated annual growth of 40% in data center capex, its revenue from this segment could jump to almost $450 billion in 2027 (which coincides with Nvidia's fiscal 2028).

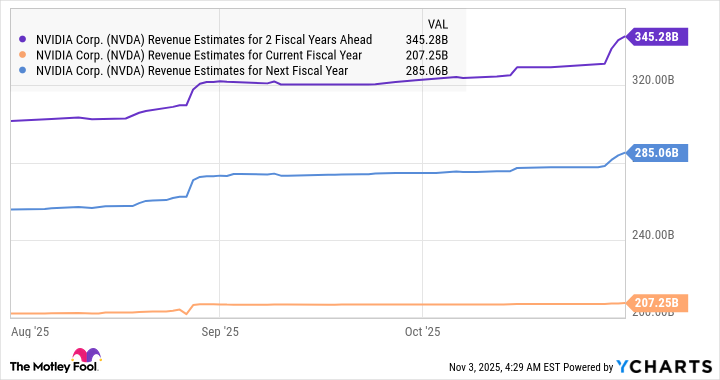

That points toward a potential increase of 165% from the $170 billion data center revenue that Nvidia may deliver this year. Analysts, meanwhile, are expecting Nvidia to generate $345 billion in revenue after a couple of fiscal years, having raised their estimate notably of late.

NVDA Revenue Estimates for 2 Fiscal Years Ahead data by YCharts

Nvidia, therefore, has the potential to easily grow at a much stronger pace than what analysts are expecting thanks to its AI chip dominance, tremendous backlog, and further growth in AI chip spending. That could ensure more upside for this high-flying AI stock over the next three years.