On a broad level, stocks are divided into three categories: growth, value, and dividend providers. Growth stocks are shares of companies whose revenue and earnings are growing faster than industry averages; value stocks trade at low valuations compared to their fundamentals; and dividend stocks provide consistent income. And in some cases, a stock can fall into one or more of the three categories.

Growth stocks (especially tech) have been the most popular choices in recent years, which makes sense, given how well many of them have performed. There are inherent risks that come with investing in growth stocks, but if you're looking for a way to hedge against these risks while still getting exposure to growth stocks, consider investing in a growth exchange-traded fund (ETF).

If you have $1,000 available to invest, a smart option to consider is the Vanguard Growth ETF (VUG 0.28%).

Image source: Getty Images.

VUG can be the best of both worlds

Many people associate growth stocks with small companies, but size doesn't define a growth stock. One of the best aspects of VUG is that it contains all large-cap companies, which can be the best of both worlds.

On one hand, you're investing in companies that are growing their business at industry-leading paces. On the other hand, large-cap companies are typically more stable because to reach that point, a company has generally established a working business model, a proven track record, and has access to more resources.

There are, of course, exceptions to these rules, but for the most part, this is the balance of growth and stability you get when investing in large-cap growth stocks.

NYSEMKT: VUG

Key Data Points

The tech sector is leading the way

Being growth-focused inevitably means that VUG is very tech-heavy. The tech sector accounts for 62.1% of the ETF, far leading the next four most represented sectors: consumer discretionary (18.2%), industrials (8.2%), healthcare (5%), and financials (2.9%).

The reason VUG is so tech-heavy is that it's market-cap weighted, meaning larger companies account for more of the ETF than smaller ones. And with megacap tech stocks exploding in valuation over the past few years, they've inevitably become a larger part of VUG. Below are its top 10 holdings:

| Company | Percentage of the ETF |

|---|---|

| Nvidia | 12.01% |

| Microsoft | 10.70% |

| Apple | 10.47% |

| Amazon | 5.55% |

| Broadcom | 4.26% |

| Meta Platforms (Class A) | 4.22% |

| Alphabet (Class A) | 3.77% |

| Tesla | 3.70% |

| Alphabet (Class C) | 3.00% |

| Eli Lilly | 1.99% |

Since it's so concentrated in a few stocks, I wouldn't recommend making VUG the bulk of your portfolio, but it can still serve as a staple piece. Just be sure to check the overlap with other stocks or ETFs you may own to ensure that your portfolio isn't just "Magnificent Seven" stocks.

A history of outperforming the market

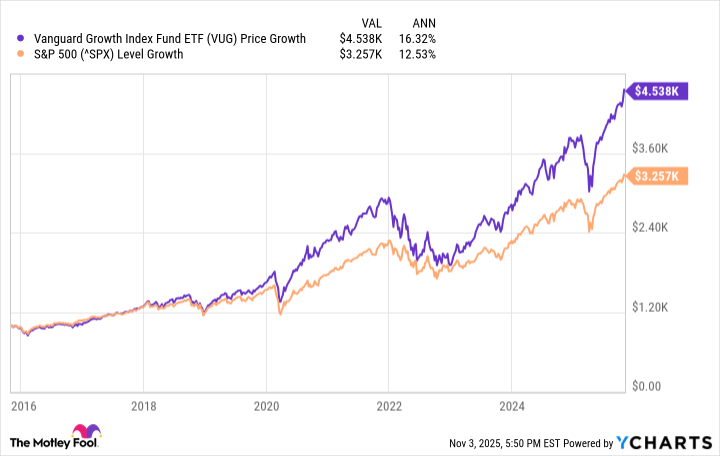

The main reason to invest in a growth ETF is to give yourself a chance to outperform the broader market (typically based on S&P 500 returns). Otherwise, you're better off simply investing in an S&P 500 ETF instead. Luckily, VUG has historically outperformed the S&P 500.

In the past decade, VUG has increased by 353% compared to the S&P 500's 225%. If you had invested $1,000 in both a decade ago, the investment in VUG would be worth well over $1,200 more.

Past results don't guarantee future performance, so I don't want to give off the impression that VUG is guaranteed to keep outperforming the S&P 500. However, as long as the tech sector continues to lead the charge on U.S. economic growth, VUG should be well-positioned to outperform the market in the long term. Investing $1,000 is likely a move you won't regret when you look back years later.