If you want to boost your income and don't mind a little risk, high-yield dividend stocks might be for you. One industry where you can find attractive dividend stocks is the real estate sector. Specifically, real estate investment trusts (REITs) can be great investments for income-oriented investors.

Realty Income (O 0.37%) and AGNC Investment (AGNC 0.14%) are two large, publicly traded REITs that offer attractive monthly dividends. But each comes with unique characteristics that can suit different investors. If you're looking at stocks and are choosing between AGNC Investment and Realty Income, here's what you need to know.

Image source: Getty Images.

REITs are made for income investors

REITs have high dividend payouts because these entities are legally required to distribute at least 90% of their taxable income to shareholders as dividends. As pass-through entities, REITs don't pay any taxes at the corporate level as long as they meet this distribution threshold. This structure enables most income to pass through to shareholders, thereby avoiding double taxation and making REITs highly attractive to income-focused investors.

Realty Income owns properties across various industries

Realty Income owns and manages more than 15,500 single-tenant commercial properties that span retail, industrial, and agricultural sectors. It leases its properties under long-term triple net lease agreements. This means that tenants are responsible for most property-related expenses, such as property taxes, insurance, and maintenance.

NYSE: O

Key Data Points

Net leases are used by REITs like Realty Income because they provide stable, recurring income and mitigate the uncertainty associated with variable operational expenses. Because tenants cover most expenses, Realty can focus on collecting rents while minimizing management duties and costs.

Realty Income's leases tend to attract large, established companies. Its largest tenants include 7-Eleven (3.3% of annualized base rent), Dollar General (3.2%), Walgreens (3.1%), Family Dollar (3.1%), and Life Time Fitness (2.2%).

AGNC invests in residential mortgages

Realty Income owns and manages its properties, and many REITs operate similarly. In contrast, AGNC Investment operates as a mortgage real estate investment trust (mREIT). Instead of owning and managing properties, AGNC invests in mortgage-backed securities (MBS). MBS are pools of home loans bundled together and sold to investors. The mortgages AGNC primarily invests in are issued through the government sponsored enterprises Fannie Mae and Freddie Mac, providing exposure to the broader housing market.

NASDAQ: AGNC

Key Data Points

As a result, AGNC doesn't worry about physical properties. Instead, the company must manage its MBS and be attentive to interest rate risks surrounding its business. To juice returns and generate a dividend yield of more than 14%, AGNC uses leverage. It does so by borrowing on a short-term basis, typically for a year or less, and then investing in MBS on a longer-term basis.

Because it borrows short-term and invests long-term, profits can hinge on the difference between these two rates. In recent years, rising short-term interest rates have hurt its earnings. While interest income nearly doubled from 2022 to 2024, from $1.4 billion to $2.9 billion, interest expense increased from $625 million to $2.9 billion over the same period. For this reason, AGNC prefers a steep yield curve where short-term rates are well below long-term rates, helping it benefit from a wider spread.

Interest rates also affect AGNC's book value on its investments. That's because there is an inverse relationship between interest rates and the value of its holdings. So when interest rates rose a few years ago, the securities it held and its book value took a hit. If interest rates decline further, it would boost the company's book value and also help reduce its borrowing costs.

Which one is better for you?

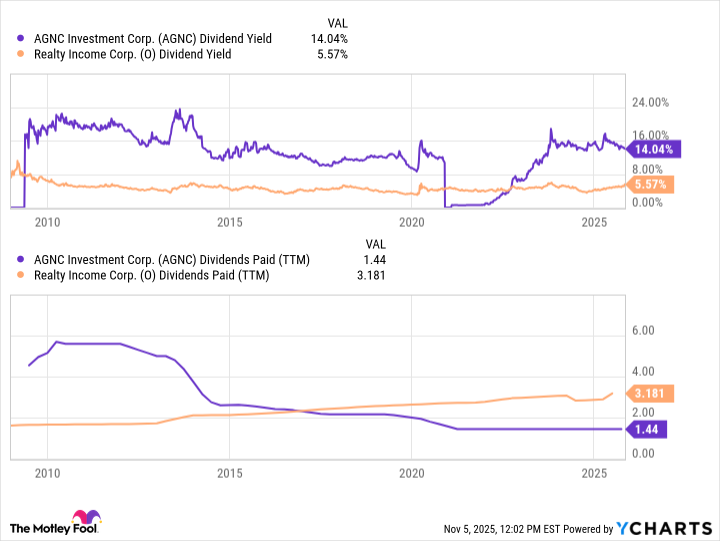

Realty Income is a traditional REIT that owns properties and collects rents, most of which have built-in rent escalators that can help protect it from the effects of inflation. The company is sensitive to changes in interest rates, as many in real estate are. However, it's not as sensitive to those changes as AGNC. AGNC's stock price and yield fluctuate more than Realty Income's. In return, investors receive a yield of 14% compared to Realty Income's 5.6%.

AGNC's high-yielding dividend is also more vulnerable to being cut, which has happened several times during the past decade. Realty Income, on the other hand, has raised its payout for 28 consecutive years, providing investors with a more predictable cash flow.

For investors who are comfortable with added volatility and interest rate risk, AGNC, with its ultra-high-yielding dividend, may be for you. However, if you're looking for a lower-risk stock with a more predictable dividend payout, Realty Income is the way to go.