Between February 2022 and August 2023, the U.S. Federal Reserve raised the federal funds rate (overnight interest rate) from a historic low of 0.1% to a two-decade high of 5.3%, in an attempt to squash a surge in inflation. It was one of the most aggressive campaigns to hike rates in the history of the central bank.

High interest rates reduce consumers' borrowing power, so they can't afford to pay as much for housing, which puts the brakes on the real estate market. Fortunately, interest rates have started to come down, but U.S. existing home sales most recently came in at just 4.06 million annualized units, which is still 38% below their peak from the last housing boom in 2021.

Douglas Elliman (DOUG 0.81%) is America's fifth-largest residential real estate brokerage company, so its business has struggled under the weight of the sluggish real estate market. However, with interest rates expected to come down further, this could be the ideal time for investors to scoop up its stock at a discount. As an added bonus, the company is experimenting with artificial intelligence (AI), which could make its business significantly more efficient over time.

Image source: Getty Images.

A dominant force in luxury real estate

Douglas Elliman was founded in 1911, so it has navigated the peaks and valleys of the real estate market for more than a century. Today, the company employs 6,600 agents in 113 offices across the U.S., specializing in high-end markets in California, New York, Florida, Texas, and more. In October, the agency also announced an expansion into ultra-luxury markets in France and Monaco.

Douglas Elliman sold $30.1 billion worth of real estate during the first three quarters of 2025 (ended Sept. 30), so it's on track to surpass its 2024 sales total of $36.4 billion, which is a good result in a difficult housing market.

The Federal Reserve cut interest rates three times in the closing months of 2024, and it made two more cuts in September and October of this year. It will take time for the positive effects to work their way through the economy, but the real estate market should benefit as consumers regain some borrowing power. Plus, according to the CME Group's FedWatch tool, the Fed could cut rates again in December, and then two more times in 2026.

But Douglas Elliman isn't standing still while it waits for the real estate market to recover. It launched Elliman Capital in July, which is an in-house mortgage platform designed to help buyers with their financing needs, unlocking a new revenue stream for the company. Then, in October, it introduced an AI assistant called Elli AI, which will help its agents cut down the amount of time they spend on manual property searches and other repetitive tasks.

Therefore, Elli AI could boost productivity and reduce costs. But this is just the first step in a broader AI transformation at Douglas Elliman, as the company says it will invest heavily in the technology from here.

NYSE: DOUG

Key Data Points

Douglas Elliman is in a great financial position

Douglas Elliman generated $787.6 million in revenue during the first three quarters of 2025, which was up 5% year over year. The company also carefully managed costs during the period, and while it still lost $53.3 million at the bottom line on a generally accepted accounting principles (GAAP) basis, that was a 24% reduction from the $70.3 million net loss it generated in the year-ago period.

But after excluding one-off and non-cash expenses, Douglas Elliman was actually profitable through the first three quarters of 2025, with $2.9 million in adjusted earnings before interest, tax, depreciation, and amortization (EBITDA). That was a positive swing from its adjusted EBITDA loss of $12.3 million in the year-ago period.

In October, Douglas Elliman announced the sale of its property management division, and it used the proceeds to clear its outstanding $50 million convertible loan. The company now has $126.5 million in cash with zero debt, placing it in a fantastic position to succeed as the housing market recovers.

Douglas Elliman stock looks like a bargain

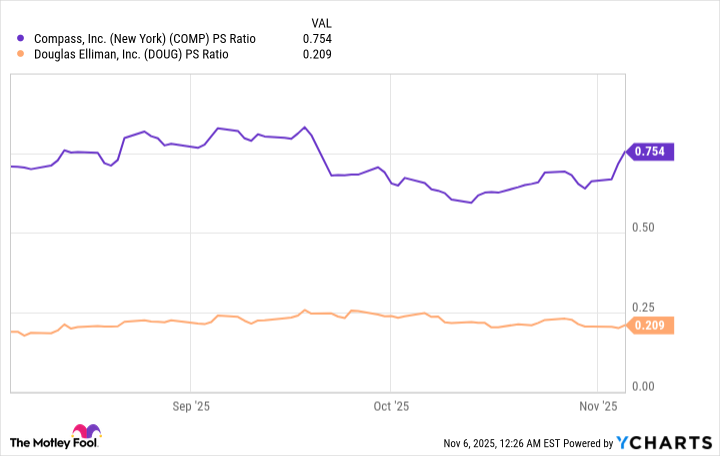

Based on Douglas Elliman's trailing-12-month revenue of $1.03 billion and its current market capitalization of $223 million, its stock is trading at a price-to-sales (P/S) ratio of just 0.2. That is down significantly from its peak of 0.8 during the last housing boom in 2021.

Douglas Elliman is also much cheaper than its main rival, Compass, which is America's largest residential real estate brokerage company. Its P/S ratio is 0.7.

COMP PS Ratio data by YCharts

Moreover, back in July, Rocket Companies acquired residential real estate brokerage powerhouse Redfin for $1.75 billion, which represented a P/S ratio of 1.7 at the time. I'm not suggesting this will happen, but Douglas Elliman stock would have to soar 750% for its P/S ratio to match that. But its stock would also have to climb 275% to trade in line with the P/S ratio of Compass stock, which might be a more realistic target.

Douglas Elliman stock is already up 46% in 2025. But considering the company's ability to grow in a difficult housing market, its solid financial position, and its investments in areas like AI, I think the stock is poised for significantly more upside from here.