A couple of weeks ago, I predicted Lemonade (LMND 6.38%) stock would soar after reporting its third-quarter operating results on Nov. 5. It rocketed higher by more than 30% on the day, thanks to a stellar report that highlighted continued momentum across the business.

Lemonade is an insurance company on a mission to disrupt its entrenched competitors by using artificial intelligence (AI) to transform the customer experience. The company has an ambitious plan to grow its in-force premium (IFP) -- which is the value of the premiums from all active policies -- almost tenfold over the next decade, which could fuel significant returns for shareholders.

Despite the recent gains in Lemonade stock, it remains 54% below its record high from 2021, when a frenzy in the technology sector drove its valuation to a then-unsustainable level. However, I think its recovery is poised to continue, so here's why the stock could be a great buy right now.

Image source: Getty Images.

Lemonade is using AI in more ways than one

Lemonade sells renters insurance, homeowners insurance, life insurance, pet insurance, and car insurance. Prospective customers can grab a quote in under 90 seconds from an AI-powered chatbot named Maya, which is accessible through the company's website. Then, when it's time to make a claim, AI Jim can analyze, process, and pay policyholders in under three minutes.

That differs from the customer experience offered by traditional insurers, because claims often involve several phone calls and lengthy waiting periods. Lemonade's approach is really resonating, because its customer base grew by 24% year over year to 2.86 million policyholders during the third quarter (ended Sept. 30). The company's IFP growth has also accelerated for eight consecutive quarters, jumping by 30% to a record $1.15 billion in Q3.

But Lemonade is using AI to do more than just improve the customer experience. The technology plays a big role in the company's operations, which is driving significant improvements in efficiency. Its loss adjustment expense (LAE) ratio, which is the cost of handling claims divided by gross earned premium, has almost halved over the last three years, from 13% to just 7%.

In other words, AI-powered automation has allowed Lemonade to shrink its claims department, while its IFP grew by more than two and a half times over that period. For some perspective, many traditional insurers maintain an LAE of around 9%, so Lemonade is now more efficient than some of its top competitors at processing claims. But it gets better, because the company expects to cut its LAE in half again from here, while doubling the size of its business.

NYSE: LMND

Key Data Points

Lemonade just increased its revenue guidance for 2025 (again)

A growing IFP wouldn't mean much without a healthy gross loss ratio, which is the proportion of premiums paid out as claims. Lemonade thinks a gross loss ratio of 75% (or lower) is the secret to a thriving insurance business, and during the third quarter, it came in at a record low of 67%.

When IFP increases and gross losses decline, the net outcome is higher revenue. After discounting the premiums Lemonade paid to other insurers to reduce risk, its third-quarter revenue came in at a record $194.5 million, which was up 42% year over year, and much higher than management's guidance of $184.5 million.

Following the strong result, management increased its full-year guidance for 2025 for the third time this year. Lemonade is now expected to generate $729.5 million in revenue -- substantially more than its original forecast of $656 million coming into the year.

Lemonade stock could soar in 2026

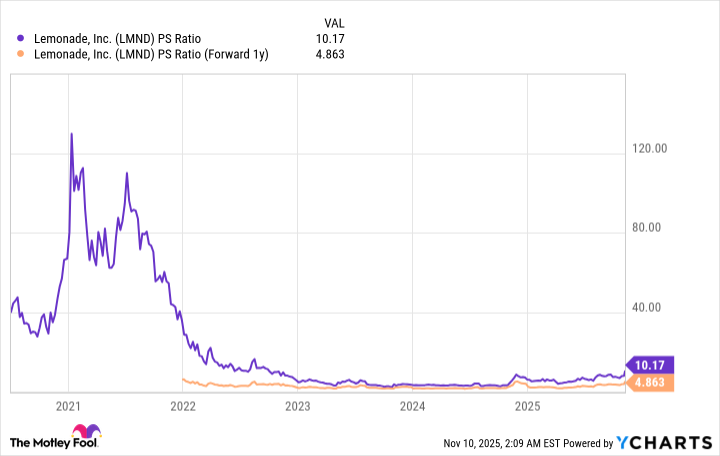

Lemonade's price-to-sales (P/S) ratio soared to over 120 when its stock peaked in 2021, which was a completely unsustainable valuation. But the company's rapid revenue growth since then, combined with the 54% decline in its stock, has pushed its P/S ratio down to a more reasonable level of 10.2.

Although this is Lemonade's highest valuation in three years, I would argue there is still room for upside given the significant momentum in its business. Wall Street's consensus estimate (provided by Yahoo! Finance) suggests the company could generate $1.15 billion in revenue in 2026, representing a whopping 58% growth compared to its expected 2025 result.

That places Lemonade's forward P/S ratio at just 4.8, so its stock would have to more than double by the end of next year just to maintain its current P/S ratio of 10.2.

LMND PS Ratio data by YCharts

Long-term investors could yield even greater returns, because Lemonade is aiming to grow its IFP to $10 billion over the next decade, representing near-tenfold growth from its current level.